8th Dec 2023. 11.13am

Weekly Briefing – Friday 8th December

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.35% |

| FTSE 250 | +1.64% |

| FTSE All-Share | +0.54% |

| AIM 100 | +1.40% |

| AIM All-Share | +1.02% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 8th December

Market Overview

Dear Investor,

Market participants are holding their breath ahead of today’s US non-farm payrolls hitting our screens at 1:30pm UK time.

This report carries weight as it could influence the Federal Reserve’s decision regarding interest rates next week.

Several indicators, like the JOLTs report revealing a significant drop in job openings and the ADP survey reporting lower-than-expected private business hires, are pointing to potential concerns in the job market. A weaker non-farm payrolls report might prompt an earlier rate cut from the Fed.

Consensus estimates project an addition of 185k jobs to the US economy in November, an increase from October’s 150k reading. Average Hourly Earnings are expected to rise to 0.3% from the previous month’s 0.2%, while the unemployment rate is forecasted to remain steady at 3.9%.

In terms of market positioning, during the last month we’ve seen US stocks skyrocket and the US dollar basket fall following dovish comments from the Federal Reserve. The S&P 500 is treading water just beneath its summer highs, leaving breakout traders on tenterhooks as we head into this pivotal economic report.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: TUI AG (LSE:TUI) +28.7% on the week

TUI AG’s share price has had a strong week following an upbeat set of full-year results.

Europe’s largest travel company experienced a substantial financial upturn in the fiscal year, achieving a profit of 977 million euros, more than doubling the previous year’s figures. This notable jump in profit was fuelled by robust demand for various travel services such as holidays, cruises, and hotel accommodations.

Looking ahead, TUI foresees another significant rise in profits for 2024, projecting a 25% increase. This positive outlook is rooted in the sustained demand for travel services, despite prevailing uncertainties globally, including geopolitical tensions and potential economic instabilities.

While TUI’s overall bookings remain robust, there was a temporary decline in demand for trips to Egypt due to the Israel-Hamas conflict. However, the company anticipates this to be a short-term setback, expecting a return to growth in bookings for Egypt post-Christmas.

TUI also revealed that it is contemplating delisting from the London Stock Exchange. This consideration is driven by the aim to streamline its listing, potentially focusing on a single German listing to better align with their ownership and trading patterns.

REGENCY VIEW:

The recovery in the travel sector has been a key investment theme for us this year. However, we prefer higher quality plays within this sector such as easyJet (which we hold in our FTSE Investor model portfolio) and Jet2, which we recommended to our AIM Investor members last month (CLICK HERE TO VIEW REPORT).

British American Tobacco dropped sharply this week after a trading update revealed that it is set to take a massive hit of £25 billion due to economic challenges affecting sales in its major market, the US.

The company is writing down the value of some of its US cigarette brands due to customers shifting to cheaper brands or quitting smoking altogether. This move has led to a significant drop in BAT’s market capitalization by 8.4%, making it the worst performer on the FTSE 100.

BATS’ write-down affected other tobacco stocks, causing declines in Philip Morris International and Altria’s share prices.

BATS’ CEO, Tadeu Marroco remains optimistic about the company’s commercial plans, aiming to transition to a “smokeless world” by deriving half its revenues from safer nicotine alternatives by 2035. Despite a decrease in year-to-date volume share in the US, BATS sees early signs of recovery in its commercial plans.

The company, known for the Vuse vape brand, is making strides in its alternative nicotine products, expecting them to break even this year, ahead of schedule. BAT projects modest growth in revenues and adjusted profits next year, with a vision for improved growth rates by 2026.

REGENCY VIEW:

BATS valuation will appeal to income investors. The stock trades on a forward PE of just 5.9 but offers a forward dividend yield north of 10% covered more than 1.5x by future earnings. However, long-term growth looks very limited and the transition toward a “smokeless world” has left investors less confident in BATS’ long-term outlook.

Sector Snapshot

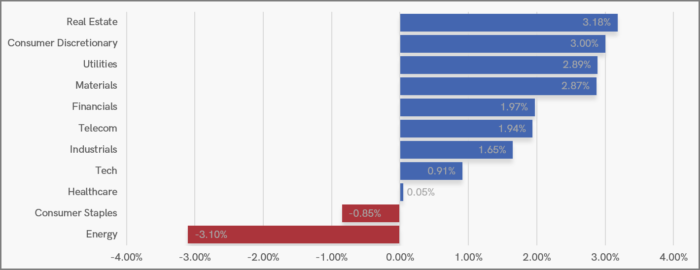

Real Estate is the UK’s strongest sector this week. It is also the strongest sector on a 1-month and 3-month basis – indicating that the recovery in the UK property market’s recovery is well under way.

This week we added an exciting small-cap stock which is benefiting from the UK property recovery to our AIM Investor model portfolio. To find out more, join AIM Investor today with a 60% discount today – CLICK HERE TO CLAIM.

Utilities have also continued to show strength – another emerging theme as we head into the final weeks of the year.

In terms of lagging sectors, Energy is bottom of the table this week with oil giants BP and Shell following crude prices lower.

UK Price Action

The FTSE is starting to break above swing resistance at 7,535 as we head into this afternoon’s non-farm payrolls.

Should the FTSE end the week above this resistance level, it would set the stage for a Santa rally towards 7,700.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.