2nd Nov 2023. 9.02am

Regency View:

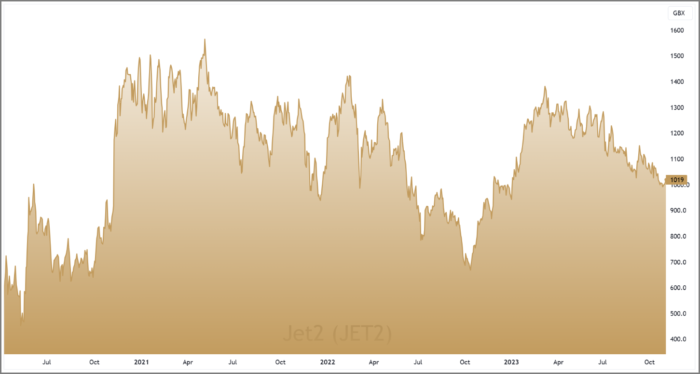

BUY Jet2 (JET2)

Regency View:

BUY Jet2 (JET2)

Jet2: A high-flyer in post-pandemic travel

Jet2 (JET2), the UK’s largest package holiday provider, is soaring high in a post-pandemic world where cost certainty and convenience are paramount for traveller’s.

The business has a rock-solid financial footing and an impressive track record of delivering profitable growth. The shares trade on an eye-catching forward valuation and we believe Jet2 offer quality and growth in equal measure.

Seamless travel experiences: Jet2’s end-to-end package holidays

Jet2’s business model revolves around offering end-to-end package holidays, providing customers with a seamless solution that encompasses flights, accommodations, and more. In a world where traveller’s increasingly seek assurance of cost certainty and convenience, Jet2’s approach resonates powerfully.

End-to-end package holidays: Jet2 takes care of every aspect of a customer’s holiday, from flights to accommodations and transfers. This holistic approach ensures traveller’s can enjoy their journeys with peace of mind, knowing that every detail is expertly managed.

Flight services: Jet2 Holidays is part of the broader Jet2.com family, one of the UK’s leading airlines. This integration allows for efficient coordination between flight schedules and accommodations, enriching the overall travel experience for customers.

Cost certainty: In an age where the cost-of-living crisis has made budget-conscious travellers the norm, Jet2 Holidays stands out with its commitment to cost certainty. By offering fixed, all-inclusive prices for its package holidays, the company enables customers to know precisely what they will pay upfront, eliminating any unpleasant surprises during or after their travels.

Recent trends underline the appeal of Jet2 Holidays’ business model, with 73% of Jet2’s departing passengers opting for a package holiday this summer, representing a 5% increase from the previous year. This shift in consumer preferences amidst the cost-of-living crisis demonstrates Jet2’s strong position in the market.

Navigating the flight path for growth

In Jet2’s full year results, it outlined four key areas which would form the basis of its growth strategy moving forward:

- Sustainable aviation: Jet2 recognises the pressing need for sustainability in the aviation industry and is making strategic investments in sustainable aviation fuel (SAF). With an equity investment in a new SAF production plant, Jet2 anticipates commencing SAF production by 2027, demonstrating its commitment to environmentally responsible travel.

- New aircraft orders: The company is committed to expanding its fleet with a focus on more sustainable and efficient aircraft. The agreement with Airbus to purchase 35 new firm-ordered Airbus A321/A320neo aircraft, with the potential to extend up to 146 aircraft, underscores its commitment to reducing its carbon footprint and enhancing operational efficiency.

- Investment in training and facilities: Jet2 has invested in a new Airbus A321 flight simulator and training centre, strengthening its workforce’s capabilities. This supports the company’s growth ambitions by ensuring a highly skilled team.

- Geographic expansion: Jet2 continues to explore opportunities for geographic expansion. Its recent launch of flights and holidays from Liverpool John Lennon Airport, its eleventh UK base, aligns with its long-term strategy for sustainable growth.

Profitability soars on revenue growth and falling costs

Jet2 not only weathered the storm of the COVID-19 pandemic but has emerged stronger and more resilient.

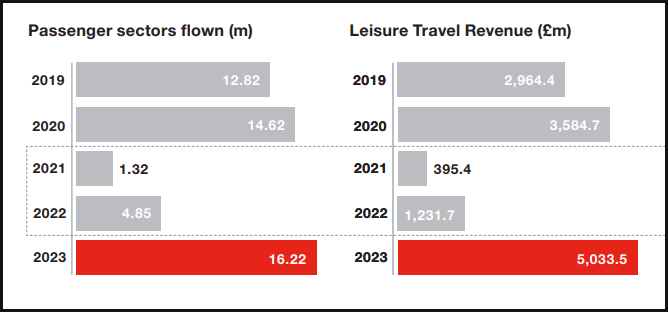

In the year ending March 2023, the company reported revenue of £5,033.5 million, marking a 40% surge from the previous year. Furthermore, the company has maintained effective cost management, reducing net operating expenses by 41% to £4,639.5 million compared to 2020. This disciplined approach led Jet2 to bounce back from a £323.9 million operating loss in 2022 to a £394.0 million operating profit in 2023, reflecting a significant 34% increase.

Another indicator of its robust financial health is the 17% growth in adjusted earnings (EBITDA), with Jet2 Holidays reporting an EBITDA of £581.8 million in 2023, compared to a negative EBITDA of £164.5 million in 2022.

And unlike many other travel stocks, Jet2’s balance sheet has not been saddled with mountains of debt. The business has a strong net cash position of £2.6bn (FY23) which is a key advantage when it comes to navigating crisis and ramping up growth.

Valuation worth noting

One of the standout qualities of Jet2 is its attractive valuation, making it a compelling choice for investors…

The company’s shares are currently trading at a forward PE (Price-to-Earnings) ratio of 5.9. This figure is not only lower than the broader market, but it also pairs remarkably well with the forecasted EPS (Earnings Per Share) growth of 12.2%. To put this in perspective, Jet2 has consistently delivered an impressive 3-year Compound Annual Growth Rate (CAGR) for EPS at 26%. In simpler terms, the company’s shares provide growth potential at a reasonable price, which is encapsulated by a forward PEG ratio of 0.5.

Additionally, Jet2 shines across several value metrics. The Price to Free Cash Flow ratio stands at 2.8, underscoring the company’s robust financial position. Furthermore, the EV (Enterprise Value) to EBITDA ratio is a sound 1.56.

These metrics confirm that Jet2 offers an enticing combination of quality and growth without the need for investors to break the bank. In other words, you’re getting a good deal on a stock that has a lot to offer.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.