31st May 2024. 9.15am

Weekly Briefing – Friday 31st May

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.08% |

| FTSE 250 | +0.14% |

| FTSE All-Share | -0.89% |

| AIM 100 | -0.23% |

| AIM All-Share | -0.10% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 31st May

Market Overview

Dear Investor,

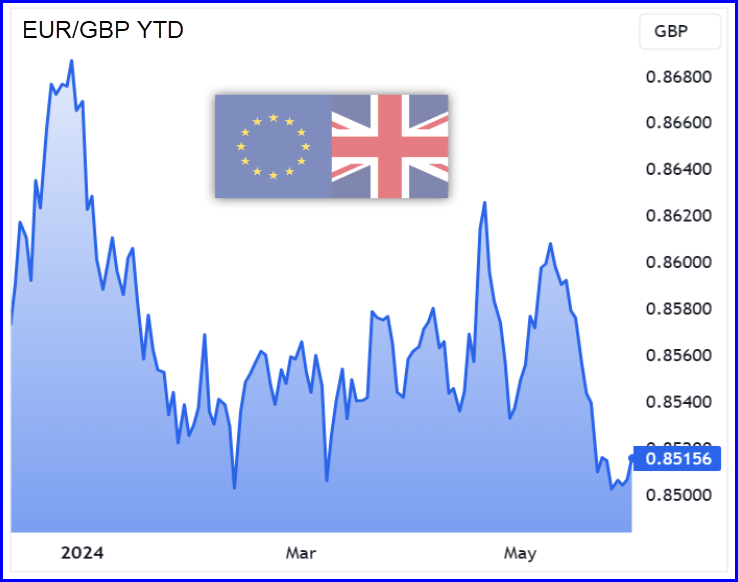

Your Spanish sangria got even cheaper this week as sterling hit a 21-month high against the euro!

The surge in sterling against the euro, reaching £0.8482 per euro, is a testament to the resilience of the UK economy. It marks a substantial 2% gain since the beginning of the year, highlighting the growing confidence in sterling-denominated assets. Sterling’s gain against the euro is inversely represented by EUR/GBP’s price chart (right).

One of the primary drivers behind the pound’s strength is the persistent pressure on prices within the UK. Despite inflation recently dipping to a three-year low of 2.3%, the services sector inflation remains robust at 5.9%. This divergence underscores the complexity of the Bank of England’s (BoE) task in balancing inflation control with sustaining economic growth.

As a result, investors are revising their expectations regarding BoE’s monetary policy, now anticipating a delay in interest rate cuts compared to the European Central Bank (ECB), which is poised to reduce borrowing costs as soon as next month.

In addition to the monetary policy outlook, the UK’s economic performance has surpassed expectations, further bolstering the pound’s strength. The ‘higher for longer’ interest rate theme, which has been prominent in the US, looks to be spreading to the other side of the Atlantic.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Auto Trader (LSE:AUTO) +9.1% on the week

Auto Trader’s share price surged over 11% after the company reported significant jumps in profit and revenue, driven by strong demand in the used car market.

For the year ending in March, revenue increased by 14% to £570.9 million, and pretax profit rose by 18% to £345.2 million. The firm attributed the growth to higher average revenue per retailer, fuelled by increased adoption of additional products and services.

Auto Trader’s competitive position strengthened, with record numbers of buyers and sellers, making it ten times larger than its nearest competitor. Despite robust demand for used cars, the new car market faced challenges, including a return to discounting. The company remains optimistic about its ability to support structural changes in the new car market.

Additionally, Auto Trader proposed a final dividend of 6.4p per share, bringing the total annual dividend to 9.6p, up from 8.4p last year. The new financial year has started well, with expected reductions in operating losses at Autorama, which it acquired in 2022. CEO Nathan Coe expressed confidence in the company’s growth prospects and the potential to expand its online car-buying marketplace.

REGENCY VIEW:

We’ve been big fans of this high-quality market leader for some time and first recommended the stock to our FTSE Investor members in July 2022 . With our position in a healthy profit, we will use technical timing to refine our exit.

Flutter Entertainment’s share price fell this week after the Illinois Senate passed a new state budget that includes a progressive tax rate on sports-betting companies.

The tax rate will increase from 15% to a range of 20% to 40%, affecting larger operators like DraftKings and FanDuel.

The higher tax rates are expected to result in worse odds and fewer promotions for customers. Lobbyists have suggested that major operators might consider leaving Illinois due to the increased tax burden. If enacted, Illinois will have one of the highest sports-betting tax rates in the U.S., second only to New York.

In response, the Sports Betting Alliance has launched a campaign against the tax hike, urging residents to contact legislators. Despite the drop, Flutter Entertainment’s stock is still up about 6% for the year. This development highlights the sensitive relationship between regulatory changes and market performance in the sports-betting industry.

REGENCY VIEW:

Flutter is a market leader with a uniquely strong position in the US sports betting market. However, the shares trade on a forward PE of 26.5 – which looks expensive relative to its peer group and relative to its unstable track record of profitability.

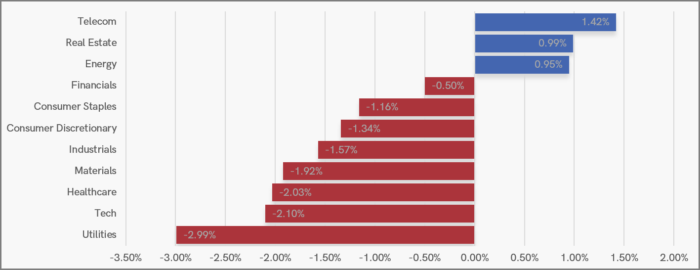

Sector Snapshot

With the FTSE continuing to pull back from highs, our 7-day Sector Snapshot remains dominated by losses this week.

Energy is showing relative strength this week after more than a month of underperforming – with BP and Shell holding firm in a weakening market.

Utilities are bottom of the pack this week and the UK market’s weakest sector on a 3-month basis.

UK Price Action

The FTSE’s pullback has brought it to some significant support levels that could potentially halt the decline if the long-term uptrend resumes:

- 50% Fibonacci Retracement (April Swing Low to May Swing High): The recent trend from April to May offers a smooth basis for Fibonacci retracements. The FTSE has now reached the 50% retracement level of this move, making it a critical point to monitor.

- 50-Day Simple Moving Average (50MA): This moving average coincides with the 50% Fibonacci retracement level mentioned above, adding further weight to its importance as potential support.

- February 2023 Highs: Before the breakout in April, the highs from February 2023 served as significant resistance. In an established uptrend, former resistance levels often become support as traders look to buy back in.

- 38.2% Fibonacci Retracement (October 2023 Lows to May 2024 Highs): Longer-term Fibonacci retracements are also noteworthy. The 38.2% retracement of the substantial rise from October 2023 to May 2024 is just below the aforementioned levels, providing another potential support zone.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.