Regency View:

BUY Auto Trader (AUTO)

A cash generating engine

Some business models you can’t help but sit back and admire…

Auto Trader (AUTO), being the dominant brand in the online auto marketplace, has minimal capital expenditure and whopping operating margins of 70%.

This asset-light, high-margin model has created a cash generating ‘engine’ of which more than 95% of operating cashflow flows through into the bottom line.

In turn, this has built a highly profitable business with a super strong balance sheet, and we believe it’s worth paying up for Auto Trader’s ‘cash is king’ quality…

Retailer numbers at record levels

The majority of Auto Trader’s revenue comes from dealerships, rather than private sellers.

Auto Trader charges according to the number of vehicles for sale and the precise type of listings selected. And much like any digital advertising platform, you pay for greater prominence.

Auto Trader’s consumer engagement and retailer numbers are at record levels…

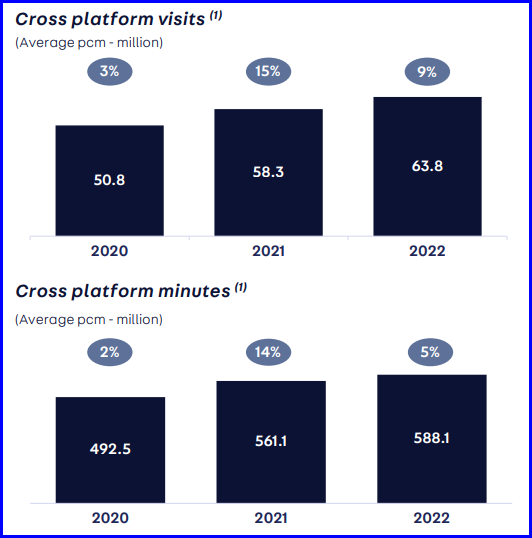

Average monthly cross platform visits increased by 9% to 63.8 million per month (FY22), and the average number of retailer forecourts advertising on our platform increased by 5% to 13,964 (FY22).

Headline revenue has more than made up for a Covid-related in dip – jumping 65% (FY22) to £432.7 million (2021: £262.8 million), and up 17% on 2020 (£368.9 million). Trade revenue surged 72% to £388.3 million (2021: £225.2 million) and up 20% on 2020 (£324.3 million).

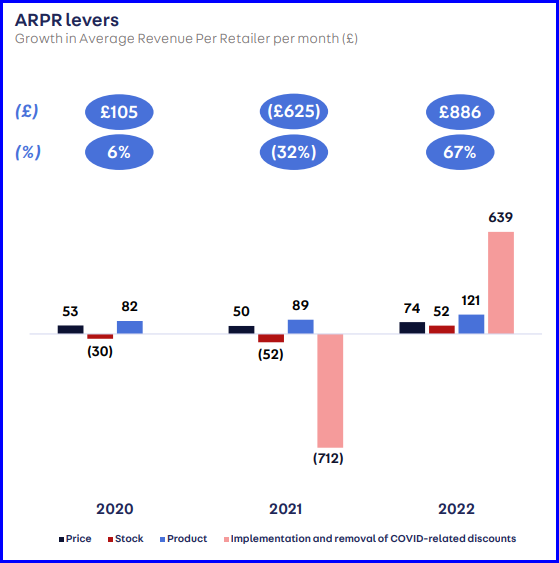

Auto Trader’s core KPI, Average Revenue Per Retailer (‘ARPR’) was up £886 to £2,210 on average per month (2021: £1,324). Excluding COVID-19 discounts in the prior year, underlying ARPR increased by £247 per month.

Auto Trader expect ARPR growth to continue into the next financial year despite a cooling car market…

“We are anticipating another good year of ARPR growth, underpinned by our product lever” commented Auto Trader CEO, Nathan Coe following the publication of their Full Year numbers.

“We expect growth in the product lever to be greater than 2021, but less than the exceptional performance achieved in 2022. We expect the price lever to be broadly consistent with last year, and the stock lever to be flat. We anticipate average retailer forecourts to be marginally down year-on-year, as market conditions start to toughen” he added.

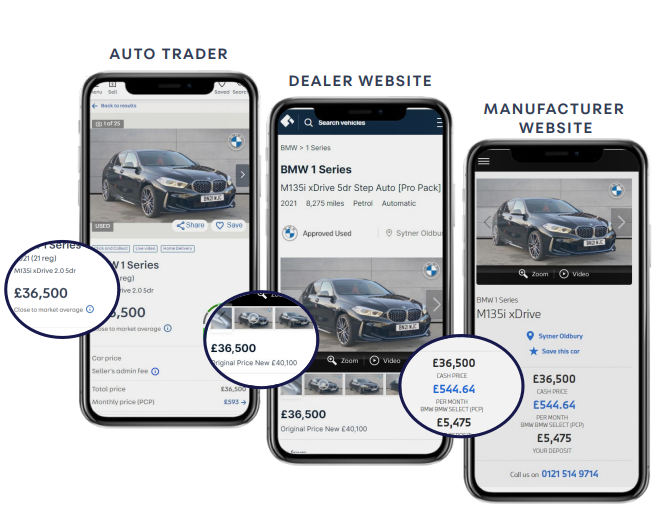

With superior scale comes superior data

Auto Trader has a clear market leading position with over 75% of all minutes spent on automotive classified sites spent on Auto Trader, that’s a staggering 8x larger than their nearest competitor.

And with this superior scale comes superior data…

The platform collects a fast amount of valuable data which it can then resell in the form of tools to help dealerships price their stock and give guidance on when and how prices need to be adjusted with changes in market conditions.

Auto Trader aim to become the UK’s industry standard data platform, and its newly launched Auto Trader Connect product gives real-time data analytics and is designed to be integrated with a dealerships existing stock management system.

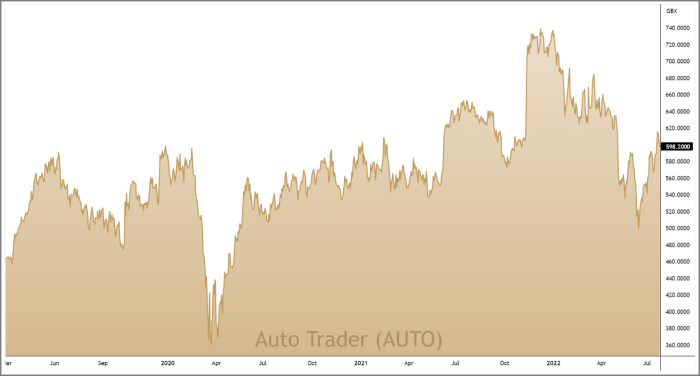

Auto Trader’s share price motors past descending trendline

After surging to highs of 749p during the festive period on record Half-Year revenues, Auto Trader’s share price has undergone a prolonged pullback…

The pullback formed a series of lower swing highs – creating a descending trendline (gold dotted line).

Selling pressure was partially fuelled by the global supply shortage which has dogged the new car market and partially due to rising interest rates making car finance less attractive.

However, whilst shortage of vehicle supply persists, consumer demand does not seem to be wavering, leaving Auto Trader’s hefty margins unaffected – prompting an upgrade from broker Peel Hunt in early July.

And in recent weeks the shares have gathered enough bullish momentum to break and hold above the descending trendline.

This burst of bullish momentum signals that the short-term downtrend is over, and a fresh wave of buyer pressure has begun – creating a bullish catalyst for entry.

You get what you pay for

With a forward price to earnings (PE) multiple of 21.2 and single digit forecast earnings per share growth, Auto Trader is no bargain basement purchase. And much like the used car market, you tend to get what you pay for…

Macro-economic headwinds are blowing strong right now, and this mean it’s worth paying up for quality.

Auto Trader’s market leading position gives it relatively stable levels of revenue growth. And its asset-light, high margin model delivers impressive cashlflows which have created a strong debt-free balance sheet.

The 51.3m net cash pile (FY22) will be used to make further acquisitions like Vanarama, which they purchased earlier this year, and Auto Trader will continue to operate a share buyback scheme which should be supportive.

And whilst the UK car market is likely to cool, Auto Trader’s monopolistic dominance should keep shareholders happy for many years to come.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.