26th Apr 2024. 10.45am

Weekly Briefing – Friday 26th April

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +2.72% |

| FTSE 250 | +2.32% |

| FTSE All-Share | +2.65% |

| AIM 100 | +1.47% |

| AIM All-Share | +1.43% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 26th April

Market Overview

Dear Investor,

It’s been a big week for the FTSE’s mining giants as BHP’s proposed £31 billion takeover of Anglo American has sent shockwaves through the market.

This potential mega-deal aims to combine two global mining powerhouses, with BHP seeking to expand its portfolio of copper mines amidst soaring demand for the metal driven by renewable energy projects and electric vehicles.

If successful, this merger would mark one of the largest transactions in the mining sector in recent years, positioning the combined entity as a dominant force in the industry.

The deal follow’s last year’s $9bn tie up of Glencore and Teck Resources’ coal division. This transaction signalled the beginning of a potential break-up of Glencore’s commodities business, with plans to merge Teck’s steelmaking coal business with its own coal assets before spinning off the combined unit within two years.

These two major deals highlight the ongoing quest for consolidation and strategic positioning among the mining industry’s key players. As BHP’s proposed takeover of Anglo American and Glencore’s deal with Teck reshape the landscape, all eyes are on how these moves will impact the future direction and competitiveness of the FTSE’s mining giants.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: AstraZeneca (LSE:AZN) +% on the week

AstraZeneca’s share price has jumped higher this week following the release of a market-beating set of results…

In the first quarter of 2024, AstraZeneca performed exceptionally well, surpassing analysts’ expectations with a 19% growth in revenue.

This impressive growth was primarily driven by increased sales of its cancer drugs. The pharma giant reported a revenue of $12.7 billion, significantly outperforming consensus estimates, which had projected $11.9 billion.

AstraZeneca also reiterated its guidance for the current year, expecting double-digit growth in both sales and earnings.

These positive results follow recent developments within the company, including a substantial pay rise for CEO Pascal Soriot and a notable increase in dividends. The dividend per share saw a significant rise of $0.20, marking the most significant increase in dividends for AstraZeneca in over a decade.

REGENCY VIEW:

AstraZeneca has long been a top pick in the Pharma sector for us due to its impressive cancer drug portfolio and solid financials. Read our full report on AstraZeneca here.

Shares in vanadium producer, Bushveld Minerals fell this week after it said it faces the prospect of suspending operations due to a severe liquidity crunch. The company’s CEO, Craig Coltman, attributes this crisis to dwindling cash reserves exacerbated by a decline in vanadium prices.

Two crucial corporate deals aimed at addressing the funding issue have hit roadblocks: one with Acacia Resources, which failed to settle its equity subscription on time, and another with Southern Point Resources (SPR), where the completion of asset sales has been delayed.

These setbacks have significantly impacted production, particularly at the Vametco site. Bushveld is now urgently seeking further funding to avert a shutdown, with a cash balance of only $2.2m as of April 21.

The company must repay approximately $7m to Orion by June 30, adding to its financial pressure. Bushveld pledges to update stakeholders once it clarifies its funding situation and hints at ongoing negotiations to resolve the crisis.

REGENCY VIEW:

Bushveld’s demise highlights the inherent problem of investing in cash burning company’s that have not reach profitability. With a balance sheet laden with debt, bargain hunters should be wary of severe dilution and the potential of liquidation.

Sector Snapshot

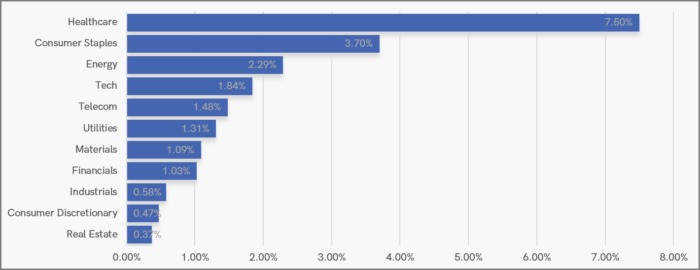

With the FTSE breaking to all-time highs, our Sector Snapshot is unsurprisingly blue across the board this week.

Healthcare is leading the pack this week – boosted by its Pharma sub-sector with AstraZeneca making gains following its quarterly results.

Lagging is Real Estate as investors remained concerned that the Bank of England may be resistant to cut rates too soon with inflation above target.

UK Price Action

In last week’s UK Price Action we highlighted the FTSE’s current tendency to respond to key structural levels. Buyers stepped in at broken support to slingshot prices higher – leading to a key breakout to new highs this week.

All eyes will now be on Friday’s closing price to see if the breakout can be maintained.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.