2nd Nov 2022. 8.59am

Regency View:

BUY AstraZeneca (AZN) – Second Tranche

- Growth

- Value

Regency View:

BUY AstraZeneca (AZN) – Second Tranche

Pullback creates second buying opportunity

The art of investing is being opportunistic, finding a stock that meets your criteria and waiting for the right moment to fill your boots.

We like AstraZeneca (AZN) for many reasons…

It’s a world leader in revolutionary cancer care with an incredible oncology pipeline. The stock offers growth at a reasonable price and has defensive qualities which are highly desirable in this current bear market.

We first highlighted the stock in June following a pullback which we looked oversold, and in recent months we’ve seen a similar pullback, creating an opportunity to snap up a second tranche.

AstraZeneca benefiting from long-term investment themes

The majority of AstraZeneca’s revenue base comes from non-communicable diseases such as cancer and cardiovascular disease.

This makes it is exceedingly well positioned to benefit from two long-term investment themes:

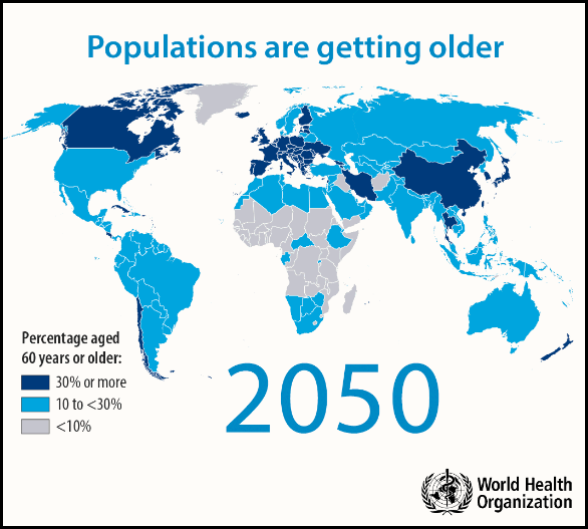

1. Aging global population

Declining fertility and increasing longevity mean the global population is both aging and growing.

Over the next 30 years, the UN forecasts the global population will grow from eight billion people to 9.7 billion people. While over the same period the number of people aged 65 or over is expected to almost double to 1.6 billion.

As a consequence, the global cancer burden is expected to be 28.4 million cases in 2040, a 47% rise from 2020 levels – creating a sustained increase in demand for AstraZeneca’s cutting-edge oncology products.

AstraZeneca is aiming to more than double its portfolio of new cancer drugs by the end of this decade, seeking the top spot in the world’s most lucrative category of medicines.

Addressing Europe’s biggest cancer conference in September, AstraZeneca’s oncology chief, Dave Fredrickson said “We have the opportunity to be the No.1 oncology player”. Doubling the number of new cancer medicines is part of the plan, “the strategy’s working that we have in place” he added.

2. Rising levels of obesity in emerging markets

Rapid economic development leads to rapid changes in diet…

In China, higher levels of economic prosperity have led to higher levels of meat and processed food consumption which in turn have led to higher levels cardiovascular disease.

According to published journals, the average Chinese diet has transitioned from ‘under-intake’ to ‘over-intake’ – leading to a rise in obesity levels and associated cardiovascular diseases.

AstraZeneca has a large presence in emerging markets, accounting for nearly a third of total revenue with China contributing more than half.

And with the IMF (International Monetary Fund) predicting that emerging markets will grow almost three times faster than developed markets next year, AstraZeneca should continue to see high levels of growth in this geographic segment.

Financial strength justifies valuation

AstraZeneca’s recent trading updates have shown significant strength against a deteriorating global economic backdrop and underlined the stocks defensive qualities.

Q2 revenue and profit came in comfortably ahead of analyst expectations, leading the pharma to up its full year revenue guidance “by a low twenties percentage” rather than the high teens forecast previously. And core earnings per share (EPS) is expected to increase “by a mid-to-high twenties percentage” which was unchanged from previous guidance.

And it is AstraZeneca’s impressive track record for delivering EPS growth (37.64% EPS CAGR over 3-years) and its forecast EPS growth which justifies its double-digit earnings multiple.

Another factor which justifies AstraZeneca’s premium valuation is its improving financial performance, which is allowing it to invest greater sums in R&D.

Core R&D spending in the first half of the year increased by 40%, which should further strengthen its product pipeline and create significant long-term growth opportunities.

AstraZeneca are set to release Q3 numbers on Thursday November 10th and we expect the pharma’s strong run of market-beating updates to continue.

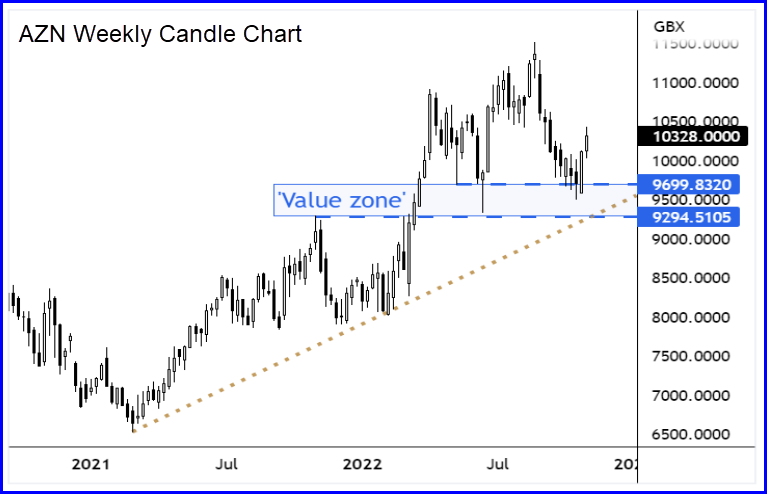

Prices pull back to ‘value zone’

In technical analysis the concept of confluence is very useful when looking to add a cutting edge to your market timing.

Areas on the price chart where multiple technical catalysts coincide are often referred to as ‘value zones’ or pockets of confluence.

In AstraZeneca’s case, a ‘value zone’ exists between 9,699p and 9,294p – an area which represents several technical catalysts:

- The location of the May 2022 and June 2022 swing lows

- The location of the November 2021 and March 2022 swing highs

- The location of the long-term ascending trendline

These three support levels have created a confluent ‘value zone’ from the which the shares have responded to in recent weeks.

With prices now moving higher from the ‘value zone’ we believe the technical timing is attractive to snap up our second tranche of AstraZeneca.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.