23rd Feb 2024. 10.19am

Weekly Briefing – Friday 23rd February

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.25% |

| FTSE 250 | +0.06% |

| FTSE All-Share | -0.20% |

| AIM 100 | -1.19% |

| AIM All-Share | -1.07% |

* Price movement from Monday's open at 8am

Weekly Briefing – Friday 23rd February

Market Overview

Dear Investor,

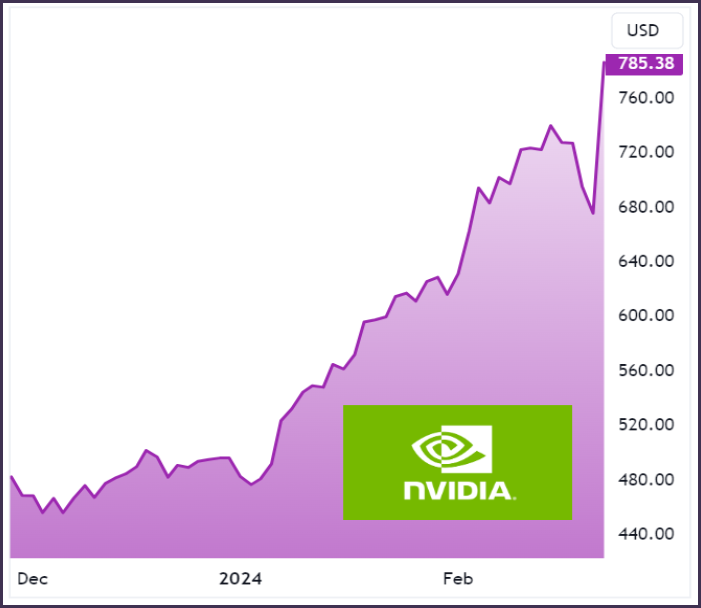

This week’s colossal quarterly update from Nvidia represents a self-proclaimed “tipping point” in the AI revolution, and the numbers speak louder than words.

Nvidia’s founder and CEO, Jensen Huang, didn’t mince words when he declared, “Accelerated computing and generative AI have hit the tipping point.” This statement encapsulates a pivotal moment where the demand for AI technologies has surged globally, creating an unprecedented frenzy.

The $22.1 billion in quarterly revenues, a staggering 265% increase, far exceeding Wall Street predictions, is not merely a financial achievement for Nvidia but a testament to the seismic shift happening in the tech landscape.

Nvidia’s H100 chips, touted as “essentially AI-generation factories,” have become the go-to standard for developers creating large language models. This technological leap has given birth to generative AI, a paradigm that is shaping the future of computing, enabling software to learn, understand, and generate information in various formats.

However, in the midst of this success story, challenges loom. Intensifying competition and geopolitical dynamics, as evidenced by the need to limit product capabilities in China due to new US export rules, add a layer of complexity to Nvidia’s path forward. Sustaining such extraordinary growth rates may pose challenging in the future, and with the stock trading on a forward PE north of 30, any misses will be severely punished.

As investors, Nvidia’s update sparks some serious reflection. AI is taking centre stage, and companies like Nvidia are steering the ship, shaping the future of tech, industry, and society. The “tipping point” Huang speaks of is not just a moment in time; it’s a paradigm shift that investors, industry leaders, and observers cannot afford to ignore.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Barclays (LSE:BARC) +11.6% on the week

Barclays bounced this week after the bank presented a three-year plan to boost its share price, involving significant initiatives such as cutting £2 billion in costs, returning £10 billion ($12.6 billion) to shareholders, and investing in its profitable UK arm.

This strategic update, the first in almost a decade, comes after a period of management turmoil and underwhelming results at Barclays. The plan includes cost-cutting measures of £1 billion in the near term, primarily targeting the UK consumer and transatlantic investment banks.

Barclays aims to allocate an additional £30 billion in risk-weighted assets to its UK retail bank by 2026, emphasising a more deliberate growth pace for the investment bank. Following the announcement, Barclays shares rose by as much as 7%, reflecting investor optimism. The bank posted a 6% fall in annual profit to £6.6 billion, meeting analyst forecasts.

As part of its restructuring efforts, Barclays plans to review its payments business and has introduced a new organisational structure with five operating divisions. The bank also announced a total return of £3 billion to shareholders for 2023, including a share buyback and a final dividend.

REGENCY VIEW:

Barclays sets ambitious targets for its return on tangible equity, aiming for over 10% in 2024 and exceeding 12% in 2026. We have been a fan of the stock for several months and recommended buying the shares last year – click here to read our original investment report.

HSBC shares saw their steepest decline since 2020 on Monday as the bank reported an 80% drop in quarterly profits and a $3 billion charge on its stake in a Chinese bank.

HSBC’s pre-tax profits for the last three months of 2023 decreased from $5 billion to $1 billion compared to the same period the previous year.

The disappointing end to 2023 caused HSBC to miss analysts’ expectations of $34 billion in full-year profits, despite a 78% increase to $30 billion. This marks a challenging period for the bank, reflected in the largest drop in its shares since the onset of the Covid-19 pandemic.

HSBC’s CEO, Noel Quinn, attributed the charge on the Chinese bank stake to a “technical accounting adjustment” and expressed confidence in China’s economy, projecting a 4.9% expansion in 2024. However, concerns arise as banks face challenges due to slowing growth in the world’s second-largest economy.

HSBC remains committed to China, and despite the challenges, it announced a $2 billion share buyback and a 31 cents per share dividend for the quarter. The bank also forecasted net interest income of at least $41 billion for 2024.

REGENCY VIEW:

HSBC’s highlights the broader impact of banks’ exposure to China, particularly concerning as the country reported its smallest annual foreign direct investment since the 1990s in the previous year.

Whilst the shares hold plenty of intrinsic value, we expect HSBC to underperform its peers following the negative reaction to this week’s update.

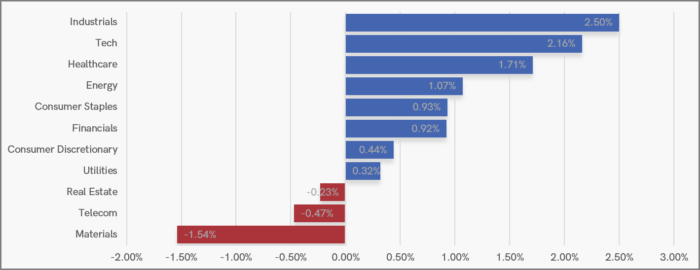

Sector Snapshot

There’s a bullish feel to this week’s sector snapshot which accounts for the last seven sessions of price action and includes the rally that we saw at the backend of last week.

With microchip stocks going bananas in the US its no real surprise to see strength in Tech this week. Industrials are also having a strong week with Rolls Royce and Ashtead leading the charge.

Materials are underperforming with concerns over Chinese growth and weak earnings in the mining sector weighing on sentiment.

UK Price Action

The FTSE retested the top of the resistance zone at the start of the week and sellers once again stepped in to drive prices lower.

The level of rejection at the resistance zone was not extreme and the bulls may make another attempt to breakout of the range in the coming week.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.