5th Jul 2023. 8.57am

Regency View:

BUY Barclays (BARC)

- Value

Regency View:

BUY Barclays (BARC)

Barclays offer big value

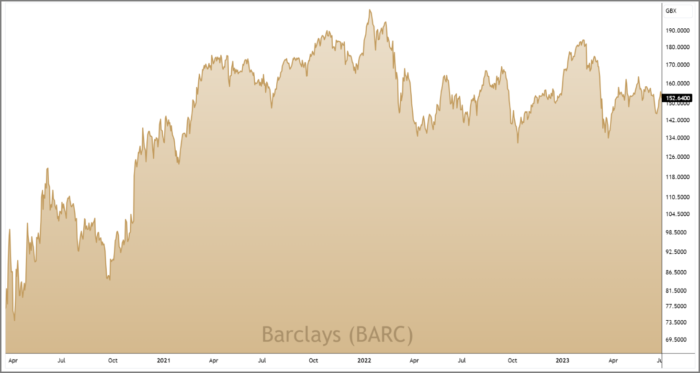

Among the banking giants of the FTSE, Barclays stands out as a prime example of being both unloved and undervalued, perhaps more so than any other.

Throughout its history, Barclays has encountered numerous challenges and controversies, having to navigate through regulatory investigations, legal disputes, and fines that have significantly impacted its reputation and investor confidence. As a result, the stock is currently trading at rock bottom valuations across various metrics.

However, with the bank projected to return £10 billion to its shareholders by 2025, we firmly believe that Barclays now offer big value.

Thriving through diversification and stability in investment banking

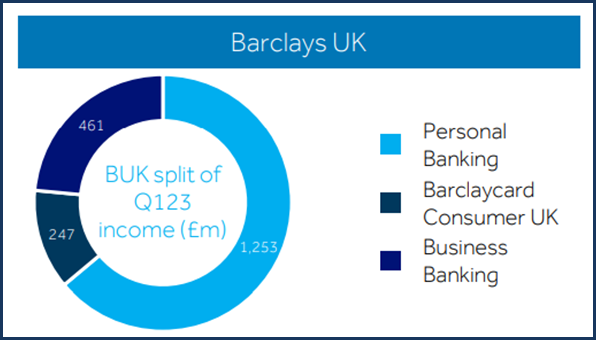

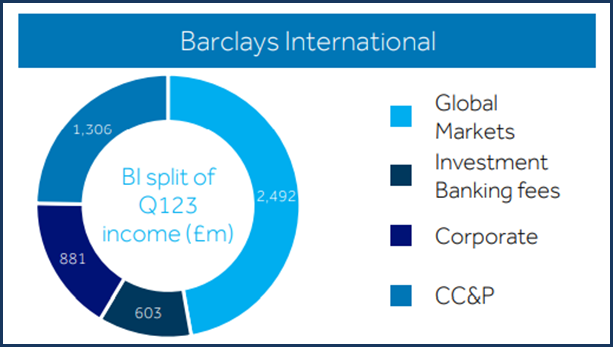

Barclays has two main divisions: UK retail banking and international banking. In the UK, they offer personal accounts, credit cards, and small business banking, while internationally, they focus on investment banking, corporate banking, and credit cards/ payment systems. Most of their revenue and profit comes from non-retail banking operations, particularly investment banking advisory and trading.

Investment banking can be a risky and capital-intensive business and is kept separate from retail banking to comply with regulations. While some investors perceive this risk as a potential troublemaker, Barclays’ investment banking division has shown relative stability in recent years. This stability can be attributed to several factors, including the division’s strong performance in equities and bonds trading, as well as its expertise in providing advisory services.

Equities and bonds trading are significant revenue drivers for investment banks, and Barclays has been able to capitalise on these areas of the market. Through its trading operations, the bank engages in the buying and selling of equities and bonds on behalf of its clients. By leveraging its expertise and extensive market knowledge, Barclays has been able to generate consistent revenue streams from these trading activities. This stability in trading revenue is a positive sign for the investment banking division and contributes to its overall resilience.

In addition to trading, Barclays’ investment banking division excels in providing advisory services to its clients. This involves offering strategic advice on mergers and acquisitions, capital raising, and other corporate finance activities. The division’s ability to deliver high-quality advisory services has earned it a favorable reputation in the industry. This reputation not only attracts clients seeking financial guidance but also contributes to the stability of the division’s revenue streams.

By diversifying its revenue streams across different business lines within the investment banking division, Barclays has been able to mitigate potential risks associated with market fluctuations or changes in client demand. This diversification helps the division maintain stability, even during periods of volatility in the financial markets.

Peering beyond the PE ratio

Valuing banks can feel like peering into a box of snakes, you’ve no idea how many there are, or which one will bite you first. This is due to the vast sprawling nature of banks’ balance sheets, their web-like capital structure, and the regulatory environment in which they operate.

Traditional value metrics like Price-to-Earnings (PE) and Price-to-Book (PB) ratios are reasonable starting point, but they rarely give you the full picture.

Barclays has a forward PE ratio of just 4.5 which compares well to its peer group and the wider market. However, Barclays have different components to their earnings, such as interest income, fee-based revenue, and trading gains. These elements can fluctuate based on market conditions and regulatory changes, making it challenging to determine a stable and reliable earnings figure.

Similarly, Barclays PB ratio of 0.35 is very attractive, but banks’ balance sheets are filled with diverse assets, including loans, securities, and derivatives, which can have varying levels of risk and liquidity. The book value alone may not fully account for the quality and market value of these assets.

To truly understand the value of a bank, investors need to delve deeper into its financials and consider factors such as Return on Tangible Equity (RoTE) and discount to Net Asset Value (NAV).

Barclays RoTE is currently around 10-11% and expected to remain at this level through 2025. This indicates that Barclays is generating good returns on its tangible assets.

When we consider NAV, banking analysts say Barclays should be trading at around 77% to 85% of its NAV versus its current discount of 50%. Additionally, Barclays NAV is projected to rise by almost 30% by 2025.

This means that even if the current discount to NAV remains the same, the share price should naturally be pulled up as Barclays book value increases. This suggests that the rising NAV should contribute to a higher share price over time.

It is also worth noting that Barclays is projected to distribute £10 billion to its shareholders by 2025. This figure includes dividends and share repurchases, indicating Barclays’ commitment to enhancing shareholder value.

In summary, it appears that the market is placing excessive emphasis on Barclays’ investment banking exposure while undervaluing its potential to significantly increase its book value in the coming years. This disconnect creates an exciting opportunity for investors seeking deep value.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.