19th Apr 2024. 11.03am

Weekly Briefing – Friday 19th April

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.92% |

| FTSE 250 | -2.11% |

| FTSE All-Share | -1.94% |

| AIM 100 | -2.33% |

| AIM All-Share | -1.98% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 19th April

Market Overview

Dear Investor,

The Vix volatility index, often referred to as the “fear gauge” on Wall Street, has spiked to its highest level since October. This surge in volatility is reminiscent of the period following the Hamas attack that initiated Israel’s conflict in Gaza.

On Monday, the Vix hit highs of 19.2 as the market priced-in the impact of Iran’s attack on Israel. And after a slight decline to around 18.2 by Wednesday, the index has surged above 20 this morning following news of retaliation from Israel.

Market turbulence has extended to US bonds, with the ICE BofA Move index, tracking volatility in US Treasuries, hitting its highest level since early January. While in the stock market, the S&P 500 and Dow 30 has extended its recent run of losses.

Alongside escalating geopolitical tensions, stubbornly high US inflation has left investors fearing that the bull run could be coming to an end.

However, established trends take considerable time and effort to reverse, and the pullback of US stocks from highs may represent a temporary correction rather than a fundamental shift in market sentiment.

In times of uncertainty, it’s crucial to maintain a diversified portfolio tailored to your investment goals and risk tolerance. While geopolitical events and economic indicators can influence market movements in the short term, a disciplined long-term approach focused on quality can help navigate through periods of volatility.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Volex (LSE:VLX) +10.8% on the week

Volex have surged higher this week after announcing full-year performance is expected to surpass market expectations due to strong organic growth.

The manufacturer of critical power and data transmission products said revenue is projected to be at least $900.0 million, representing a minimum 25% increase over the previous year, including contributions from the acquisition of Murat Ticaret.

Underlying operating profit is anticipated to exceed analyst predictions and operating profit margins improved in the latter half of the year, partly due to product mix and contributions from Off-Highway sales.

Despite accelerating investments in future strategic growth initiatives to support long-term customer demand, Volex remains confident and optimistic about entering the new financial year.

Chairman Nat Rothschild attributed the company’s strong growth in challenging markets to the quality of its team, strategy, and responsiveness to customer needs. He expressed confidence in the momentum generated during the current financial year, improving market conditions in electric vehicles and consumer electricals sectors, and opportunities in the new off-highway sector.

REGENCY VIEW:

Volex stands out with its diverse product portfolio, strategic acquisitions, and commitment to innovation. For investors looking for growth, value, and a foothold in the future, Volex looks a compelling long-term investment opportunity.

Volex is a stock we recommended to our clients last year and it is one of our Share Tips of 2024. CLICK HERE to read our full report.

Shares in money transfer company, Wise slid this week after full year revenues fell short of the market’s lofty expectations.

Despite announcing a 24% increase in revenue to £277.2 million for the full year, Wise share price gapped lower as top line growth missed consensus estimates by 1%.

Additionally, the growth in volume during the fourth quarter, which reached 14% to £30.6 billion, was lower than what analysts had expected. Despite this setback, Wise did experience a 30% increase in personal customers, reaching 7.5 million over the quarter.

However, the final quarter income fell short of projections, which contributed to the overall disappointment in the results. Nonetheless, analysts believe there is potential for a rebound driven by customer growth and anticipated earnings upgrades.

CEO Kristo Käärmann expressed confidence in the company’s progress. He highlighted the continued growth in customer numbers and emphasized that Wise’s investments are meeting genuine needs. This gives him assurance that the company is progressing well on its mission.

REGENCY VIEW:

Wise has seen impressive levels of top line revenue growth averaging more than 50% on a compound annual basis over five years. Profitability has improved and cashflow remains strong – creating a robust debt-free balance sheet.

However, market expectations are very high and this is reflected in the stocks lofty valuation. The stock trades on a forward price-to-earnings ratio of 24.9 – one of the highest in its sector and the wider market.

Sector Snapshot

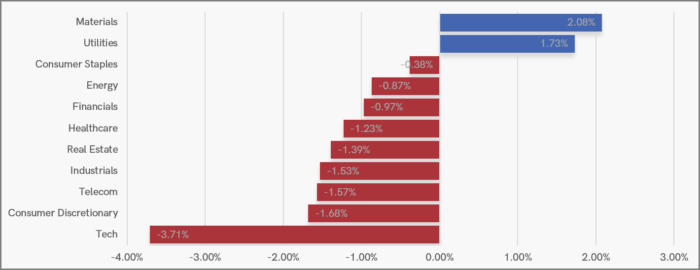

There is a distinctly ‘risk off’ feel to this week’s UK sector snapshot. Materials have been boosted by the rising gold price and ultra-defensive Utilities are also showing strength.

While ‘risk on’ sectors such as Industrials, Consumer Discretionary and Tech have erased some of this year’s gains.

UK Price Action

It’s been a volatile week for the FTSE 100 rich in short-term structure-based trading opportunities…

Having touched the February 2023 highs, the market reversed on a dime and formed a bearish pin-bar candle. This was followed by a swift sell-off which has taken the market back down into a key area of broken resistance / new support.

We’re already seeing signs of the market responding to support this morning and a close within the top 25% of the today’s range could be the first indication of a relief rally next week baring any geopolitical developments over the weekend.