10th Aug 2023. 9.01am

Regency View:

BUY Volex (VLX)

Regency View:

BUY Volex (VLX)

Unveiling the powerhouse behind connectivity: Volex’s electrifying rise

In a world increasingly driven by the invisible currents of data and power, there’s a company at the forefront of ensuring these lifelines remain seamless, efficient, and reliable.

Meet Volex (VLX) – a name synonymous with connectivity solutions that touch everything from kitchen appliances to electric vehicles, sparking the gears of modern life.

Volex isn’t just about cables; it’s about bridging the gap between imagination and innovation. This industrial manufacturer crafts power and data transmission products that form the backbone of our technologically infused existence.

Think about the charging cable that fuels your smartphone, the intricate wiring that powers your smart home, and the arteries of energy flowing through electric vehicles – that’s the world Volex thrives in.

Volex’s shares offer attractive value due to a robust growth trajectory, diverse revenue streams, and favorable earnings multiples. This combination provides investors with a compelling opportunity for potential long-term returns.

Crafting tomorrow’s industries, not just riding today’s trends

Volex isn’t just riding the tech wave; it’s shaping its trajectory.

For instance, in the realm of electric vehicles (EVs), Volex isn’t just producing cables; it’s creating the essential power components that drive the EV revolution. By being at the forefront of this industry, Volex is shaping the future of transportation.

In the medical field, Volex is an enabler of cutting-edge medical devices and procedures. As healthcare becomes increasingly technology-driven, Volex’s solutions play a pivotal role in advancing diagnostics, treatment, and patient care.

Volex has a global manufacturing footprint with multiple factories across different regions. They have manufacturing sites in Poland, Indonesia, Vietnam, Mexico and three plants in China.

This diverse manufacturing network enables them to efficiently produce a wide range of power and data transmission products to meet the demands of different industries and markets.

Recent triumphs illuminate the path ahead

Volex’s recent financial results offer a glimpse into its electrifying journey…

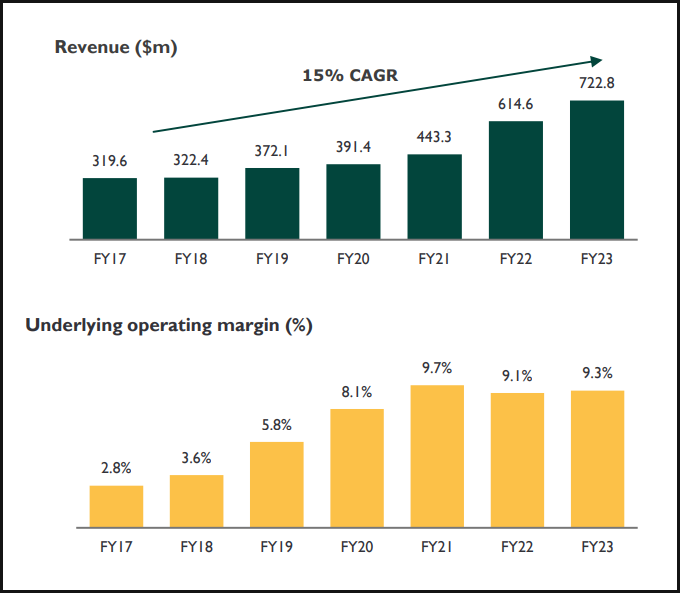

With a 17.6% surge in group revenue, reaching $722.8m, Volex’s growth is both substantial and sustainable. Revenues have grown at 5yr compound annual growth rate (CAGR) of 15%.

Notably, the EV sector has been a significant driver of revenue growth. The surge in organic EV sales, which increased by a third to $138m, showcases Volex’s pivotal role in the EV revolution.

Only this week, Volex announced that it has partnered with Tesla to supply authentic connectors for Tesla’s North American EV charging standard. The collaboration positions Volex at the heart of the EV revolution, as other automakers plan to adopt Tesla-compatible ports from 2025.

Furthermore, Volex’s engagement in complex industrial technology has proven to be another growth accelerator. The organic revenue increase of 19% in this sector, reaching $177.7m, demonstrates Volex’s role as a catalyst for advanced manufacturing and automation.

The medical division’s organic sales growth of 16% to $145m is yet another testament to Volex’s revenue-driving capabilities. The rollout of new medical technology and the global backlog in medical procedures have fuelled this growth, positioning Volex as an enabler of cutting-edge medical devices and procedures.

And in a landscape plagued by inflation and cost challenges, Volex has showcased its adeptness at cost control, boosting its underlying operating margin to an impressive 9.3%.

Murat Ticaret deal: A transformational leap for Volex

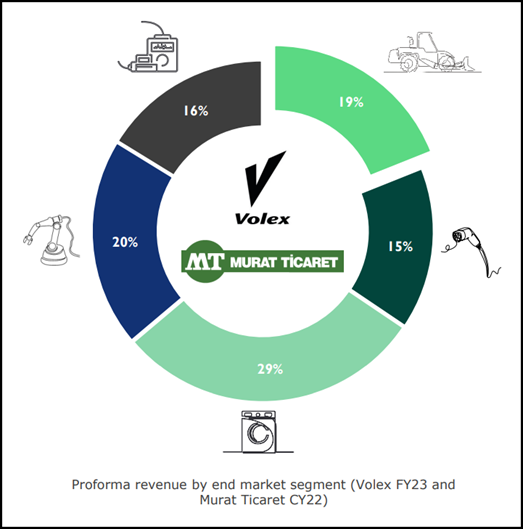

Volex’s agreement to acquire Murat Ticaret, a Turkish wire harness manufacturer, has recently been given the greenlight by regulators.

The deal, valued at €178.1m, offers Volex the opportunity to tap into new growth markets, particularly in the realm of wire harness manufacturing.

Wire harnesses are essential components in various industries, including automotive, aerospace, and electronics. By integrating Murat Ticaret’s expertise and capabilities in wire harness manufacturing, Volex can expand its presence and offerings in these sectors.

The automotive industry, for instance, is experiencing a surge in demand for wire harnesses as vehicles become more technologically advanced. EV autonomous driving features, and increased connectivity require intricate wiring systems, driving the demand for specialised wire harness solutions.

Similarly, the aerospace and electronics industries rely on wire harnesses for communication, control systems, and power distribution. As these sectors evolve and adopt new technologies, the demand for high-quality wire harnesses is expected to grow.

Valuation: The spark that ignites interest

Volex’s track record for profitable growth, inflation-protected profit margins and double-digit return on equity mean the stock scores highly for quality.

And when we peer into the forward valuation metrics, this quality is available at a reasonable cost. Currently trading at a forward price-to-earnings (PE) ratio of 12.6, coupled with an anticipated 18.6% growth in earnings per share, investors are not being asked to overpay for growth.

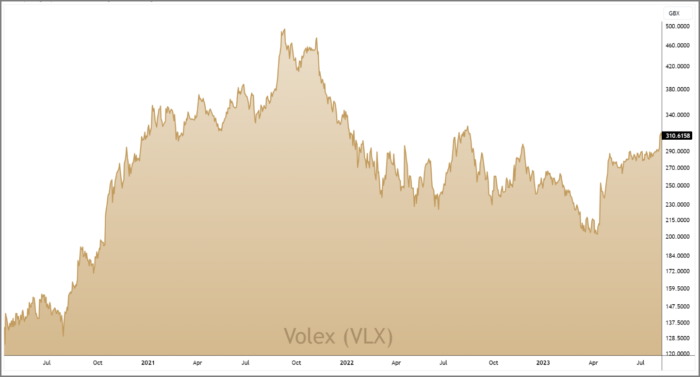

What’s more, the stock trades at a 15% discount to its estimated Fair Value. The price chart confirms this attractiveness, as the shares have plenty of upward momentum. Having gapped higher on a trading update in April, the stock has continued to trend higher.

With the stock fuelled by a steady stream of bullish newsflow, it is well positioned to revisit its September 2021 highs of 495p – implying an impressive 50% potential upside from current levels.

In conclusion, Volex stands out with its diverse product portfolio, strategic acquisitions, and commitment to innovation. For investors looking for growth, value, and a foothold in the future, Volex looks a compelling long-term investment opportunity.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.