15th Mar 2024. 10.41am

Weekly Briefing – Friday 15th March

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.08% |

| FTSE 250 | -0.34% |

| FTSE All-Share | +0.85% |

| AIM 100 | -0.03% |

| AIM All-Share | -0.01% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 15th March

Market Overview

Dear Investor,

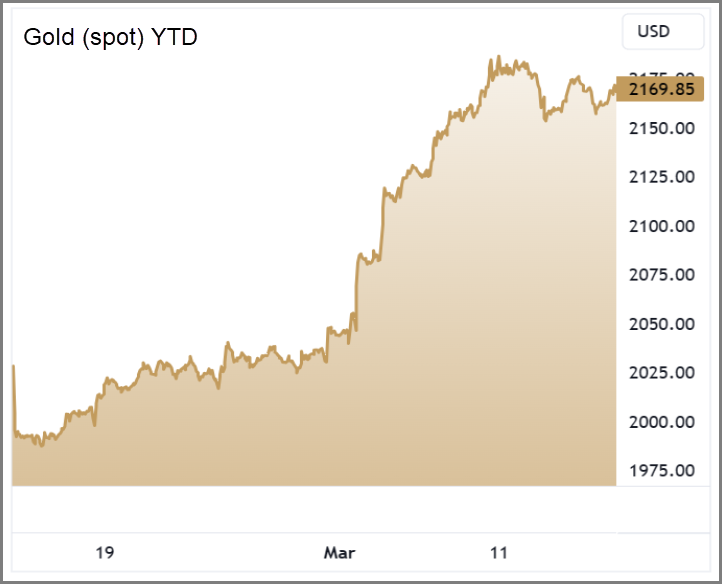

Gold has started to shine this month, surging to a new record high, driven by a confluence of factors including expectations of lower interest rates, geopolitical concerns, and growing caution surrounding stock market valuations.

In less than four weeks, gold has added over $175 (8.8%) to its price – breaking above a key area of long-term resistance dubbed the “triple tops” near $2,070.

At the forefront of this surge are Chinese investors seeking refuge for their cash amidst turmoil in local property and stock markets. Ongoing geopolitical concerns have also added fuel to gold’s ascent. Uncertainties surrounding conflicts and trade disputes, have heightened investor risk aversion and bolstered demand for gold as a reliable store of value during turbulent times.

Furthermore, growing caution surrounding stock market valuations has further propelled gold’s rally. With US equities markets reaching lofty heights and concerns over potential corrections or downturns looming, investors are diversifying their portfolios and allocating capital to assets with proven resilience during market downturns.

For those interested in adding some gold exposure to their portfolios, we have selected a small number of high-quality gold mining stocks – they can be found in our lists of FTSE Investor and AIM Investor Open Positions.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Balfour Beatty (LSE:BBY) +10.8% on the week

Balfour Beatty’s share price jumped this week after a strong trading update which indicated increased profit in its core infrastructure businesses for the current year, driven by heightened activity in the UK power sector and a rise in US orders.

The company’s underlying profit rose by 2% in 2023, reaching £236 million, excluding its investment portfolio. CEO Leo Quinn highlighted increased activity in the US and UK, particularly in transmission projects like the Accelerated Strategic Transmission Investment (ASTI) framework in the UK.

Balfour said its UK nuclear projects are progressing well, aligning with the UK government’s efforts towards energy security and achieving net zero carbon emissions. Balfour maintained an optimistic forecast irrespective of the outcome of the next UK general election, and said the government’s focus on clean energy would benefit the company.

Firm orders for US projects are increasing as the tech downturn from last year eases and lower interest rates become a prospect. In 2023, the UK and U.S. construction divisions contributed about 29% and 22%, respectively, to Balfour’s underlying profit.

REGENCY VIEW:

Balfour Beatty is a high-quality business with diverse and stable revenue streams along with a rock-solid cash rich balance sheet. However, it’s current valuation of just under 10x forward earnings looks quite expensive relative to its sector peers and relative to a forecasted contraction in earnings per share (EPS).

Shares in Shoe Zone took a downturn this week following the retailer’s announcement of trading performance slightly below expectations.

CEO Anthony Smith noted growth in the previous financial year, highlighting ongoing efforts in store refits and relocations.

However, current trading has been impacted by various factors, including higher labour costs, increased container expenses due to ongoing Suez Canal issues, property portfolio upgrades, and a slower end to the Autumn/Winter season.

This update follows Shoe Zone’s acknowledgment of a significant boost in profit before tax for the year ending September 30, 2023, attributed to back-to-school shopping. Pre-tax profits surged by 19.1% to £16.2 million during the twelve months, alongside a rise in revenues to £165.7 million from £156.2 million the previous year, despite reducing its store count by 72 to 323.

REGENCY VIEW:

Shoe Zone operates a strong business model which generates plenty of cash and delivers impressive returns to shareholders (1yr Return on Equity 42.1%). However, the negative outlook for the retail sector is weighing on the share price, and this week’s update hasn’t helped change this narrative.

Sector Snapshot

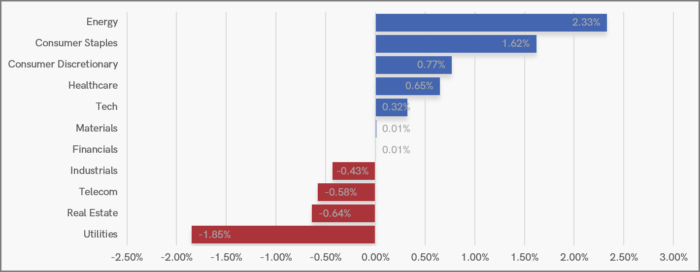

Last week’s bullish bias has changed to a more balanced sector snapshot this week.

At the extremes, the balance points toward a ‘risk on’ bias with Energy leading the pack and Utilities lagging. However, within the pack there we’re seeing strength in traditionally defensive Consumer Staples and Healthcare sectors and weakness in some aggressive sectors like Real Estate.

UK Price Action

Last week we highlighted the subtle signals that indicated the FTSE was coiling for a breakout. On Wednesday the market hit its highest level in more than 9 months.

However, the breakout could not hold, and Thursday saw the market sink back below resistance. Today’s close will be significant and may set the tone for next week’s trading. A close below yesterday’s lows would confirm a false breakout scenario. On the other hand, should the market strengthen into Friday’s closing bell, we could see another attempt to break and hold above resistance.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.