12th Jan 2024. 10.54am

Weekly Briefing – Friday 12th January

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.72% |

| FTSE 250 | +0.20% |

| FTSE All-Share | -0.59% |

| AIM 100 | -0.04% |

| AIM All-Share | -0.30% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 12th January

Market Overview

Dear Investor,

It’s been a busy week of corporate earnings, economic updates, and geopolitical developments.

Starting with domestic news, the UK economy beat expectations with a 0.3% month-on-month GDP growth in November. The expansion, driven by the services sector, alleviated concerns of a technical recession following October’s 0.3% contraction.

These positive GDP figures could influence the Bank of England’s interest rate decisions. Speculation in swaps markets suggests a potential interest rate cut in May or June, reflecting the impact of the economic rebound on monetary policy.

On the geopolitical front, tensions in the Red Sea intensified as the US and UK launched military strikes against Iran-backed Houthi rebels in Yemen, responding to their attacks on commercial ships. President Joe Biden authorised the strikes, and the UK’s RAF also participated, garnering support from the international community. The situation raises concerns about broader regional escalation, impacting global trade through the Red Sea and leading to a rise in crude oil prices.

Shifting to corporate data, upcoming earnings reports from Bank of America, Citigroup, JPMorgan, and Wells Fargo will provide insights into the financial performance of these major banks in Q4 2023. Anticipated increases in bad loans during the quarter, totalling around $24.4 billion, are of particular interest, up nearly $6 billion since the end of 2022.

These initial US bank earnings, set for release later today, may set the tone for the remainder of the earnings season.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Trustpilot (LSE:TRST) +21.4% on the week

Trustpilot has announced plans to kick off a £20 million share buyback program, part of its strategy to return excess capital to shareholders.

The Danish review website is confident that its full-year profits will exceed market forecasts and anticipates reporting adjusted underlying earnings for 2023 “above the top end” of expectations.

In a preliminary trading update, Trustpilot revealed an 18% increase in annual revenue to $176 million in 2023, with bookings rising by 16% year over year to $195 million.

The company closed the year with $91 million in cash and no debt. CEO Adrian Blair highlighted a strong performance, growth in new business, and a resilient retention rate across all regions.

The share buyback program could commence as early as today. And in addition to the updates, Trustpilot also shared the departure of Ben Johnson, a non-executive director, who is retiring from the board after eight years.

REGENCY VIEW:

Trustpilot is currently pursing growth over profitability. This is a common strategy for global tech platforms, but it makes the business a relatively high-risk proposition for long-term investors.

Free cashflow is tepid, but Trustpilot do have the benefit of a well-capitalised balance sheet.

Sainsbury’s share price has fallen this week despite reporting robust Christmas grocery sales. The UK’s second-largest supermarket chain faced concerns over its struggling general merchandise business, leading to a decline in shares.

During the 16 weeks to January 6, grocery sales rose by 9.3%, driven by premium ranges and promotions. However, general merchandise sales, which include Argos, disappointed with a 0.6% decline. Additionally, clothing sales saw a drop of 1.7%.

Sainsbury’s CEO, Simon Roberts, had focused on enhancing the food offering in the past three years to compete with rivals like Waitrose and discounters such as Lidl and Aldi. While grocery sales exceeded expectations, the weakness in general merchandise raised questions about whether it had been neglected.

Roberts explained that the general merchandise business faced tough comparisons with the same period in the previous year, particularly due to high energy bills driving demand for specific items.

Despite the challenges, Sainsbury’s reported that general merchandise sales, excluding the closure of Argos stores in the Republic of Ireland, were up 1.5% during the quarter. The company expressed confidence, stating it had entered 2024 with good momentum.

REGENCY VIEW:

While UK supermarkets have been cutting prices as food inflation eases, Sainsbury’s maintained its forecast for underlying pre-tax profit to be between £670 million and £700 million for the year.

The shares trade on a forward PE of 13 which is one of the highest in its peer group, this valuation also looks expensive relative to a forecast contraction in EPS. Of the UK supermarkets, we currently favour Tesco (TSCO) – find out why here.

Sector Snapshot

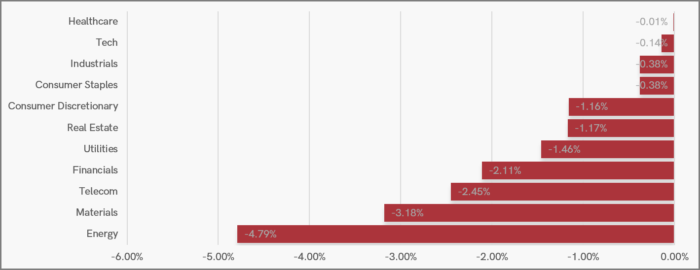

The rising geopolitical tensions in the Red Sea have created a sea of red on this week’s Sector Snapshot.

Healthcare still leads the pack on a relative basis with ‘risk on’ Financials and Materials continuing to lag.

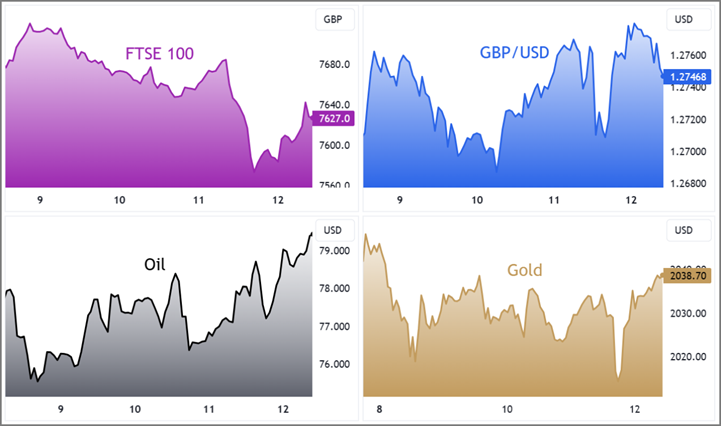

UK Price Action

This week the FTSE has continued to move lower from the major resistance zone (see chart below).

FTSE bulls will be targeting 7,560 as a potential ‘buy the dip area’ as this level has the ascending trendline and the volume-weighted average price (VWAP) from the October lows.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.