25th Oct 2023. 9.00am

Regency View:

BUY Tesco (TSCO)

- Value

- Income

Regency View:

BUY Tesco (TSCO)

Tesco: A defensive anchor in turbulent times

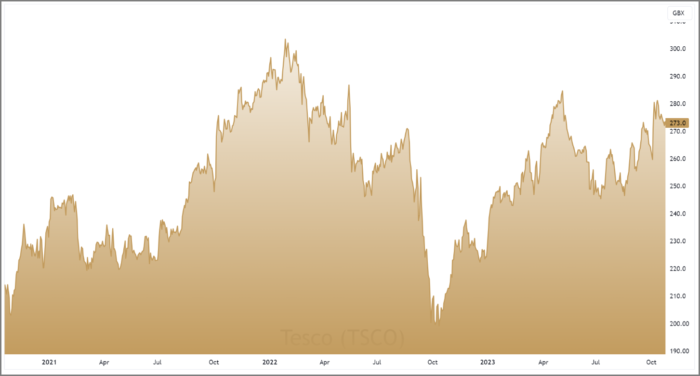

In the midst of a 300-point sell-off that hit the FTSE 100 last week due to escalating geopolitical tensions and weaker quarterly earnings from many constituents, the pursuit of stability in investment choices becomes paramount. Against this turbulent backdrop, Tesco (TSCO) stands as a beacon of defensive strength.

Tesco’s core strength

The foundation of Tesco’s resilience lies in its core business – providing the essentials that households cannot forgo, regardless of economic ups and downs. Through deep-rooted relationships and a colossal scale, Tesco has mastered the art of consistently offering low prices and accessible goods.

Robust Interim Results

Earlier this month, Tesco unveiled robust Interim Results that underscore its resilience and prowess in the retail sector. Group sales surged by 8.4% to a staggering £30.7 billion. This growth was primarily driven by a 7.8% increase in like-for-like (LFL) sales, with the UK market leading the way with an 8.7% boost, achieving £21.8 billion in sales.

Tesco’s unwavering commitment to providing affordable prices while effectively managing inflation has played a pivotal role in this strong performance. In the words of Ken Murphy, Tesco’s Chief Executive, “We are committed to doing everything we can to drive down food bills, and Tesco is now consistently the most budget-friendly full-line grocer.” And whilst Tesco is known for value, its premium product line, Tesco Finest, saw a 4.1% increase in sales volume within the UK, signifying the brands pricing power among consumers.

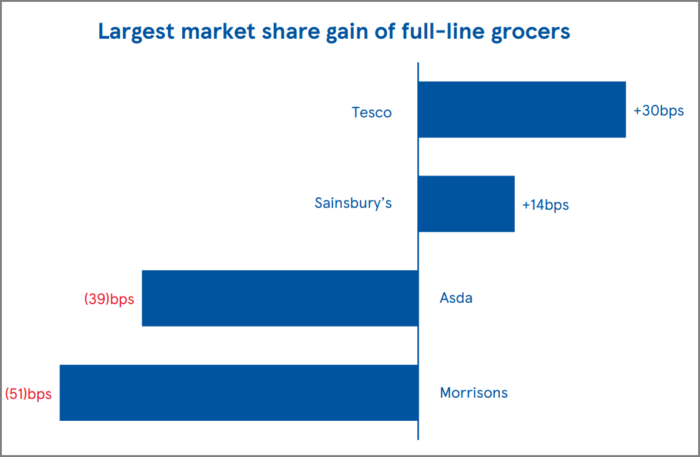

Market dominance and profit

In terms of market share, Tesco’s dominance has significantly expanded, making it the front-runner among the major four supermarket chains. This growth has been accompanied by a 13.5% increase in underlying retail operating profit, which reached an impressive £1.4 billion, surpassing initial expectations. Consequently, Tesco has raised its full-year profit outlook, anticipating a range between £2.6 billion and £2.7 billion.

Tesco share of Total Grocers Till Roll sales on a 12 week rolling basis to 3 September 2023 vs 4 September 2022

Sound financials

Beyond the top-line figures, the company reported a substantial 6.6% boost in retail free cash flow, totalling £1.4 billion, while effectively trimming down its net debt from £10.0 billion to £9.9 billion. In keeping with its consistent performance, Tesco also announced an interim dividend of 3.85p, aligning with the previous year’s payout.

Diversification: Booker and Tesco Bank’s success

Tesco’s appeal extends beyond its core retail operations, a testament to the company’s diversified business portfolio. A significant segment of this diversification is its wholesale subsidiary, Booker, which has consistently demonstrated impressive performance.

Booker delivered topline revenue growth of 11.5% – driven by a resurgence in catering demand. Booker’s retail segment benefited from the addition of 143 new retail partners, while the catering sector saw volume growth from independent businesses, accompanied by record-high availability.

Additionally, Tesco Bank has adeptly harnessed the advantages of rising interest rates while maintaining a robust balance sheet. The bank saw revenue climb 16.4% to £702m in the first half of the year, with operating profit jump 25% to £65m. The bank’s impressive performance was driven by higher credit card balances and improved yields.

Bullish momentum

For investors seeking a blend of resilience, value and momentum, Tesco’s valuation and share price metrics are appealing…

The shares are currently trading at a compelling 39.7% discount to their estimated Fair Value. Coupled with a forward price-to-earnings (PE) ratio of 11.1 and a forward dividend yield of 4.50%, Tesco offer value and income.

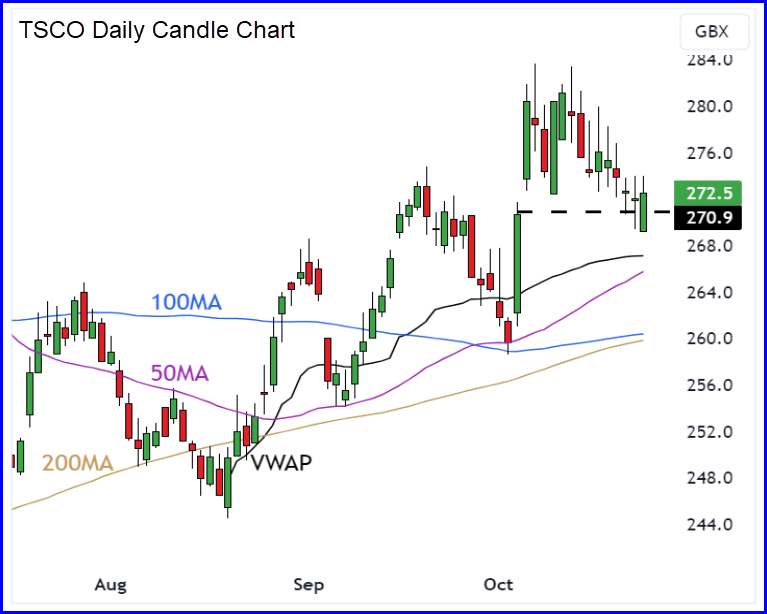

In terms of price action, Tesco’s shares have been charting an upward trajectory, forming a series of higher swing lows since August. Impressively, they maintain a strong position above the 50-day, 100-day, and 200-day moving averages, underlining the sustained momentum in the stock.

Recent market activity has witnessed a temporary pullback, culminating in the closure of the bullish price gap that emerged in the wake of the Interim Results release earlier this month. Such price gaps often serve as support levels, further reinforced by the dynamic backing of the Volume Weighted Average Price (VWAP) anchored to the August lows.

With a discounted valuation, attractive income potential, and a bullish short-term catalyst on the price chart, Tesco represent a solid addition to our FTSE Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.