15th Feb 2023. 8.57am

Regency View:

BUY TP ICAP (TCAP) Second Tranche

- Value

- Income

Regency View:

BUY TP ICAP (TCAP) – Second Tranche

TP ICAP: value and income without compromising on quality

With the FTSE pushing all-time highs it can be hard to keep a cool head…

Valuations of market leaders are eye-wateringly high and the ‘dash for trash’ has already started, with impatient investors buying underperforming dogs just because they trade on lower multiples.

However, if you take time to run the right stock scans and apply to right due diligence, it remains possible to find value without compromising on quality – TP ICAP (TCAP) being a prime example.

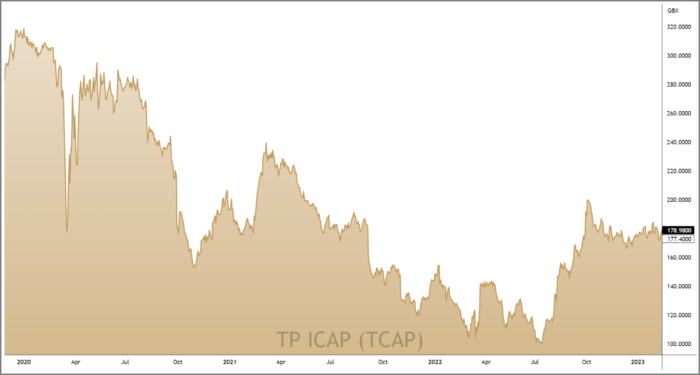

We published our first buy recommendation on TP ICAP in early September with the shares looking considerably undervalued.

And whilst the shares have rallied since then, putting our position into a modest double-digit profit, we believe this high-quality market leader continues to offer compelling levels of value and income.

Global Broking division in rude health as interest rate hikes create volatility

TP ICAP is the world’s biggest interdealer broker (IDB).

Its largest division by revenue is Global Broking and its most profitable asset class within Global Broking is Rates.

Rates involves making a market in short-term and long-term interest rate products such as swaps or options.

During the last year, Central Banks have raised interest rates from long-term lows, creating volatility in interest rate products which has created “favourable market conditions” for TP ICAP.

In a recent trading update, TP ICAP said its Global Broking division was “well positioned as Central Banks continue to withdraw liquidity and increase interest rates”.

TP ICAP delivered total group revenue of £1.6bn in the first nine months of 2022, which was up 10% on the same period in 2021 and “in line with (TP ICAP’s) expectations”.

November’s bullish third quarter update is the latest in a number of strong statements from TP ICAP which has served to underline its recovery from a prolonged period of underperformance.

TP ICAP will report its 2022 Preliminary Results in a month’s time (14 March 2023) and we wouldn’t be surprised to see the stock start to rally in anticipation of the numbers.

Valuation continues to look compelling

In September we wrote the following:

TP ICAP’s Price to Book Value has edged higher to 0.65, but the stock remains just as attractive.

The shares trade on a lowly forward PE of 7.5 which remains one of the cheapest in the Investment Banking & Investment Services sector. It also remains favourable relative to double-digit forecast earnings per share (EPS) growth.

And when it comes to income, TP ICAP scores highly too…

The shares trade on a market-leading forward dividend yield of 7.29% – covered twice over by forward earnings and forecast to grow steadily over the next three years.

Market harmonics project 58% potential upside

As a long-term investor, you’d be forgiven for not knowing what market harmonics mean.

Market harmonics uses the current volatility profile of a stock to project ultra-realistic profit targets and potential turning points.

It’s typically used by short-term traders, but on higher timeframes it can be a very handy tool for long-term investors to derive a market-based price target.

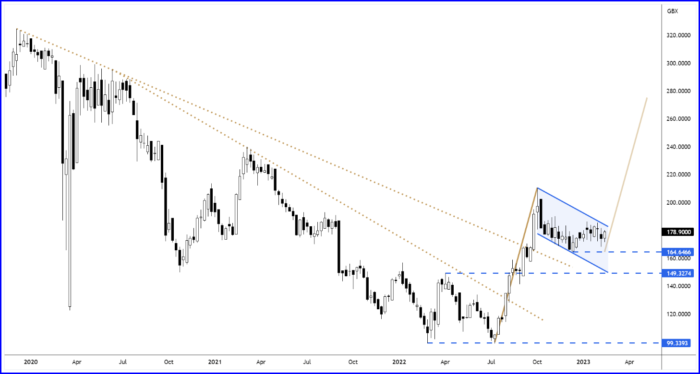

Take a look at the weekly candle chart below:

We can see that the sharp rally that took place from July-October last year broke through two major descending trendlines.

The burst of bullish momentum has been followed by a period of quiet consolidation and we can use the principles of market harmonics to retrieve a market-based price target for TP ICAP.

If we take the magnitude of the July-October rally and project that forward from the current consolidation phase, we get an approximate price target of 274p which represent some 58% potential upside from current prices.

This target looks modest and achievable given TP ICAP’s current profit projections of £159m (FY22) and £183m (FY23). And the target is still more than 18% below TP ICAP’s 2019 highs.

We believe it is worthwhile snapping up a second tranche during the current consolidation phase.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.