7th Sep 2022. 8.57am

Regency View:

BUY TP ICAP (TCAP)

- Value

- Income

Regency View:

BUY TP ICAP (TCAP)

Unloved TP ICAP is significantly undervalued

TP ICAP (TCAP), has been unloved and overlooked since Brexit…

Brexit meant British brokers can no longer supply investment services to customers in the EU, a problem which TCAP, the world’s biggest interdealer broker (IDB) had to circumvent with a new office in Paris.

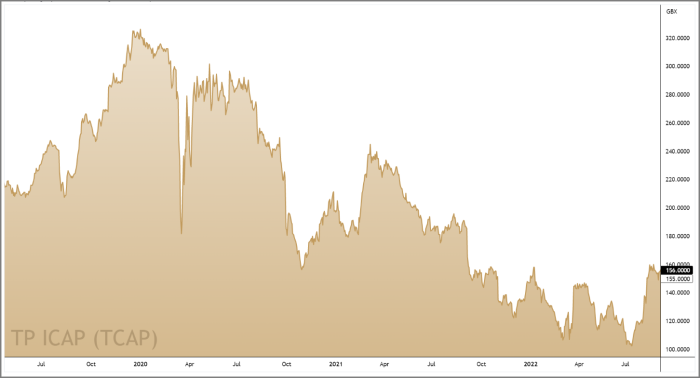

TCAP’s revenue and profitability is higher than pre-Brexit levels, but it would appear nobody told the market as the shares still change hands at more than 50% below their 2019 highs.

Of course, the true story of TCAP’s underperformance runs deeper than Brexit…

The shares dropped heavily in 2020 following the announcement of a plan to acquire US equities trading firm Liquidnet via a dilutive rights issue.

Further drops followed almost every trading update in 2021 as margins contracted and the market lost faith in TCAP’s management. And activist investor Phase 2 Partners has been putting pressure on TCAP to sell the business to unlock shareholder value.

However, we are starting to see evidence that the tide is turning for TCAP, leaving their low PE and high dividend yield looking very attractive.

Strong half year results set a new tone

Being an IDB, TCAP facilitates transactions between investment banks, broker-dealers, and other large financial institutions, meaning it benefits from market volatility…

This was evident in TCAP’s August half year results which saw a surge in client activity and volumes as the Ukraine war and a raft of rate hikes from the world’s major central banks kept financial markets volatile.

TCAP’s half year revenue jumped 12% year-on-year to £1.08bn with growth across all asset classes – comfortably beating market expectations of £1.03bn. And adjusted earnings (EBITDA) climbed 19% to £185m with earnings per share (EPS) up 25% to 12.8p.

Importantly, operating margins, which had previously been dwindling, increased from 6.1% to 9.2%, despite a spike in overheads. And this bodes well for the second half of the year

There were also signs that TCAP are finally starting to reap the rewards of its Liquidnet deal with cost saving synergies expected to reach £25m by the end of 2023.

The Liquidnet deal was originally pitched as “a unique opportunity to transform TP ICAP’s growth prospects” by TCAP CEO, Nicolas Breteau. And whilst the addition of Liquidnet initially fell flat with investors who were heavily diluted, there remains plenty of potential for it to be transformative…

Liquidnet run a private marketplace or ‘dark pool’ where fund managers with large equity stakeholders can buy and sell without moving the price on the open market.

Their customer base of 1,000 fund managers will help TCAP compete with larger rivals such as Tradeweb, MarketAxess and Bloomberg in the market for electronic trading of credit and fixed income products.

TCAP’s full year outlook was upbeat with central bank de-risking expected to continue – creating volatility in the interest rate market which generates almost half TCAP’s revenue.

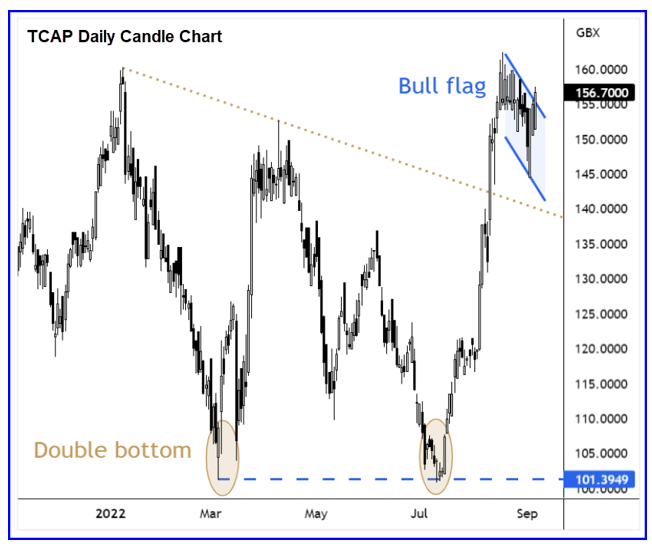

Double bottom reversal in place

TCAP’s turnaround is reflected on their price chart…

In July, the shares retested their March lows at 101p and rallied sharply – forming the basis of a long-term ‘double bottom’ reversal pattern.

The rally, which coincided with TCAP’s half-year results, was so strong that it broke above the ‘neckline’ (gold dotted line) and confirmed the reversal pattern.

TCAP’s price action following the late-summer rally has seen the shares consolidate their gains and form a small bull flag pattern.

The bull flag has formed while the FTSE 350 has been falling and this clear relative strength signals upside continuation.

Low PE high yield

TCAP offer investors income and value in equal measure…

The shares currently trade on a market-leading forward dividend yield of 7.83%…

This pay-out is covered twice over by forward earnings and grow steadily over the next three years.

And the recent rally in TCAP’s share price has done little to take the shine off its eye-catching valuation…

TCAP trade on a forward price to earnings (PE) multiple of 6.4 – one of the cheapest in the Investment Banking & Investment Services sector.

This low forward PE also compares favourably to forecast earnings per share (EPS) growth just shy of 20% – giving TCAP a price to earnings growth (PEG) ratio of 0.4 (where anything less than 1 is attractive).

The stock has a Price to Book Value of just 0.62 and a negative Enterprise Value to Adjusted Earnings (EV to EBITDA), which for a stock with a cash rich balance sheet indicates that the stock is significantly undervalued.

Consensus analysts price targets for TCAP currently sit at 263p, 60% above current prices. And if TCAP can continue recent momentum with profits and margins remaining elevated, a re-rating should be on the cards for later this year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.