6th Mar 2024. 8.58am

Regency View:

BUY Indivior (INDV) – Second Tranche

- Growth

Regency View:

BUY Indivior (INDV) – Second Tranche

Indivior: A resilient market leader with fresh momentum

US-focused pharma, Indivior (INDV) is a market leader with fresh momentum.

Having recently reached a settlement on a protracted legal battel, the stock is finally free to move higher. And February’s impressive set of Final Results underlined why we believe Indivior remain undervalued.

Recap of investment thesis and growth drivers

Indivior continues to stand out as a compelling investment opportunity, primarily driven by its robust performance in the addiction treatment market.

With a strategic focus on addressing the opioid addiction crisis in the US, where over 80% of its sales are generated, the company has established itself as a pivotal player in the industry. Notably, its flagship products, including Sublocade, have experienced remarkable growth, with Sublocade sales surging by over 50% in the past year.

The company’s commitment to innovation and expansion in the addiction treatment space positions it favourably for sustained growth. Click here for a more detailed look at Indivior’s product offering and its unique position in fighting the US opioid crisis.

Overcoming legal challenges

In the face of legal challenges related to the marketing of Suboxone, a blockbuster opioid addiction treatment, Indivior has demonstrated resilience and a proactive approach to resolution.

Recent legal settlements, including a $30 million agreement in August 2023 and a subsequent $385 million settlement with Direct Purchaser Class in February 2024, signal significant progress in resolving legacy legal issues.

These resolutions not only mitigate legal uncertainties but also underscore the company’s commitment to addressing legal matters efficiently, allowing it to shift focus back to its core mission.

Strong trading update and New York listing plans:

The latest trading update from February 2024 further reinforces Indivior’s positive trajectory…

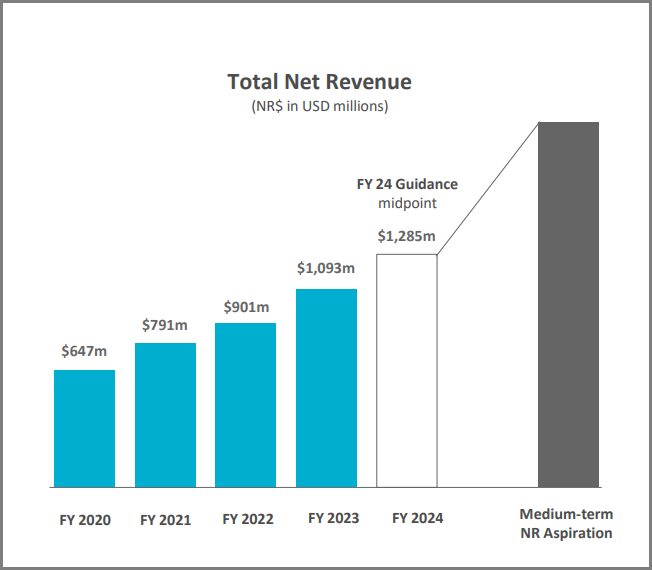

The company reported a robust financial performance in 2023, achieving a 21% net revenue growth and expansion of its adjusted operating margin.

Sublocade, with a net revenue of $630 million at the top end of the range, showed a remarkable 54% growth compared to the previous year. The forward-looking guidance for 2024 is equally promising, with expectations of an 18% net revenue growth and approximately 300 basis points of operating margin expansion at the midpoints.

One key strategic move highlighted in the update is Indivior’s plan to transition to a primary listing in New York. While maintaining a secondary listing in the UK, this shift is aimed at capitalizing on the company’s strong presence in the US market.

The move is expected to attract more American investors, enhance the company’s profile in US capital markets, and potentially lead to inclusion in major US indices. The market has responded positively to this initiative, driving a nearly 20% surge in the stock price post-announcement.

Attractive valuation amidst growth outlook

Despite the substantial rally in Indivior’s share price following the release of its Final Results, the stock continues to present an attractive forward valuation.

With a forward price-to-earnings (PE) ratio of 10.6, the shares are favourably positioned compared to sector peers. This valuation is particularly attractive given Indivior’s historical track record of profitable growth and the positive outlook outlined in its recent financial updates.

As investors looking for a blend of quality and growth potential, Indivior ticks plenty of boxes and we’re more than happy to snap up a second tranche.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.