Regency View:

BUY Indivior (INDV)

Indivior key to fighting opioid crisis

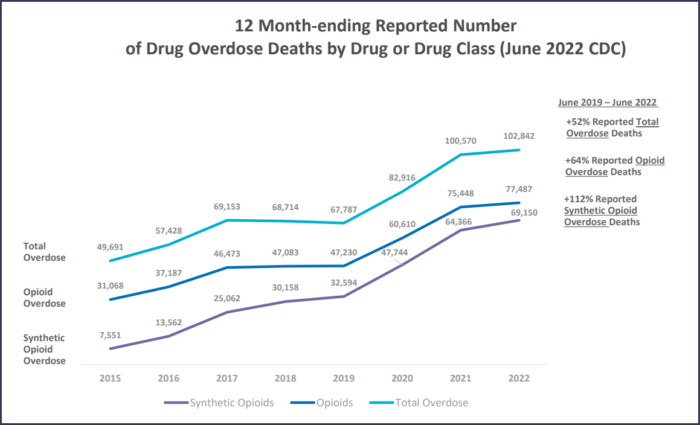

The opioid epidemic is one of the worst public health disasters affecting the U.S. and Canada.

Over the past two decades, nearly 600,000 people have died from an opioid overdose in these two countries, and The Lancet estimates that as many as 1.2 million people could die from opioid overdoses by 2029.

Opioids, which include prescription pain killers such as oxycodone and illicit drugs such as heroin, have the potential to “hijack” the brain and change how it normally functions and processes reward, creating a severe addiction called OUD (opioid use disorder).

The most effective treatment for OUD is through careful and controlled medical withdrawal and Indivior (INDV) has a market leading OUD treatment called Sublocade which is playing a key role in the opioid crisis.

Growing Sublocade to >$1 billion net revenue

Sublocade is the only long-acting treatment for OUD and continuously releases medicine all month at sustained levels without real daily ups and downs.

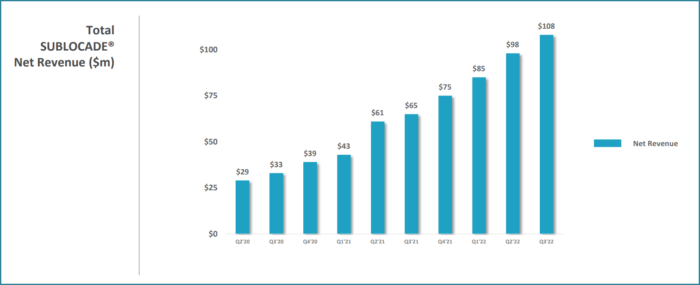

In 2021, Sublocade delivered net revenue of $244m, an increase of 88% compared to 2020. And recent quarterly numbers showed that Sublocade revenue has grown for nine consecutive quarters (see chart below).

Indivior expect Sublocade to reach $1bn in net revenue run-rate by the end of 2025.

Indivior plan to achieve this ambitious objective by expanding Sublocade’s availability across Organized Health Systems (OHS) in the U.S. – these larger care systems cover the majority of the approximately 3 million OUD patients in the region.

Indivior are also exploring opportunities within the criminal justice system, an OHS sub-channel. This is an important patient setting where daily treatment can be sub optimal given the inherent restrictions.

Sublocade meets the unique needs of the criminal justice system, including once-monthly dosing and a closed distribution system.

Indivior are also making strides in diversifying revenues beyond Sublocade into other therapies such as schizophrenia, cannabis use disorder and alcohol use disorder. And Indivior have a $200m-$300m net revenue goal for their schizophrenia treatment, Perseris.

Momentum is building

Indivior has plenty of momentum in price, newsflow and fundamentals…

In November, Indivior announced the acquisition of Opiant Pharmaceuticals for $145m.

The deal gives Indivior ownership of an opioid overdose rescue treatment OPNT003, which is at the start of its clinical journey but has been given fast-track status by the American regulator.

Indivior sees sales potential of between $150m-to-$250m after a possible launch in late 2023.

The acquisition news was followed by last week’s Capital Markets Day, which saw Indivior release another positive trading update.

“We have made tremendous progress executing on our strategic priorities,” said CEO Mark Crossley.

Indivior expects to achieve a “double-digit percentage net revenue growth over the medium-term”, driven primarily by Sublocade in the U.S. and growing contribution from Perseris.

Indivior also expect to achieve “significant operating margin expansion” over the medium-term driven by an improving gross margin and focused management of operating expenses.

And the bullish Capital Markets Day presentation has been well received by the market, prompting the shares to breakout from a key trading range.

A 300p range was formed between April and November from 1,694 to 1,388p and recent price action has seen the shares break and hold above the range, signalling that Indivior’s long-term uptrend is kicking back into gear.

Quality at a deep discount to Fair Value

When heading into a global recession, there is a premium attached to companies whose earnings are less affected by the worsening economic backdrop.

Indivior trades on a forward PE multiple of 17.1, reflecting their bullet proof earnings profile. And when it comes to quality, you tend to get what you pay for…

High levels of free cashflow have created a debt-free balance sheet with $918m net cash.

Indivior boast the best Return on Equity (RoE) in the pharmaceuticals market and have operating margins north of 24%.

These two metrics underline the strength of Indivior’s management at delivering shareholder returns and the company’s clear competitive advantage.

And, on a discounted cashflow basis, Indivior is trading at significant discount to Fair Value. Current estimates which take into account the Indivior’s forecast earnings growth, profit margins and other risk factors put the stock on a Fair Value of £40.62 which is a deep 56% discount to current prices.

All factors considered; we believe Indivior adds some compelling momentum to our list of open FTSE Investor positions.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.