7th Aug 2024. 8.58am

Regency View:

BUY Halma (HLMA) – Second Tranche

- Growth

Regency View:

BUY Halma (HLMA) – Second Tranche

Halma: A summer earnings season standout performer

The recent global stock sell-off has created a compelling opportunity for long-term investors to acquire shares in standout performers from this summer’s earnings season. Among these is Halma (HLMA), a high-quality stock that has shown resilience and substantial growth potential, even amidst challenging market conditions.

A leader in life-saving technology

Halma is a global leader in life-saving technology, specialising in safety, environmental, and healthcare products. The company operates a diverse portfolio designed to enhance safety, protect the environment, and improve quality of life.

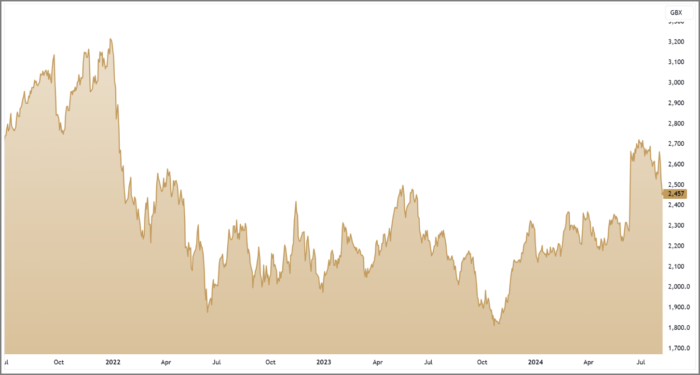

Our initial recommendation in January 2023 was based on Halma’s robust financial health, proven track record of profitable growth, and its recession-resistant business model. At the time, the stock was overshadowed by the market’s focus on COVID-recovery plays. Our contrarian stance proved valuable as the stock has been catching up impressively over the past twelve months.

With growing investor concerns about a potential U.S. recession, defensive stocks like Halma are positioned to hold up well, especially given the quality of their recent results.

Exceptional June results

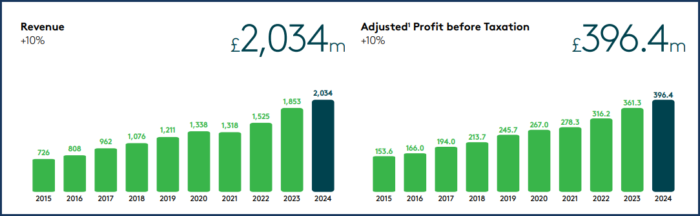

In June, Halma reported exceptional annual results, marking a significant milestone by surpassing £2 billion in revenue for the first time. The company achieved a 10% increase in revenue, totalling £2.03 billion, and a 12% rise in adjusted EBIT, reaching £424 million. This growth was driven by strong contributions from recent acquisitions and solid performance across its diverse sectors.

The results were further bolstered by a 7% increase in the annual dividend to 21.6 pence per share, reflecting the company’s commitment to returning value to shareholders. CEO Marc Ronchetti’s optimism about Halma’s future prospects and the company’s positive start to the new financial year added to the excitement. Halma’s ability to deliver a record profit for the 21st consecutive year and its strong order intake demonstrated its ongoing growth momentum.

Three key areas driving Halma’s future growthStrategic acquisitions and integration:

1. Strategic acquisitions and integration:

Halma’s growth strategy heavily relies on its “buy and build” approach, focusing on acquiring complementary businesses to expand its market presence. In the fiscal year 2024, Halma completed several acquisitions, significantly contributing to revenue and adjusted EBIT growth. The company’s ongoing strategy involves identifying and integrating high-quality acquisition targets that enhance its product portfolio and geographic reach. By leveraging these acquisitions, Halma can tap into new markets, diversify its revenue streams, and drive sustained growth.

2. Innovative Product Development and R&D Investment:

Halma’s commitment to R&D is a critical driver of future growth. In 2024, the company invested £107.2 million in R&D, representing 5.3% of its revenue. This investment fuels the development of innovative products and technologies across its core sectors—safety, environmental, and healthcare. Halma’s focus on creating advanced solutions that address emerging challenges and regulatory requirements positions it well to capture new opportunities and maintain its competitive edge. Continued innovation will help Halma meet evolving customer needs and adapt to changing market conditions.

3. Sustainability and market expansion:

Halma’s dedication to sustainability and improving quality of life aligns with broader market trends and regulatory shifts towards greener and safer technologies. The company’s diverse portfolio includes products that support environmental protection, safety enhancements, and healthcare advancements—areas that are increasingly critical to global markets. Halma’s ability to address these key areas through its sustainable growth model will support long-term market expansion. By focusing on sectors with high growth potential and addressing global challenges, Halma is well-positioned to benefit from increasing demand for sustainable and life-saving technologies.

Strong financials and valuation

Halma’s financials remain robust. The company boasts a healthy balance sheet with a net debt to EBITDA ratio of 1.35x, well within its comfort zone. The forward P/E ratio stands at 27.0, reflecting its premium valuation, but this is justified given the company’s consistent revenue and profit growth. Halma’s operating margin is solid at 18.1%, and its return on equity (ROE) of 16.1% underscores its effective management and capital allocation.

The dividend yield of 0.96% and continued dividend growth of 7% per annum add nicely to Halma’s propensity for growth. Despite a premium valuation, the high-quality earnings and strong cash flow generation provide a solid foundation for future growth and shareholder returns.

Technical opportunity

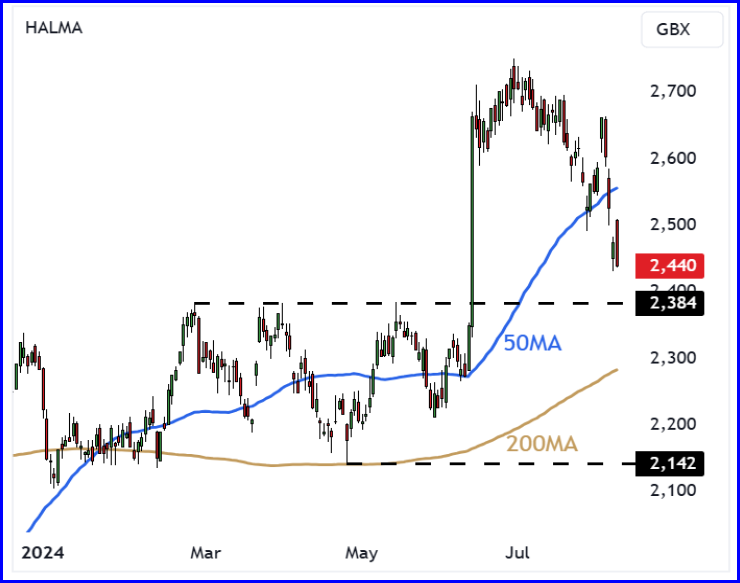

From a technical perspective, Halma’s share price has been on an upward trajectory since the beginning of the year, characterised by a series of higher swing lows. The price surged to new highs following the June results, reflecting bullish momentum. However, the recent broader market sell-off has pulled Halma’s share price back below the 50-day moving average and towards a key support level created by previous resistance from March to May.

This broken resistance area now represents a potential buying opportunity. The support level should hold firm, providing an attractive entry point for those looking to add to their position. With the 50-day moving average still above the 200-day moving average, the overall trend remains positive, and this pullback offers a chance to acquire shares at a more favourable price.

With solid technical support and a strong growth outlook, Halma remains a high-quality addition to any portfolio, offering both growth potential and diversified defensive qualities that are welcomed in this current environment.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.