18th Jan 2023. 8.59am

Regency View:

BUY Halma (HLMA)

- Growth

Regency View:

BUY Halma (HLMA)

High quality Halma is being overlooked

Those who follow our research will know that we have an unapologetic focus on quality.

It is our belief that investing in predominantly high quality stocks is an effective way to make long-term returns in the market.

By ‘high quality’ we mean companies that have a proven track record of delivering profitable growth, that generate high levels of cash, and that maintain strong balance sheets so they don’t need to dilute shareholders.

A great example of a high quality stock is safety equipment maker, Halma (HLMA).

Halma have a five year average Return on Equity of 18.1% (CAGR/Avg), double-digit profit margins and an “exceptionally strong” order book.

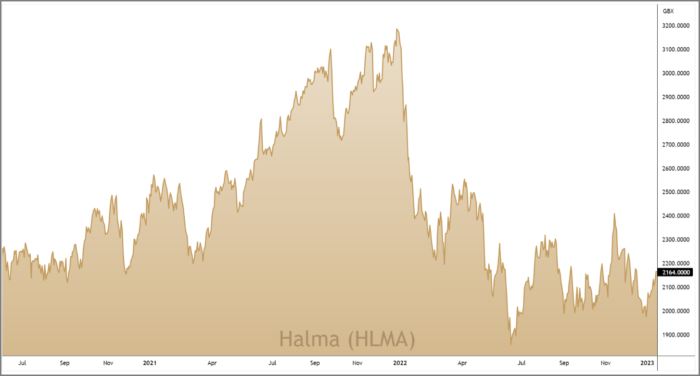

And whilst the FTSE 100 index nears record highs, Halma’s share price remains more than 30% below the £32 mark it hit last January.

Recession-proof revenue

Halma is a global conglomerate of around 45 companies which provide innovative products and services designed to save lives, protect the environment and improve quality of life.

The majority of Halma’s products are key to their customer’s fixed operations, meaning demand is almost recession-proof.

The group operates across three broad market areas:

1. Safety:

Halma’s largest sector by revenue and profitability, this sector includes fire detection and fire suppression equipment along with safe storage, elevator safety and industrial access control.

In the Half-Year (HY22) to end November 2022, this sector delivered revenue of £355m, up 11% on the same period in 2021 of which 10% was organic in nature. Profits in this sector edged 3% higher to £75m during the same period.

2. Environment:

Halma’s group of companies in this sector include gas detection businesses along with water treatment companies and environmental monitoring services.

This sector saw HY22 revenue surge 26% to £264m and profit increased by a similar percentage to £65m.

3. Healthcare:

Halma’s Healthcare portfolio includes numerous health assessment companies and life sciences businesses as well as companies that offer therapeutic solutions.

This sector delivered revenue growth of 23% to £257m (HY22) of which 9% was organic. Profitability was also strong at £56m (HY22), up 22%.

Strong and sustainable growth

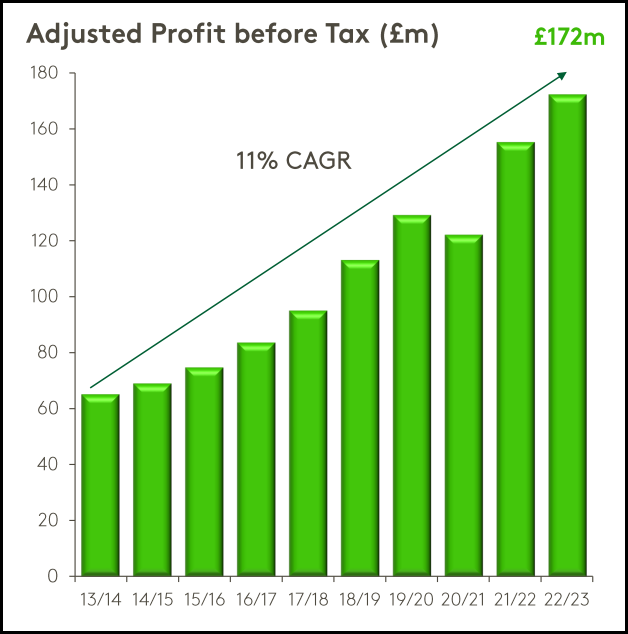

For a conglomerate, Halma has a stunning track record of delivering profitable growth.

Halma have a double-digit CAGR in revenue and profit over the last decade, with the management’s ‘buy and build’ strategy being executed to perfection.

Return on invested capital is 15% over the last three years and operating margins have averaged 18% over the same period – underlining the strength of Halma’s market dominance.

Free cashflow is very healthy and Halma maintain a strong balance sheet which has net debt to adjusted earnings (EBITDA) of 1.2x, which is well below Halma’s target of 2x.

Of course, this quality does not come cheap. Halma trade on a forward earnings multiple of 26.9, which is one of the highest valuations in the sector and market.

However, with all three of Halma’s sectors posting robust levels of revenue and profit growth in the half year, we believe Halma’s recession-proof growth story is worthy of its premium valuation.

Hammering out a bottom

There’s no getting away from it, Halma’s share price has considerably underperformed during the last year.

The market isn’t stupid and key reasons behind this underperformance include; Halma having to hold more stock due to the global supply crisis and reduced short-term sentiment towards defensive stocks as the Chinese economy reduces Covid restrictions.

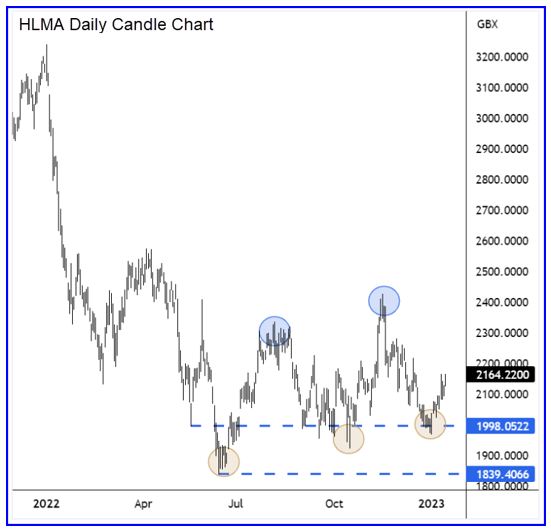

However, we are starting to see some subtle signs in Halma’s recent price action that the ‘smart money’ may be accumulating the stock again…

Having hit lows of 1,839p last summer, the shares have been trading sideways in a choppy consolidation phase. Closer inspection of this consolidation phase reveals the shares are starting to make higher swing lows (gold circles on chart right) and higher swing highs (blue circles). This indicates that the ‘smart money’ or institutional investors are starting to soak up supply.

And, having formed a new swing low at the turn of the year, the technical timing looks compelling. Combine this with Halma’s high-quality financials and we believe there is a strong case to put Halma in your portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.