13th Sep 2023. 8.59am

Regency View:

BUY Aviva (AV.) – Second Tranche

- Value

- Income

Regency View:

BUY Aviva (AV.) – Second Tranche

Locking in a second tranche of market-beating income

When we initially recommended buying Aviva (AV.) it was for good reason. The insurance giant had undergone a transformation that saw it emerge as a robust, cash-generating machine which translated into bumper payouts for shareholders.

At the heart of Aviva’s resurgence was the revival of the annuities market, driven by rising interest rates. Annuity incomes, closely tied to gilt (government bond) rates, had soared to a 12-year high, presenting a lucrative opportunity for the company.

Moreover, Aviva’s bulk annuities business was in excellent health, taking on final salary pension commitments from corporate pension funds, and contributing to asset flows into Aviva Investors, its wealth management arm.

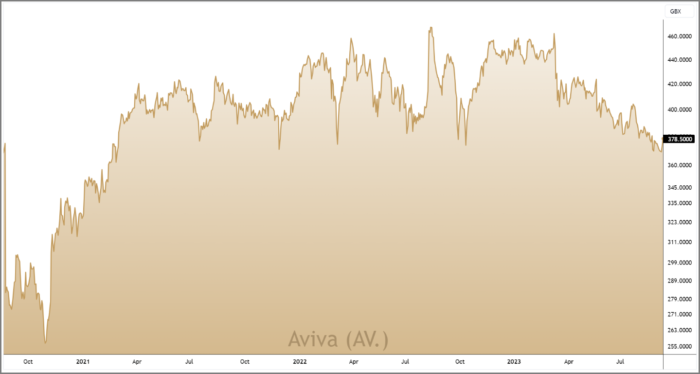

Fast forward to today, and we find ourselves revisiting Aviva with renewed enthusiasm. Whilst the general insurance market has seen a decline in premiums due to rising repair costs, and Aviva’s share price has underperformed, many of the catalysts that make Aviva a compelling buy remain.

Dividend yield and security

One of the primary drivers behind our initial recommendation was Aviva’s ability to deliver market-beating income to investors. This trend remains firmly intact, with Aviva continuing to reward shareholders handsomely.

In August, Aviva hiked its interim divided by 8% to 11.1p and reiterated guidance for a full year dividend of c.33.4p – giving Aviva a forward dividend yield north of 9%. This places the company in the top quartile for income stocks in the UK market, offering investors an income stream that’s both substantial and reliable.

While no dividend income is guaranteed, the security surrounding Aviva’s dividend appears robust. The company boasts a cash-rich balance sheet with low levels of debt. Additionally, dividend cover is forecasted to be 1.29 by the end of FY23, providing further assurance of the dividend’s sustainability.

Bulk annuity business continues to flourish

Aviva reported a solid set of interim results in August, with operating profit exceeding expectations, cost management under control, and a promising medium-term outlook.

The bulk annuity business has continued to see significant growth. It brought in £2.4 billion in the year to date, enhancing scale and profitability for Aviva Investors.

Aviva’s strategic strength lies in its early adoption of digitization, which helps control costs despite inflation. The company aims to leverage digitization for cross-selling opportunities.

And despite challenges in the wealth management market, Aviva’s long-term direction is positive.

Aviva projects a 5-7% increase in Group operating profit for 2023 compared to 2022 and is on track to exceed its financial targets, including a £750 million gross cost reduction by 2024, a year ahead of schedule.

Back to the ‘buy zone’

The art and science of technical analysis when used correctly can really help to enhance our market timing.

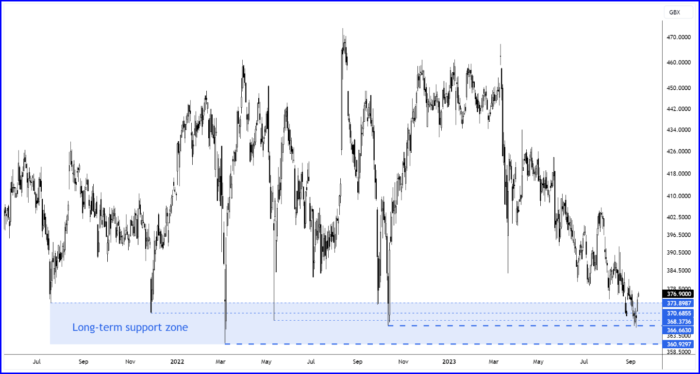

We can see from Aviva’s candle chart (below) that the shares have formed a number of spike lows over the last two years. It’s no coincidence that these spike lows are printing at very similar prices because markets have a memory.

When prices return to a level which marked a key inflection point, like a major spike low, those buyers who profited from the previous bounce, and those who missed the opportunity to buy last time, tend to step back in and support prices.

Of course, support levels do break from time to time, but a cluster of major spike lows like Aviva’s marks a key ‘buying zone’ or support zone for the stock.

Aviva’s recent price action has seen the shares retreat back to the ‘buy zone’ during the summer months, before starting to bounce.

This recent bounce from the buy zone suggest that buyers are stepping in once again to support the stock. And, given Aviva’s market-beating dividend, we believe the technical timing is supportive of a second tranche buy.

50% below Fair Value

Aviva’s share price scores well across a number a value metrics…

The shares trade on a forward PE of 8.1, which looks attractive relative to forecast double-digit growth in earnings per share (EPS) over the next two years.

Aviva has a Price to Book Value of 1.11, a Price to Free Cashflow of 1.2, and a Price to Sales of 0.65 – all of which paint a picture of a value-oriented stock.

For investors using discounted cash flow (DCF) analysis to determine a fair price for the stock, Aviva’s estimated Fair Value share price of £7.62 is particularly striking. This estimate is more than double Aviva’s current share price, indicating a significant potential for appreciation.

Overall, with the shares looking great value on a fundamental and technical basis, we’re more than happy to snap up a second tranche of this stock.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.