Regency View:

BUY Aviva (AV.)

Aviva’s brilliantly boring cashflows

Boring businesses can make exciting investments and Aviva (AV.) is a great example of this…

Under the stewardship of chief exec Amanda Blanc, Aviva have done a great job of turning themselves into a boring, cash generating machine that plays to its strengths.

Having sold off a host of non-core assets, Aviva is now fully focused on its core insurance businesses in the UK, Ireland and Canada.

Profits are rising, costs are falling and strong levels of free cashflow should see shareholders continue to receive bumper payouts.

Rising interest rates drive bulk annuities boom

After a decade in the doldrums, the annuities market has burst back into life.

An annuity is a guaranteed income for life bought with a pension pot. The income offered by annuities is tied to the interest rate on gilts (government bonds) which move in relation to the Bank of England’s base rate.

Due to recent interest rate hikes, the income offered by annuities has risen to a 12-year high.

As an example, a 65-year-old with a £100,000 pension pot could now get an annuity income of £6,637 versus just £4,900 a year earlier – that’s a 35% jump in income.

Rising interest rates also make it easier for company pension schemes to afford the cost of insurance, leading to growth in the pensions insurance market which has been a real tailwind for Aviva…

Aviva’s bulk annuities business, which takes on final salary commitments from corporate pension funds, is in rude health.

In the half-year to June 2022, Aviva’s UK&I annuity & equity release sales jumped 12% to £2.8bn, and this growth is set to continue with companies keen to use higher interest rates to offload pension schemes from their balance sheets.

Strong bulk annuity volumes create a virtuous cycle for Aviva’s circular business model.

The annuities contracts feed asset flows into Aviva Investors, the group’s wealth management arm which saw net inflows of £5bn during the first half of the year.

Market-beating income and value

Aviva’s strong and stable cashflows, combined with a willingness to appease its shareholders, makes the stock look very attractive in the context of current market conditions.

Aviva have committed to paying out £4bn to shareholders by the end of next year through a combination of dividends and share buybacks.

The shares trade on a forward dividend yield of 8.92%, putting Aviva in the top quartile for income stocks in the UK market.

And whilst dividend income is not guaranteed, the security around Aviva’s dividend looks strong.

Aviva’s balance sheet is cash-rich with low levels of debt and dividend cover is forecast to be 1.32 by full-year 2022.

It’s also worth noting that increasing cashflow’s have taken Aviva’s Solvency II ratio to 213%, well above its 180% target.

Putting the dividend to one side, Aviva look attractively priced based on a number of value metrics.

The shares trade on a forward price to earnings ratio (PE) of 7.5 which compares favourably to its peer group and the wider market.

The PE also looks attractive relative to forecast earnings per share (EPS) growth of 51.2%, giving Aviva a price to earnings growth (PEG) ratio of just 0.2.

And a sector-leading price to free cashflow ratio of 1.7 underlines the stock’s current valuation.

Long-term support provides ‘insurance’

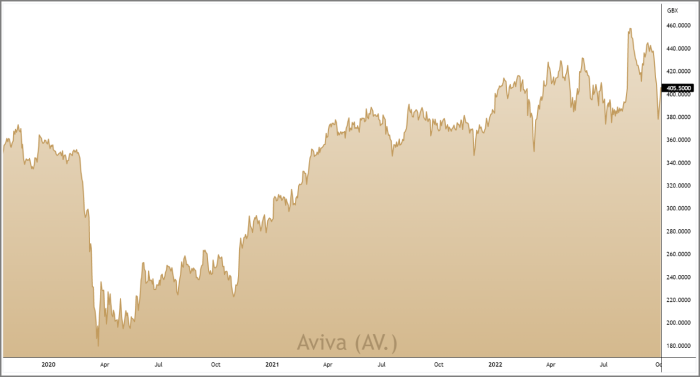

Aviva’s share price burst higher in August following the release of a strong set of half-year numbers which saw operating profits jump 14% to £829m.

Since then, the shares have been dragged lower by the sell-off across the wider market, taking prices back down into support at 373p.

The support level at 373p is just one of five key inflection points that have printed on Aviva’s price chart during the last year (see chart right).

Technical support levels are of course not guaranteed to hold, but this cluster of key inflection points has created a strong base which should provide some protection or ‘insurance’ as the stock’s long-term uptrend progresses.

Overall, we believe this new look Aviva offers investors financial strength amid an uncertain global economic outlook and, as interest rates continue to rise, its bulk annuities business should continue to flourish.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.