1st Sep 2022. 8.57am

Regency View:

BUY Tremor International (TRMR) 2nd Tranche

Regency View:

BUY Tremor International (TRMR) 2nd Tranche

Tremor’s short-term sell-off is a long-term buying opportunity

“In the short run, the market is a voting machine but in the long run, it is a weighing machine.”

This quote from Benjamin Graham, the father of value investing and Warren Buffett’s mentor, is as relevant today as it was back in the 1950’s…

What matters in the long run is a company’s actual underlying business performance and not the investing public’s fickle opinion about its prospects in the short run.

A great example of a stock that has been suppressed in the short-term, but has great long-term potential is digital video advertising platform, Tremor International (TRMR)…

We first highlighted Tremor in April last year due to its strong position in North America’s fast-growing Connected TV (CTV) market.

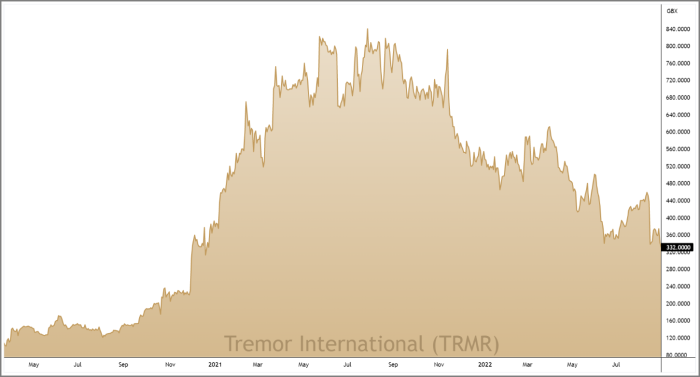

Fast forward 18-months and the stock is trading more than 60% below its summer 2021 highs after organic growth failed to meet the market’s lofty expectations.

Short-term sentiment has undoubtedly taken a hit, but Tremor’s long-term growth story is not just intact, it’s been enhanced by a blockbuster acquisition and a series of smart investments.

And with the shares trading on a forward price to earnings (PE) multiple of less than 5, we believe it’s worth snapping up a second tranche of this high-quality growth stock.

Amobee acquisition will bring significant scale

In July, Tremor entered into an agreement to acquire rival Amobee for $239m…

The deal, which is expected to complete this coming quarter, will be financed through a combination of existing cash resources and a new $100m debt facility.

Tremor’s balance sheet is currently debt free and as of June 30 had a net cash balance of approx. $360m – meaning that Tremor’s post-deal balance sheet will remain strong and the growth potential that comes with the deal is highly compelling…

Amobee serves over 500 customers globally and Tremor are buying its omnichannel demand side platform (DSP) and Amobee’s advanced TV Platform.

The deal will significantly expand Tremor’s US and international presence and will be immediately earnings enhancing. Amobee generated earnings of $22m on revenue of $150m for the year ended 30 June 2022, this number excludes traffic acquisition costs (TAC) and Amobee’s email marketing business which Tremor is not acquiring.

According to Tremor CEO, Ofer Druker the Amobee deal will “add several capabilities including campaign execution across linear and digital channels within a single platform”.

The deal will also “add significant global scale and self-service growth to our demand side platform, increase our US and international customer reach and data footprint, and drive more advertiser spend to our SSP, Unruly” added Mr Drucker.

Amobee will not be Tremor’s only growth driver this year, Tremor have recently invested $25m in VIDAA, the Smart TV operating system owned by Hisense.

Hisense is an official sponsor of the upcoming FIFA World Cup and Tremor expect an increase in global awareness for Hisense VIDAA-powered devices.

Tremor’s investment will extend its exclusive agreement to share VIDAA’s global ACR (automatic content recogonition) data and VIDAA will grant exclusivity to Tremor’s Unruly and Spearad businesses for monetization in the US, UK, Canada, and Australia.

Tremor’s eye-catching forward valuation

Earlier this month, Tremor released Q2 numbers which received a poor reaction from the market’s short-term ‘voting machine’…

Revenue and net income figures fell short of market expectations. Tremor had previously guided for Q2 ex-TAC revenue of $75m-$80m, but it came up short of this guidance with $70.8m – causing the shares to dop back towards six-month lows.

However, underlying profitability remained strong, and Tremor achieved record Q2 adjusted earnings (EBITDA) of $39.1m, reflecting a 5% increase year-on-year. Tremor also delivered record half-year EBITDA of $72.7m, an increase of 12% compared to 1H21.

These numbers were below expectations, but the market’s punishment looks overdone for a stock that is delivering record profitability…

Tremor’s share price is trading on a forward PE multiple of just 4.2, one of the most attractive PE’s in the Media & Publishing sector and across the wider market.

This PE also catches the eye when we compare it to Tremor’s forecast growth in earnings per share (EPS) of 57.2%.

Tremor’s Price to Book Value is 1.02, Price to Free Cashflow is 4.4 and Enterprise Value to EBITDA is 2.22. All three of these value metrics are best in sector and these numbers look very low for a stock that has a double-digit Return on Equity.

We’re not alone in thinking Tremor’s share price looks too low, Tremor’s management have repurchased 7,401,470 ordinary shares at an average price of 479.98 pence, stating that “our ability to have repurchased shares at what we believe are discounted levels to drive long-term shareholder value is a testament to our continued balance sheet strength and cash-generating abilities” in their recent Q2 report.

Overall, we believe it’s a smart move to achieve a lower average entry price on our Tremor position. And with global digital advertising spend expected to grow to $700bn in 2025, we believe the market’s long-term ‘weighing machine’ will revalue Tremor in our favour.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.