29th Apr 2021. 9.00am

Regency View:

BUY Tremor International (TRMR)

Regency View:

BUY Tremor International (TRMR)

Tremor sending shockwaves through traditional TV advertising

How do you watch TV?

If you are anything like me, you’ll jump from bingeing a boxset on Netflix, to watching a podcast on YouTube, to catching up with something on iPlayer or a movie on Prime Video.

Chances are, if you weren’t using some form of streaming platform prior to the first lockdown, you are now and the popularity of this form of TV experience, known as Connected TV (CTV) has skyrocketed in recent years…

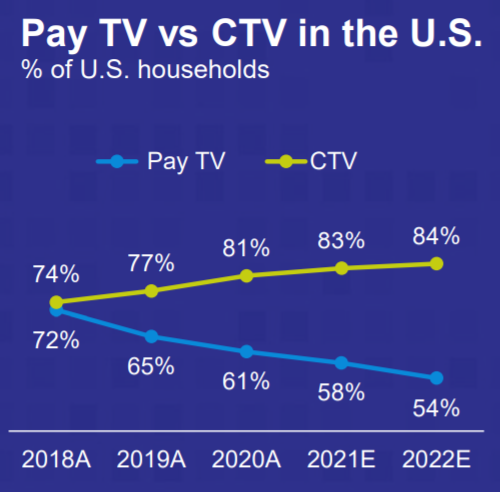

In the US alone, there were 104.7 million US households using CTV in 2020, and that number is forecasted to increase to 113 million by 2024, which will represent nearly 86% of all US households.

A key reason behind the growth is the trend of ‘cord-cutting’ or cancelling your pay TV subscription. And according to Trade Desk, 27% of pay TV subscribers in the US plan to cut their subscriptions in 2021.

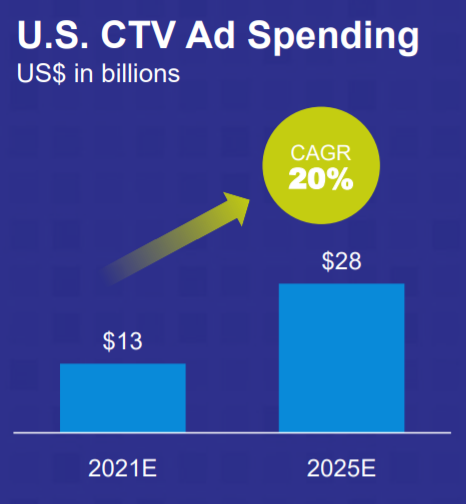

As the number of streaming services grow, so too do the opportunities for advertisers to utilise CTV in a way that has never been done before – with data-driven personalised ads and measurable outcomes.

If 2020 was the year of CTV, 2021 is set to be the year of CTV advertising, and that’s where today’s stock Temor International (TRMR) comes in…

Tremor is a digital video advertising platform with a focus on North America’s fast-growing CTV market.

An end-to-end platform offering real time data-driven insights

Tremor’s advertising platform is ‘end-to-end’, this means it is a demand-side platform (DSP) for advertisers, as well as being a supply-side platform (SSP) for publishers.

Tremor Video is the DSP, designed to help advertisers deliver effective video ad campaigns with offerings in CTV, in-stream (whilst streaming video content), out-stream (while browsing a webpage) and in-app. Solutions include use of a self-service package to create and manage ad campaigns, or use of an in-house creative team to deliver a bespoke video ad campaign.

Unruly is the SSP side of Tremor’s platform and was purchased from Newscrop in January last year. Unruly aims to optimise inventory management and revenue yield for publishers by using Tremor’s real-time data driven insights. Unruly works with 95% of the AdAge 100 top advertisers list and 82% of video views are delivered across Comscore 1,000 sites (Comscore provide a world ranking for top web properties).

Tremor’s platform has 100 billion daily ad requests, 250 million daily ad impressions across 100 million unique webpages.

They have established relationships with ten major CTV providers including ViacomCBS, Xumo and Vizo. They have ads on global sites such as Fox Sports, Variety and National Geographic, and they have exclusive access to world-renowned publishers including The Wall Street Journal, The Times and Dow Jones.

Aggressive growth without sacrificing profitability

In the tech business, strategy 101 is to focus on market share and forget about short-term profitability. After all, for any platform model to work you need scale…

The CTV market is unique because it offers advertising space outside of the walled gardens of Amazon, Facebook and Google.

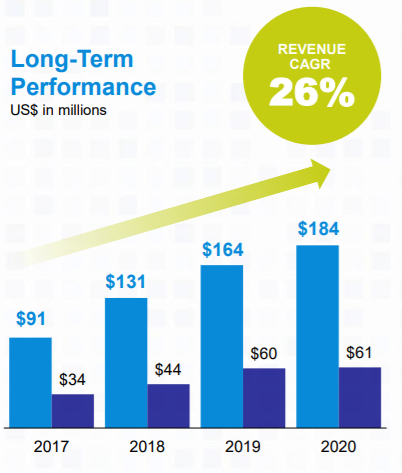

This has enabled Tremor to have market leading margins, allowing them to grow their top line while also being free cash flow generative.

Tremor has a five-year cumulative average growth rate (CAGR) for revenue of 26%, and a free cashflow CAGR of 30% over the same period.

Having now fully integrated Unruly, Tremor look set to utilise their $97m (FY 2020) cash pile to fund further acquisitions. And with US CTV ad spend set to more than double to $28bn by 2025, there is plenty of scope for organic growth.

Full-Year trading to be significantly ahead of expectations

Tremor, like many in the media & advertising sector were not immune from the immediate impact of the pandemic as the sector had to navigate a once-in-a-generation advertising collapse during the first half of 2020.

However, the rapid growth in CTV usage during lockdowns has seen Tremor’s revenues come roaring back in the later part of 2020 with momentum set to continue…

In March, Tremor said it expects to report Q1 2021 net revenue of $55m-$60m, an increase of 71%-87% on Q1 2020, with adjusted earnings of $25-$28m a major on the $0.5m in Q1 2020.

These numbers are “significantly ahead of management expectations” and have lead to manage upping their full-year guidance.

Indeed, if we annualise Q1’s performance, which is traditionally its weakest quarter of the year, and do not factor in any further growth, you can easily see that Tremor is going to make at least $225m (£162m) of revenues in 2021.

This puts Tremor on a forward Price to Earnings Growth ratio of just 0.5 (where anything below 1 is attractive).

Tight consolidation signals trend continuation

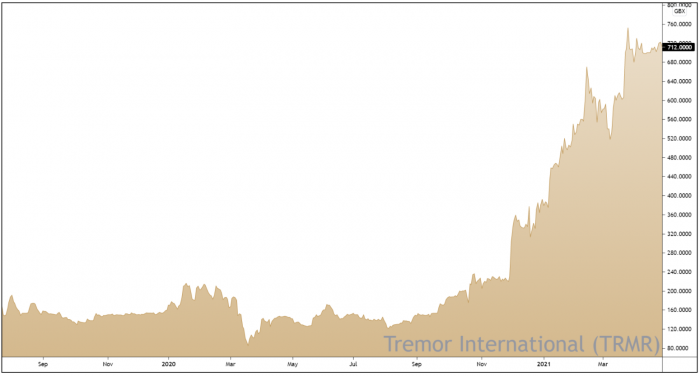

Tremor’s price chart ticks plenty of boxes when it comes to filtering for quality…

The share price has formed a powerful uptrend in recent months following a series of bullish updates and broker upgrades.

Having gapped higher on their March trading statement, Tremor’s share price has been consolidating near its highs with a bullish ‘wedge’ pattern.

As we’ve highlighted in previous recommendations, this form of ‘high and tight’ consolidation tends to resolve itself in higher prices, and we believe Tremor is no exception.

Should management continue to execute their aggressive growth strategy, we believe Tremor’s share price has much further to run.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.