Regency View:

BUY Totally (TLY) – Second Tranche

Keep buying Totally as NHS waiting list crisis deepens

The latest NHS waiting list numbers made for grim reading…

According to new figures from NHS England, 7.1 million people were waiting to start routine hospital treatment at the end of September, the highest number since records began in August 2007.

A staggering 401,537 people have been waiting for more than 52 weeks to start their routine hospital treatment.

There was also a record number of people waiting more than 12 hours to get a bed in A&E departments.

This is a deepening crisis, and the only way out is through ‘insourcing’ where the NHS sub-contracts medical services/procedures. And this is where Totally (TLY) come in…

Totally is a healthcare services provider which provides ‘insourcing’ and urgent care services to the NHS.

We first highlighted the stock in March and the business has continued to go from strength to strength, extending several key contracts and winning plenty of new business.

Totally have made themselves integral to clearing the NHS backlog and with the stock trading on a cheap forward valuation we’re going to snap up a second tranche.

Raft of contract renewals increase earnings visibility

Last month, Totally delivered a strong set of interim results which underlined the stability of its revenue and earnings profile.

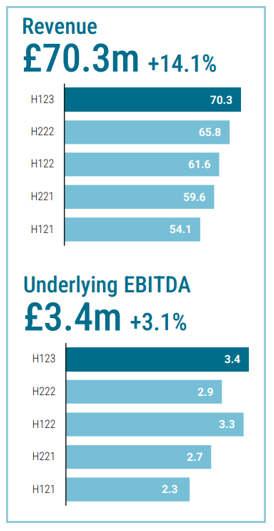

Revenue increased 14.1% to £70.3m in the half year to end September – in line with management expectations.

Totally secured extensions to 15 existing urgent care contracts amounting to more than £37m in future revenue and providing greater earnings visibility.

Adjusted earnings (EBITDA) jumped 33% to £3.4m and profit before tax came in at £1m versus £0.9m in the first half of last year.

Totally has used its cash pile of £15.3m (FY22) to fund acquisitions, most notably the £13m acquisition of Pioneer Health.

Pioneer Health holds the difficult-to-acquire Any Qualified Provider (“AQP”) status, which enables it to offer services direct to NHS patients across the whole of England, free at the point of delivery, where there is sufficient demand.

The deal beefs up Totally’s insourcing division, making it better placed to win additional slices of the UK government’s £36bn Health & Social Care package.

And Totally are already starting to reap the benefits of the acquisition, with Pioneer being awarded a new contract and four contract extensions, collectively valued at approximately £9.5m.

Totally remain attractively priced

For a stock that has a debt free balance sheet and high level of earnings visibility, Totally looks attractively priced.

Investors are being asked to pay less than nine times forward earnings, which gives Totally one of the best valuations in the Healthcare Providers & Services market.

Totally’s single digit earnings multiple also compares well to forecasted growth in earnings per share (EPS) of 64.8%, putting Totally on a Price to Earnings Growth (PEG) ratio of just 0.2.

And a Price to Book Value of 1.70 and Price to Sales ratio of 0.45 add further weight to the argument that Totally offer steady growth at a reasonable price.

It’s also worth noting that Totally pay a dividend with a forward yield of 3.13%, which is covered more than three times by forward earnings.

Shares respond to key support

Having surged to highs of 48p in April, Totally’s share price underwent a steady pullback during the summer months.

This pullback took the shares down to a key level of support created by the November 2021 and March 2022 lows at 30p (see chart right).

Recent price action around this support level has seen the shares break below and then bounce back above 30p support on multiple occasions – signalling that buyers are stepping in.

The last bounce from support followed the release of Totally’s interim results and this adds greater significance to the price action.

With 30p support in place, we believe the technical timing looks compelling to buy a second tranche with a view to riding a run back towards the April highs.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.