Regency View:

Buy Totally (TLY)

Totally integral to clearing record NHS backlog

On 23rd March 2020, the prime minister announced the first UK lockdown to prevent the NHS from buckling.

Two years on, and thanks to the vaccine rollout the Covid-19 pandemic no longer dominates our front pages, but the NHS remains under immense pressure…

The NHS waiting list hit 6.1 million, a new high in January as nearly 24,000 patients were left waiting more than two years for care.

While new figures on A&E waits for February showed just 60.8% of patients attending major emergency departments were seen within four hours – the lowest performance on record.

The Government and NHS England have set the ambition of eliminating all waits of more than a year by March 2025, a target that will be funded through a Health & Social Care package worth more than £36bn over the next three years.

A company that is integral to the government coming anywhere near its NHS backlog targets is Totally (TLY).

Totally is a healthcare services provider which provides ‘insourcing’ and urgent care services to the NHS.

Totally’s share price is trading on an eye-catching forward valuation, the company is well managed with a rock-solid balance sheet, and with government healthcare spend likely to remain elevated for years to come, we like the look of Totally’s long-term prospects.

Largest independent provider of Urgent Treatment Centres in England

The Totally operates three clear divisions:

1. Urgent Care

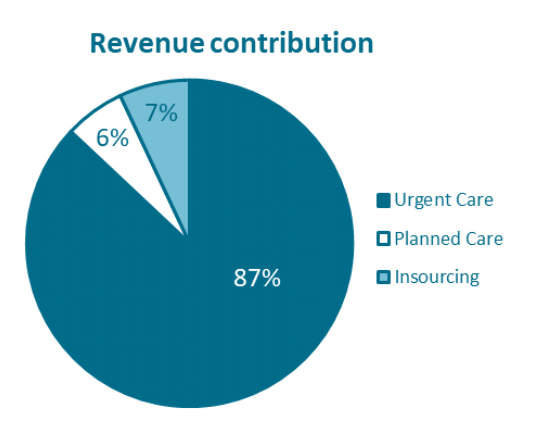

Urgent Care accounts for 87% of Group revenue, and Totally is England’s largest independent provider of Urgent Treatment Centres (UTC’s).

Totally works in partnership with the NHS to provide a full range of Urgent Care Services including NHS 111, GP out-of-hours, Clinical Assessment Services and UTC’s. Subsidiaries include Vocare and Greenbrook Healthcare.

2. Insourcing

Insourcing is a system whereby hospitals subcontract medical services and procedures to Totally Healthcare who then utilise hospital premises and equipment for service delivery.

The insourcing model is cost-effective model and reduces the pressure caused by long waiting lists, while providing patients quicker access to care and a high-quality service.

This may be a small division in terms of Group revenue, but it is high margin and growing fast with Totally expecting significant growth from this segment as the government seeks to clear the vast NHS backlog.

3. Planned Care

This division includes the subsidiaries:

About Health Ltd – a leading provider of dermatology and referral management services.

Premier Physical – a provider of occupational physiotherapy to NHS, prisons, the police force and private clients.

Totally Health – provider of personalised Clinical Health Coaching.

Totally’s ‘new business as usual’

Demand for Totally’s healthcare services surged during the height of the pandemic, but CEO Wendy Lawrence believes this represents a “new business as usual” as highlighted in Totally’s impressive November Interim Results…

Group turnover increased 14% during the Half-Year 2022 to £61.6m – reflecting growth across all divisions. While gross profit jumped by the same percentage to £11.6m (H122) and there was a significant jump in adjusted earnings (up 44% to £3.3m H122), as income from higher margin planned care and insourcing business doubled.

Totally’s Urgent Care Division was awarded extensions to 20 existing contracts worth circa £45m, along with a new UTC contract at Kings College London.

Totally operate a strong debt-free balance sheet and the impressive Half-Year performance allowed the board to double its well-covered dividend to 0.5p per share – putting Totally on an attractive forward dividend yield of 2.16%.

‘Buy and build’ strategy starting to take shape

When commenting on Totally’s strong £18.3m cash balance in November, CFO Lisa Barter said:

“We are not looking to fund raise for future acquisitions, we’re accelerating our buy and build activity, we do not intend to sit on this cash”.

True to her word, Totally have announced two key acquisitions since November:

Pioneer Health Care acquired for £13m: Pioneer is an established independent provider of specialist NHS secondary care services.

Pioneer also holds the difficult-to-acquire Any Qualified Provider (“AQP”) status, which enables it to offer services direct to NHS patients across the whole of England, free at the point of delivery, where there is sufficient demand.

The deal beef’s up Totally’s insourcing division – making it better placed to win additional slices of the UK governments £36bn Health & Social Care package.

For the year ended 31 March 2021, Pioneer generated revenue of £5.13 million and profit before tax of £0.80m while gross assets were £2.82m.

Energy Fit-Pro (EFP) acquired for £1.3m: EFP is a corporate fitness provider, and its customer base provides Totally with access to the corporate health and wellbeing market.

The acquisition is earnings enhancing (£0.4m to March 2021) and creates further opportunities to for Totally to expand EFP’s relationships with its corporate customers through additional services such as online physio and virtual GP.

High-quality value play

Totally’s valuation metrics tick plenty of boxes…

The shares are trading on a forward Price / Earnings (PE) multiple of just 10.9, the best in the Healthcare Providers & Services market.

This PE also looks attractive when compared to forecast earnings per share (EPS) growth of 81.7% – giving Totally a price to earnings growth (PEG) ratio of 0.2 – signalling that the stock offers growth at a reasonable price.

The shares also score well across a number of traditional ‘value’ metrics, such as Price to Book Value (1.87), Price to Free Cashflow (8.3), Price to Sales (0.54) and enterprise value to adjusted earnings (EV to EBITDA) (7.02) – Totally is top quartile in its sector across every metric.

Bouncing from the bottom of a range

Totally’s share price gapped higher in April 2021 following a bullish trading update…

As is often the case with bullish price gaps it has become a reference point for the market with the shares hammering out a key level of support just above it.

Recent price action has seen the shares bounce from support once again, and in the short-term we would expect to see the shares retest the top of the range at 42.5p.

Given the strength of Totally’s long-term uptrend, we would expect to see prices eventually break to new trend highs and we believe entering on a ‘bounce’ from the bottom of a range offers attractive risk reward.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.