18th Jul 2024. 9.01am

Regency View:

BUY Jet2 (JET2) – Second Tranche

Regency View:

BUY Jet2 (JET2) – Second Tranche

Jet2 set for take-off after strong preliminary results

A key element of AIM Investor’s strategy is adding to strength, especially within the context of buoyant market conditions. With the AIM All-Share Index up more than 6% during the first half of the year, the tailwinds are right for adding to strength and one of our star performers has been Jet2 (JET2).

Having added the package holiday company to our AIM Investor list of open positions in November last year, Jet2 have delivered as series of strong trading update, propelling our initial position to a gain of 35%. With the company having recently published a market-beating set of preliminary results and the shares breaking out of key technical pattern, we’re keen to add to this strength and snap up a second tranche.

Prelims propel Jet2 higher

Last week, Jet2’s delivered an eye-catching set of preliminary results that captured the market’s imagination. Here’s the five key takeaways:

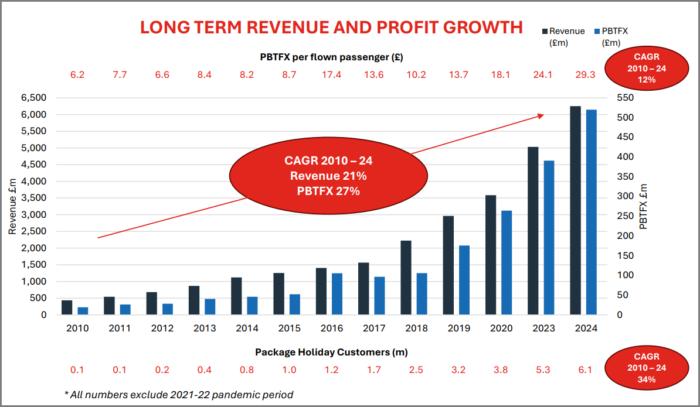

1. Record profit surge: Jet2 reported a substantial 43% jump in annual profit, reaching £529.5 million ($680.94 million). This impressive growth was driven by robust demand for its holiday products and a record number of passengers flown.

2. Revenue growth: The company’s total revenue soared to £6.26 billion, marking a significant 24% increase from the previous fiscal year. This growth was fuelled by a strong recovery in travel demand as restrictions eased, coupled with effective pricing strategies across its holiday and flight offerings.

3. Strategic expansion: Jet2 continues to expand its fleet and routes, enhancing its market presence and operational capacity. This expansion is poised to capitalise on increasing consumer confidence in travel.

4. Operational efficiency: Despite challenges posed by fluctuating fuel costs and ongoing logistical adjustments, Jet2 maintained solid operational margins. The company’s focus on efficiency and cost management bolstered its financial performance, ensuring sustainable profitability amid external uncertainties.

5. Forward guidance and optimism: Looking ahead, CEO Steve Heapy emphasised Jet2’s optimistic outlook, stating, “Despite the challenges posed by the external environment, we remain confident in the underlying strength of our business model and our ability to deliver long-term value for our stakeholders.” He highlighted Jet2’s commitment to expanding its leisure travel offerings, leveraging its strong brand reputation and customer loyalty to drive future revenue growth.

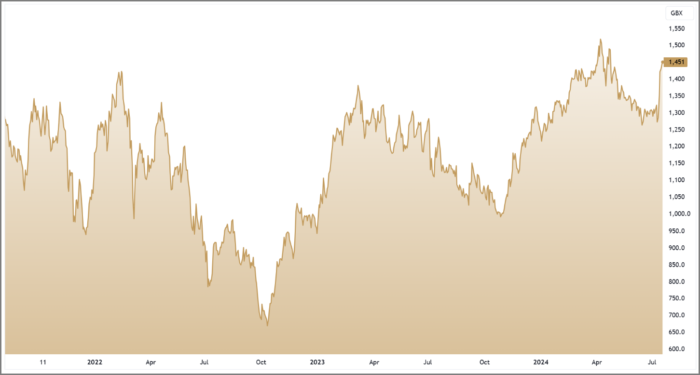

Technicals signal smooth ascent

On the price chart, Jet2 appears ready to resume the uptrend that began back in October last year. After reaching highs of 1,565p in April, Jet2’s share price entered a consolidation phase, retracing back to the 200-day moving average within a descending channel over the past two months. However, last week’s price action has shifted the momentum dynamic dramatically.

The recent breakout from the descending channel is a significant as it indicates the end of the consolidation phase and the potential for a new upward leg. This breakout was accompanied by a surge in trading volume, underscoring strong buying interest and investor confidence in the stock.

Jet2’s share price has now decisively moved above the 50-day moving average, which is currently positioned above the 200-day moving average. This “golden cross” formation is a classic bullish signal, suggesting that the long-term trend is back on track and poised for further gains.

Value & Quality

When analysing Jet2’s financials, two investing terms jump out: Value and Quality. While these terms often represent opposing forces in the stock market, we believe Jet2 embodies both qualities.

Jet2’s value proposition is evident in its attractive valuation metrics. The shares trade on a forward PE ratio of 8.2, significantly below the market average. Additionally, Jet2’s price-to-free cash flow ratio stands at an impressive 4.5, underscoring the company’s robust cash-generating capabilities relative to its market price. With a price-to-sales ratio of just 0.50, Jet2’s stock appears attractively priced, further reinforcing its value case.

On the quality front, Jet2’s financial health and operational efficiency shine through. The company’s return on equity (ROE) of 33% and return on capital employed (ROCE) of 14.9% demonstrate its ability to generate substantial returns for shareholders and effectively reinvest capital to drive future growth.

The company’s strong balance sheet adds another layer of quality to its financial profile. With Cash & Equivalents standing at £3.2bn and net debt of -£1,8bn, Jet2 enjoys a healthy cash position, providing financial stability and flexibility for future investments and potential challenges. This negative net debt signifies that the company has more cash and cash equivalents than its total debt, a strong indicator of financial health.

Overall, Jet2’s combination of compelling value and robust quality makes it a standout second tranche buy in the current market environment.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.