4th May 2023. 8.58am

Regency View:

BUY CentralNic (CNIC) – Second Tranche

Regency View:

BUY CentralNic (CNIC) – Second Tranche

CentralNic still look cheap

Quarterly earnings season.

A time for caffeine-fuelled analysts to filter through mountains of trading updates to determine which sectors will be in fashion this summer.

So far, tech is coming out on top and there are real signs that the ‘Teck Wreck’ of 2022 may be coming to an end…

Last year, US tech stocks tumbled more than 30% as a backdrop of rising interest rates, high inflation and uncertain economic conditions caused sentiment in Silicon Valley to plumet.

However, within the last week we have seen a “stronger than expected” start to the year from the kingpins of global tech – Microsoft, Google’s Alphabet, and Facebook owner Meta.

We have also seen a record-breaking set of quarterlies from one of our favourite small-cap tech stocks, CentralNic (CNIC).

CentralNic is a business which is amassing a goldmine of data through its domain name platform, which it is now monetising through its fast-growing marketing division.

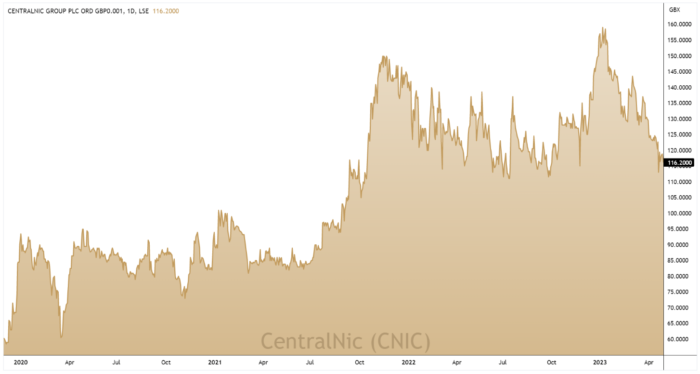

We first recommended the stock last year, and whilst the share price has tracked sideways, CentralNic’s growth momentum has continued to accelerate…

Total revenue surged 77% to $728.2m last year (FY22) driven by an 86% organic growth in its Online Marketing business.

With sector sentiment starting to improve and the shares trading back at a key level of support, we’re looking to snap up a second tranche following last week’s impressive quarterly results.

A first quarter to remember

Last week, CentralNic published a “best-ever” set of quarterly results along with news of a key contract renewal with Microsoft Bing.

Revenues jumped 24% to $194.9m during the first three months of the year and adjusted earnings (EBITDA) rose 15% to $21.3m.

Cash increased 8% to $102.9m during the quarter while net debt reduced by 13% to $49.2m.

CentralNic said its “expanding product range” and the “benefits of operating leverage” will see it “continue to trade at least in line with current market expectations”.

As it stands, consensus analyst estimates have earnings growing at 52.1% this year – which looks conservative given CentralNic’s stellar first quarter.

The Microsoft Bing tie up will see CentralNic’s fast-growing Online Marketing division combine its existing AI capabilities with OpenAI’s ChatGPT, which has taken the world by storm since it was released in November last year.

CentralNic said the Bing deal “complements” its existing relationships with Google and Yahoo, and that it was “excited for the potential revenue growth opportunities that this strategic partnership could bring”.

Too cheap to ignore

For a business growing at break-neck speed, CentralNic’s valuation looks too cheap.

Operating cashflows have accelerated at a rate of 43.4% over the last five years and levels of free cash have followed suite.

CentralNic have a Price to Free Cashflow of 6, which is the best in the Software & IT Services market, with a Price to Sales ratio of just 0.6, compared to an industry average of 1.80.

The stock also trades on a deep discount to estimated Fair Value, which predicts what a stock should be worth based on the cashflows the business is expected to generate in the future.

CentralNic’s estimated Fair Value is £2.04 per share, which is over 70% above the stock’s current price.

Management have also shown a clear appetite to “enhance shareholder value” through a “progressive dividend policy and continued share buybacks”.

The proposed dividend for 2022 is 1.0 pence per share, which represents approximately 6% of the year’s free cash flow.

Play the range

The price of any stock will alternate from periods of trend, be it up or down, to periods of choppy sideways consolidation.

CentralNic’s share price is currently in the choppy sideways consolidation phase.

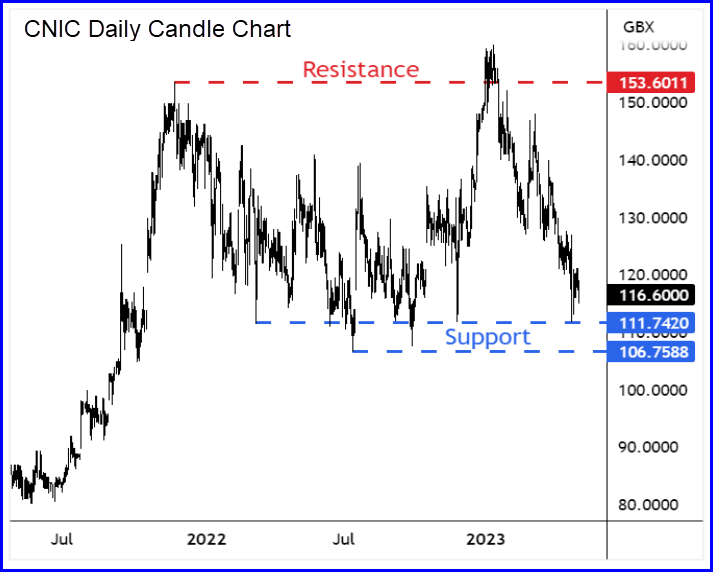

Whilst much of what we see during these sideways consolidation phases is ‘random walk’ price behaviour, we have seen CentralNic’s share price print clear levels of support and resistance…

Resistance comes in the form of the November 2021 trend highs at 153p – this level was retested and rejected in January this year.

Support is also very clear to see on CentralNic’s price chart, with the shares bouncing from the 111p-107p area on multiple occasions.

Recent price action has taken the shares back to the support zone – skewing short-term risk / reward in favour of buyers.

This technical catalyst, combined with last week’s strong trading update and CentralNic’s attractive valuation, means we are more than happy to snap up a second tranche of this compelling growth stock.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.