Regency View:

BUY CentralNic (CNIC)

CentralNic’s domain data creates goldmine of AI-driven insights

Data is the most valuable commodity on the planet.

It is the fuel driving the furious progression in artificial intelligence (AI) and the DNA linking our ever growing ‘internet of things’.

But unlike oil or gold, data increases in value the more it is connected…

Data is infinitely durable and reusable and for those companies who can collect and unlock its power, the sky is the limit.

Today’s stock, CentralNic (CNIC) is a business which is amassing a goldmine of data through its domain name platform, which it is now monetising through its fast-growing marketing division.

Highly scalable, fixed cost platform-based business

CentralNic supplies the tools for businesses to get online and the tools for websites to acquire customers and generate revenues.

Or as CentralNic CEO, Ben Crawford puts it, “we’re a one-stop-shop for anyone who wants to get their business online and make some money”…

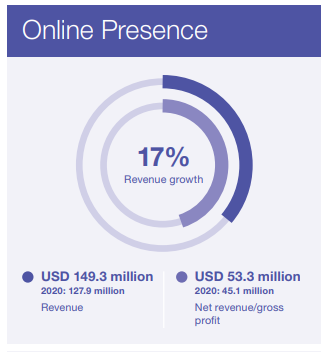

The business operates within two interlinking marketplaces: Online Presence and Online Marketing

Online Presence includes domain names (web addresses), websites, hosting and email…

CentralNic sells its Online Presence services via an annual subscription model. And with only 3% of customers changing supplier each year, these subscriptions tend to be very sticky.

Currently, more than 45 million domain names use at least one of CentralNic’s platforms – that’s around 12% of the market.

CentralNic have visibility of all the traffic heading to its domain names which represents a treasure trove of data…

Through AI software, CentralNic can take the domain data and match up the buyers and sellers of advertising – enabling it to build a suite of Online Marketing tools.

This segment of the business is where the true shareholder value lies…

CentralNic’s Online Marketing services are billed continually on utility-style rolling contracts and revenue is growing at break-neck speed (133% FY 2021).

And whilst the revenue split between the two divisions is roughly 50/50, the size of the Online Marketing market dwarfs that of Online Presence at $400bn versus $30bn.

Both segments of CentralNic’s business dovetail beautifully – creating an overall model with high levels of recurring revenue, strong cashflow generation and plenty of scope for organic and acquisitive growth.

Value & Growth

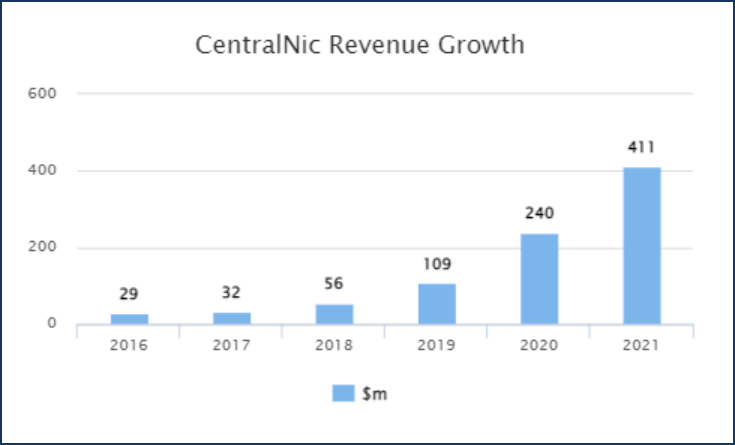

CentralNic’s 5-year revenue growth curve has all the hallmarks of high-quality growth stock…

Their average compound annual growth rate (CAGR) in revenue since 2016 is just shy of 70%, with 3-year sales CAGR of 94%.

This near-exponential top-end growth is starting to feed through into the bottom line, with CentralNic swinging to an operating profit of $12.4m last year (FY21) with net profits projected to climb to $40m this year (FY22).

Those of you who follow our research regularly will know that we like buying companies at this stage – established revenue growth that is feeding through into the bottom line…

Risk/reward for medium-term investors tends to look more favourable than during the unprofitable years without valuations getting too ahead of themselves. And this certainly seems to be the case with CentralNic…

The shares are trading on a very reasonable forward price earnings (PE) ratio of 10.2 – one of the most attractive in the Software & IT Services sector.

The PE also compares favourably to projected earnings per share (EPS) growth of 116.7%.

Alongside ‘growth at a reasonable price’ metrics, CentralNic look attractive across a number of traditional value metrics…

Free Cashflow is increasing rapidly, and the shares have a Price to Free Cashflow of 12, one of the best in the sector.

Price to Sales is just 1.06, and Enterprise Value to Adjusted Earnings (EV to EBITDA) is 13.67 – again one of the most attractive in its peer group.

Bullish Q1 Trading Update creates catalyst for entry

On Monday, CentralNic released a quarterly trading update which confirmed its “strong start to the year”…

CEO, Ben Crawford expects the Group to “exceed the most recent market expectations”…

Total revenue for the first quarter was $156m, generating adjusted earnings (EBITDA) of $18m. And year-on-year organic growth reached a record high of 51% as CentralNic “gained market share in a growing market”.

The growth has been “driven largely by the growth of the Online Marketing Segment, driven by increased demand for our privacy-safe online customer acquisition services”.

CentralNic’s balance sheet has continued to de-leverage as cash increased to $86.9m as at 31 March 2022 from $55.6m as at 31 December 2021, whilst Net Debt decreased to $65m as at 31 March 2022 from $75m as at 31 December 2021.

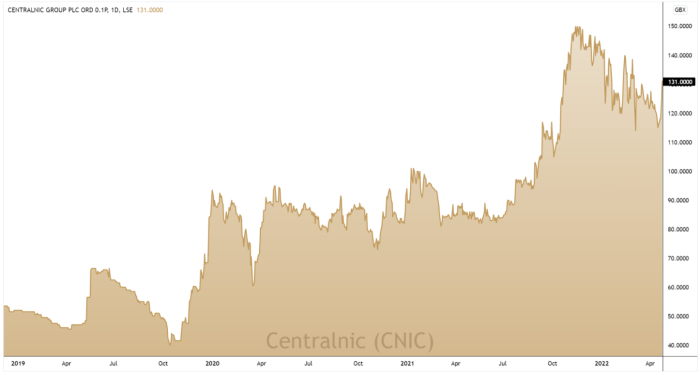

This strong trading update has created a catalyst for our entry, and we expect CentralNic’s share price to breakout of the ‘bull channel’ which has formed since the turn of the year, and for the shares long-term uptrend to continue.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.