5th Dec 2024. 9.01am

Regency View:

BUY 1Spatial (SPA) Second Tranche

Regency View:

BUY 1Spatial (SPA) Second Tranche

1Spatial: A stellar year of growth and strategic milestones

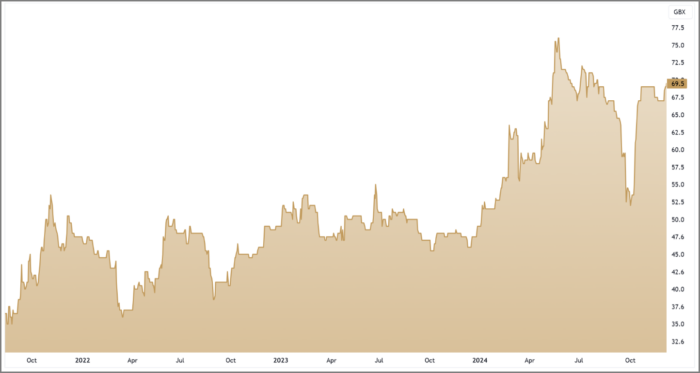

In a year where many stocks have faced turbulence, 1Spatial (SPA) has truly stood out…

The global leader in Location Master Data Management (LMDM) software has not only weathered market volatility but is charging ahead with impressive growth and strategic wins. This is exactly why we’re adding a second tranche to our position—1Spatial has demonstrated clear momentum, expanded its geographic footprint, and delivered on its growth strategy.

Recap: Why we liked 1Spatial back in March

When we first highlighted 1Spatial back in March, the company was already showing signs of strong potential. As a provider of innovative software solutions that help organisations manage their geospatial data, 1Spatial plays in a crucial space—one where the demand for accurate, accessible location-based data continues to surge.

We were impressed by the company’s solid track record of recurring revenue and the significant opportunities within the US and UK markets. Additionally, their strong customer base, including major names in utilities, government, and transportation, gave us confidence that their solutions had a proven and growing appeal. The stock looked undervalued at the time, with promising upside potential, and today, those factors have only become more evident.

1Spatial’s stellar achievements since March

Since March, 1Spatial has made several notable strides that reinforce our belief in its long-term growth potential. Let’s break down the key milestones:

- Strong financial performance: 1Spatial delivered a solid 5% revenue growth in its H1 2025 results, with recurring revenue up by 9%. This demonstrates the strength and sustainability of their business model. Their Annualised Recurring Revenue (ARR) grew 7%, with Term Licenses ARR expanding by 30%, a clear indicator of the strong demand for their solutions, particularly in the US market.

- Expansion in the US: 1Spatial has continued its push into the US, with 21 states now covered, up from 18 in the previous half-year. Notably, they secured a significant $1.4m contract with the US Forest Service, marking their first engagement with a major federal agency in the US. This contract, which involves long-term recurring revenue, is a significant validation of 1Spatial’s technology and sets the stage for further expansion in federal and state departments.

- Strengthened leadership: The company has continued to build its leadership team, appointing Nabil Lodey as Managing Director for the UK and Ireland, and Steve Hanks as Business Development Director for 1Streetworks. These strategic appointments are poised to enhance 1Spatial’s market presence and ensure they execute on their growth plans in the UK and beyond.

- 1Streetworks gaining momentum: 1Spatial’s flagship product, 1Streetworks, has gained significant traction. The company recently secured a £1m contract with a County Council, and their relationship with major clients like UK Power Networks has only deepened. These wins reinforce the value of 1Spatial’s software in the UK utilities sector, which continues to grow.

- International expansion: Beyond the US and UK, 1Spatial is seeing success in other markets. The company has landed new contracts in France, Belgium, and Australia, further proving its global reach and the scalability of its solutions. Contracts with government departments and utilities demonstrate the company’s growing influence in the geospatial data space.

Why 1Spatial is an attractive growth stock

Looking at 1Spatial’s valuation, it’s clear that the stock offers significant upside. Despite a standout performance this year, the market hasn’t fully priced in its growth potential. The company has built a solid foundation with a growing proportion of recurring revenue, now making up 55% of total income. This gives 1Spatial a predictable cash flow base, which is crucial for supporting its growth ambitions.

The boost in Term Licenses revenue, up 26%, is another positive sign. It shows that new customers are flocking to 1Spatial’s solutions while existing clients are expanding their use. This kind of growth is a strong signal of the company’s ability to scale effectively.

Profitability is also on the up. Adjusted EBITDA rose 18% in the first half of the year, and the company’s gross margin remains solid at 52%. That’s a sign that 1Spatial is managing costs well, even with inflationary pressures. As the company continues to grow, these margins should only get better, which is a great sign for long-term value.

Looking ahead, the US market is a big area of growth. 1Spatial has been expanding rapidly, signing new deals with state and federal agencies. As it secures more contracts, particularly with high-margin SaaS offerings, revenue growth will likely accelerate. This is where a lot of the upside is coming from, especially as the US government and utilities continue to digitize their operations.

Finally, if we look at the stock’s valuation in relation to its growth, it’s still reasonably priced. Given the strong performance, expanding ARR, and increasing market share, 1Spatial hasn’t yet been fully priced for the future gains we expect. Compared to peers in the SaaS and geospatial data sectors, 1Spatial looks like an attractive pick. With so much room for expansion, especially in the US, we believe the stock has plenty of upside left.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.