14th Mar 2024. 8.58am

Regency View:

BUY 1Spatial (SPA)

Regency View:

BUY 1Spatial (SPA)

1Spatial: Navigating the data revolution – a GPS for business growth

In an era where data stands as the world’s most valuable commodity, Master Data Management (MDM) has swiftly become the linchpin for organizations seeking to unlock their data’s full potential.

As businesses worldwide recognise the value of unified, accurate, and actionable data, MDM has become the linchpin in navigating the complexities of the digital landscape. The global MDM sector is growing a compound annual rate of 18.2% and is projected to reach a staggering $23.8 billion by 2030.

1Spatial (SPA) has carved out a niche in Location Master Data Management a sub-sector of the rapidly growing MDM sector.

GPS for data

Location Master Data Management (LMDM) is like the GPS for data. Just as GPS helps you find your way by pinpointing locations on a map, LMDM helps businesses manage and organise information based on where things are located.

Imagine you have a massive amount of data, like addresses, maps, or information about different places. LMDM ensures that this data is accurate, consistent, and organised in a way that makes sense.

For example, a company might use LMDM to manage data about its stores, warehouses, or customers’ addresses. This way, they can easily analyse and use the data to improve their services, plan more efficient routes for deliveries, or understand where their customers are located.

In simple terms, Location Master Data Management is the tool that helps organisations keep their location-based data in top-notch shape, making it easier for them to navigate and use information effectively.

1Spatial’s key revenue drivers

1Spatial’s primary revenue streams are intricately tied to its provision of cutting-edge solutions and services within the LMDM sector. The company operates on a model that caters to the evolving needs of organisations grappling with the challenges of managing vast amounts of location-based data. Here’s a breakdown of 1Spatial’s key revenue drivers:

Software Solutions:

1Spatial offers innovative software solutions, including its flagship product 1Integrate, designed to validate, cleanse, and enhance location data. These solutions serve as the technological backbone for organisations seeking to streamline their data management processes.

Consulting and Services:

Beyond software, 1Spatial provides consulting and professional services to assist clients in implementing and optimising LMDM solutions. This includes data validation, integration, and maintenance services, ensuring that organisations derive maximum value from their location-based data assets.

Subscription Models:

With a transition towards Software as a Service (SaaS), 1Spatial leverages subscription-based models. This allows clients to access and benefit from the latest updates, features, and support, fostering long-term relationships and recurring revenue for the company.

Licenses and Contracts:

1Spatial engages in licensing agreements and multi-year contracts with clients, securing a stable revenue stream. Notable wins, such as the €9 million utility project in Belgium, underscore the company’s ability to secure high-value contracts for its expertise in LMDM.

70% jump in recurring software licence revenue

Last week, 1Spatial delivered an impressive full-year trading update, showcasing the company’s robust performance and strategic advancements.

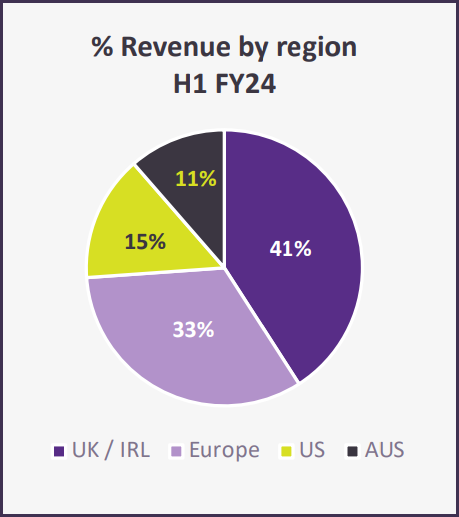

The trading update emphasised the strength of 1Spatial’s sales mix, with recurring revenue reaching 55% and a substantial increase of approximately 70% in software term license revenue, driven by double-digit growth across key regions such as the UK, US, and Australia.

1Spatial’s performance in the US market was underscored by securing five new annual NG9-1-1 licenses, a testament to effective execution by the new sales head. Additionally, 1Streetworks, an innovative SaaS product, gained momentum after a successful win with UK Power Networks, contributing to a growing paid trial pipeline.

The trading update also shed light on management’s forward-looking strategies, emphasising the potential expansion of flagship contracts, particularly leveraging efficiency and cost enhancements, to tap into a substantial £400 million market opportunity – the potential market size for 1Spatial’s flagship product, 1Streetworks, in the UK.

Growth at a reasonable price

1Spatial has an impressive track record of delivering year-on-year revenue growth even during market shock such as the pandemic.

The shares currently trade on a forward price-to-earnings (PE) multiple of 18.3. Whilst this can’t be considered cheap relative to its peer group or the wider market, it compares very favourably to forecast growth in earnings per share of 30.9% – putting 1Spatial on a price to earnings growth ratio of 0.8.

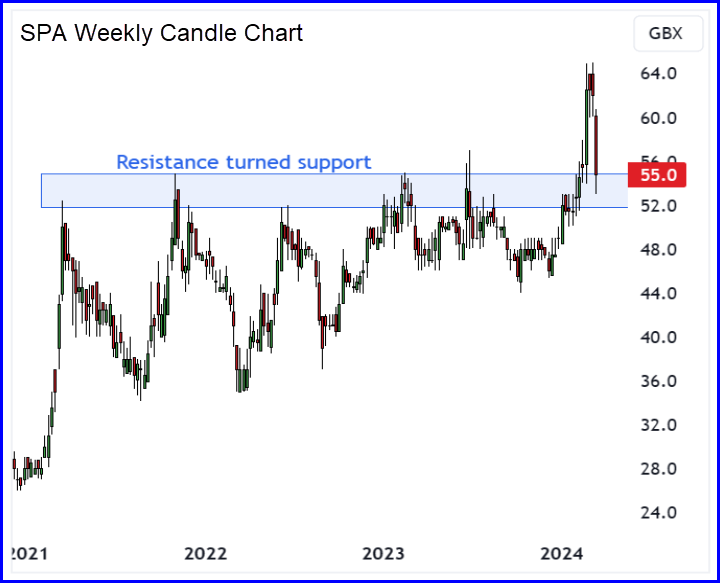

In terms of market timing, the shares have been trending broadly higher since 2020 and recent price action has seen the shares pullback and retest a key area of broken resistance. Within the context of a long-term uptrend, we believe this pullback to resistance turned support represents an attractive opportunity to position ourselves within the trend at favourably levels of risk/reward.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.