4th Oct 2024. 10.41am

Weekly Briefing – Friday 4th October

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.72% |

| FTSE 250 | -1.97% |

| FTSE All-Share | -0.88% |

| AIM 100 | -1.20% |

| AIM All-Share | -1.23% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 4th October

Market Overview

Dear Investor,

This week has been dominated by a significant escalation in tensions between Israel and Iran, with the situation intensifying rapidly.

The conflict took a sharp turn after Iran launched a barrage of ballistic missiles at Israel, in what it described as retaliation for the assassination of key figures linked to Hezbollah and Hamas. Israel responded by stepping up airstrikes, including a high-profile attack on a Hezbollah-linked medical facility in central Beirut, which killed several medical staff and paramedics.

These developments have stirred fears of a broader conflict in the region, with Israel also intensifying its ground offensive in southern Lebanon. The rising threat of all-out war has created a difficult environment for managing geopolitical risk.

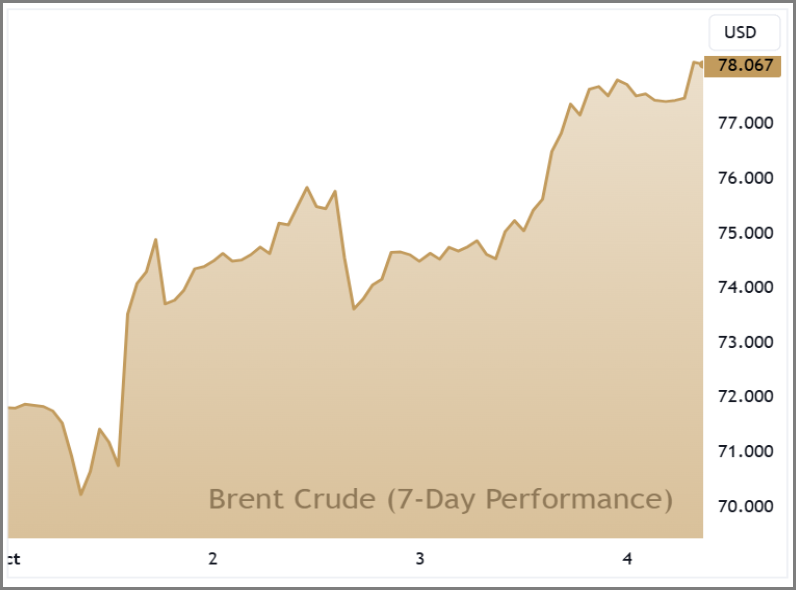

In response, financial markets have reacted cautiously, particularly in the energy and safe-haven asset sectors. Oil prices, which had been struggling near recent lows, bounced higher as traders began to factor in the risk of disruption to global oil supplies. Brent crude has trended higher all week and is currently trading around the $78 mark. Oil traders remains sensitive to any developments that could impact key infrastructure or transport routes in the Middle East. However, the current rise in oil prices has been measured, reflecting increased supply from Libya and the fact that the conflict has yet to significantly disrupt supply chains.

The US dollar has also strengthened from the escalating tensions, rallying as investors sought the safety of more stable assets. Geopolitical uncertainty tends to favour the dollar, and this week’s developments have been no exception. The currency’s rebound from recent lows highlights its ongoing role as a global haven in times of crisis.

Meanwhile, gold has held firm near recent highs, reflecting the broader risk-averse sentiment in the market. Investors are turning to gold to hedge against the uncertainty, and its performance this year underscores the defensive positioning many are adopting as the conflict evolves.

Wishing you a peaceful weekend,

Tom

Market Movers

On the rise: Saga (LSE:SAGA) +11.7% on the week

Saga’s share price has rallied this week after the company announced that it is in discussions with Belgian insurer Ageas regarding a potential partnership. The news sent Saga’s shares higher by more than 14%, reflecting investor optimism about the strategic implications of this collaboration.

The potential partnership comes at a critical time for Saga, which specialises in products and services for individuals over 50. The company has been grappling with challenges in its insurance business, prompting it to implement measures such as price increases and staff reductions to manage costs. By aligning with Ageas, Saga aims to strengthen its insurance offerings and capitalise on the growing demand for pension and savings products from aging populations in Europe and Asia.

The backdrop of these discussions includes Saga’s previous attempt to sell its insurance underwriting arm, a process that was put on hold earlier this year after an acquisition by Australia’s Open fell through.

Despite the recent gains, Saga’s shares remain down 18% year-to-date, highlighting the challenges the company has faced. However, the news of the potential partnership has reinvigorated investor interest and confidence in Saga’s ability to navigate its current challenges and drive future growth.

REGENCY VIEW:

Saga’s strong brand loyalty, diverse revenue streams, and recent operational successes, particularly in the cruising division, underscore its resilience and potential for upside as the market re-evaluates its worth. Click here to read our full report on Saga.

Shares in Aston Martin Lagonda went into reverse this week after the luxury car-maker issued a stark warning about lower-than-expected profits due to ongoing supply chain issues and sluggish demand, particularly in China. The company’s announcement marked a significant shift from its previous guidance just nine weeks earlier, when it had confidently reiterated its forecasts.

The trading update revealed that disruption at suppliers had delayed the arrival of critical components, significantly impacting Aston Martin’s plans to ramp up production of its newly launched models. This led the company to strategically reduce its wholesale volumes by around 1,000 units, adjusting its production targets to better align with the prevailing market conditions. Aston Martin also projected that full-year wholesale volumes would decline by a high single-digit percentage compared to last year, a stark contrast to earlier expectations of growth.

Furthermore, Aston Martin’s adjusted earnings (EBITDA) is now anticipated to be slightly below last year’s figures, with gross margins expected to fall below the 40% target. The company also indicated that it would no longer achieve positive free cash flow in the second half of 2024, a departure from its earlier guidance, which further rattled investor confidence.

REGENCY VIEW:

Aston Martin is struggling as supply chain disruptions and weak demand in China have put pressure on its profitability and free cash flow expectations for 2024. With a significant decline in share price over the past year and a precarious balance sheet, the company faces an uphill battle to improve efficiency and meet its ambitious growth targets for 2025.

Sector Snapshot

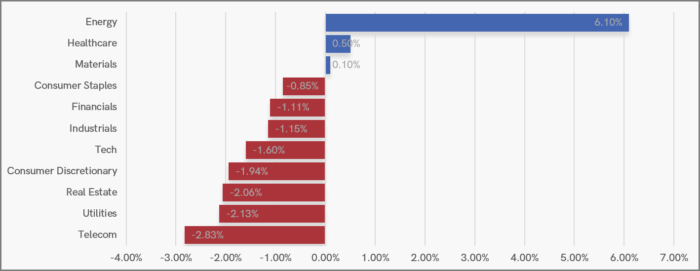

The UK market is being held up by the Energy sector this week as the FTSE’s oil giants rallied in response to rising tensions in the Middle East.

Energy aside, the market has a bearish aesthetic seven sectors showing losses of more than -1% during the last seven sessions.

UK Price Action

The symmetrical triangle consolidation pattern that we identified last week remains very much in place with prices being ‘funnelled’ towards the apex. As a general rule, the more intense the period of price compression, the more explosive the eventual breakout – we continue to monitor this pattern closely.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.