20th Jun 2024. 8.59am

Regency View:

BUY Beeks Financial Cloud (BKS) – Second Tranche

Regency View:

BUY Beeks Financial Cloud (BKS) – Second Tranche

Snap up a second tranche of Beeks Financial Cloud: A high-growth opportunity

We’ve been waiting patiently for the opportune moment to secure a second tranche of Beeks Financial Cloud (BKS), a standout performer in the cloud computing sector for financial markets.

With a series of significant contract wins and an attractive valuation, we believe Beeks is poised for substantial growth.

Why we like Beeks Financial Cloud

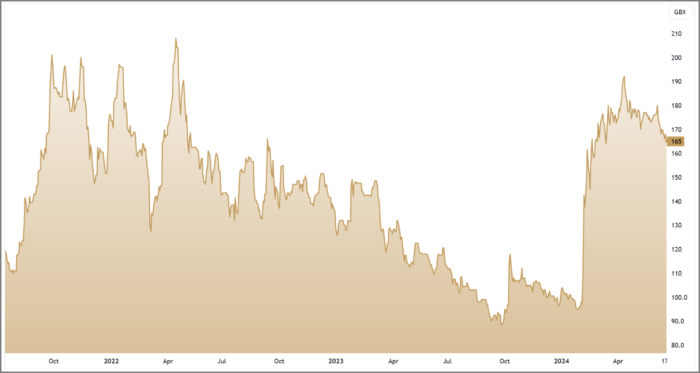

Back in 2023, we recommended buying Beeks Financial Cloud due to its strong position in the niche market of cloud computing for financial services.

The company’s tailored cloud solutions, including Private and Proximity Cloud services optimised for low-latency trading, were attracting major financial institutions, boosting its revenue and earnings.

Additionally, Beeks’ strategic partnerships, such as its collaboration with the ICE Global Network and its strong focus on recurring revenue through its Exchange Cloud and Private Cloud offerings, positioned it well to capitalise on the increasing shift towards cloud computing in the financial sector.

For a deeper dive into Beeks products check out our original recommendation on the stock – click here.

Exciting contract wins

February 2024: Beeks announced two significant contract wins that boosted investor confidence:

- Tier 1 investment manager: Beeks secured a substantial contract with a prominent Tier 1 investment manager. This contract, valued at $3.6 million over a four-year period, represented a doubling of the initial contract’s value. The investment manager’s decision to expand their engagement with Beeks reflected confidence in the reliability and effectiveness of Beeks’ Proximity Cloud offering.

- Exchange cloud contract: Beeks entered into a conditional contract with one of the world’s largest exchange groups. This contract marked the beginning of a potentially long-term partnership, underscoring Beeks’ appeal as a preferred provider of cloud infrastructure solutions for financial exchanges. The partnership not only validated Beeks’ technological capabilities but also positioned the company to further enhance its market presence and capture additional revenue streams from global financial exchanges.

March 2024: Beeks announced a significant contract extension with the Johannesburg Stock Exchange (JSE) for its Exchange Cloud services. This extension followed the successful launch of JSE Colo 2.0. The extension indicated the potential for further collaboration and expansion of services with JSE, including backup and disaster recovery solutions.

These contract wins underscored Beeks’ ability to innovate and deliver value-added solutions that address the complex needs of its global client base, solidifying its reputation as a trusted partner in the financial services industry.

Attractive valuation and growth potential

Currently, Beeks trades at a forward price-to-earnings (P/E) multiple of 22. While this may not appear cheap relative to sector peers, it is compelling given Beeks’ growth potential:

- Revenue Growth: Beeks has achieved a compound annual growth rate (CAGR) of 32% in top-line revenue over the past five years.

- Earnings Growth: Earnings per share (EPS) are forecast to grow at a rate exceeding 46%, giving the stock a forward price-to-earnings growth (PEG) ratio of 0.7. This indicates that Beeks offers growth at a reasonable price.

- Financial Health: Beeks maintains a debt-free balance sheet and strong cash flow, significantly reducing the risk of shareholder dilution as the company expands.

Technical analysis and timing

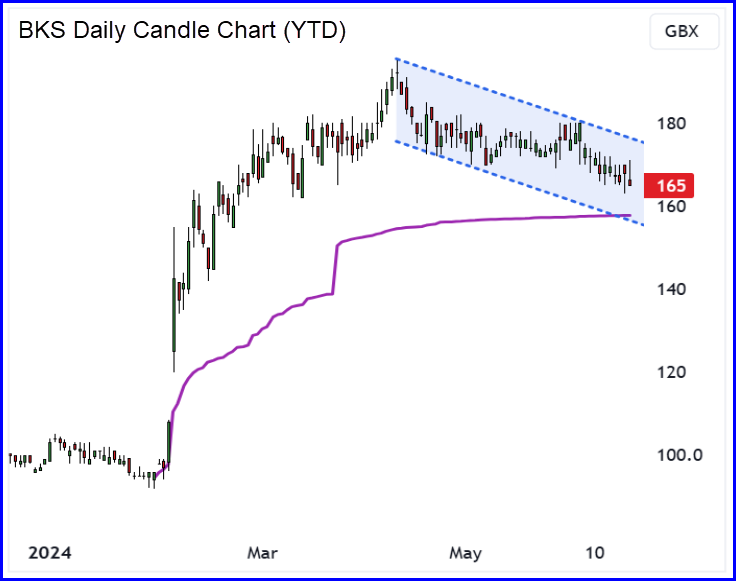

In the first quarter of 2024, Beeks shares surged due to impressive contract wins. Since then, the shares have retraced within a small descending channel, taking prices back towards the volume-weighted average price (VWAP) anchored to the January lows.

The anchored VWAP represents the average price of ‘smart money’ institutional investors who acquired the shares before the contract wins.

With prices now settling near the anchored VWAP, the timing is right to buy a second tranche, as this price point is attractive and reflects institutional confidence in the stock.

Given Beek’s robust growth trajectory, significant contract wins, attractive valuation, and favourable technical setup, we recommend snapping up a second tranche of this strong growth stock. We believe Beeks is well-positioned to continue its upward momentum and deliver on its potential this year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.