Regency View:

Buy Beeks Financial Cloud (BKS)

Carving out a niche in cloud computing for capital markets

‘Small stocks. Big potential’ its AIM Investor’s slogan for a reason.

We invest in well run small cap stocks that offer growth potential which eclipses that of their large cap peers.

Today’s stock, Beeks Financial Cloud (BKS) is an exciting micro-cap which is carving out a niche in a large and progressive market.

Beeks is a cloud computing and connectivity provider for businesses operating in financial markets.

With a market cap of just over £86m, Beeks is a tiddler which is swimming in a very big pond…

There are upwards of 20,000 financial institutions around the world which fall into Beeks addressable market, a large percentage of which are yet to move to the cloud computing model.

Beeks already have a host of Tier 1 financial institutions as clients, revenue and earnings have doubled in the last year, and the business has a number of exciting products that are yet to be scaled.

The need for speed

Cloud computing is superior for many reasons:

- Accessibility: Cloud-based applications and data are accessible from virtually any internet-connected device.

- Speed to market: Developing in the cloud enables users to get their applications to market quickly.

- Data security: Hardware failures do not result in data loss because of networked backups.

- Savings on equipment: Cloud computing uses remote resources, saving organisations the cost of servers and other equipment.

- Pay structure: A “utility” pay structure means users only pay for the resources they use.

The transition to cloud computing is a key investment theme for AIM Investor and Beeks have exciting growth potential in this space.

Beeks deliver Public Cloud and Private Cloud connectivity and analytics which are optimised exclusively for global capital markets and financial services.

For banks, exchanges, brokers and traders, high speed connectivity (low latency) is essential when it comes to placing trades.

For this reason, Beeks have strategically placed their data centres to be directly connected to major exchanges, banks, brokers and FX venues (see map below).

The dotted lines between the locations (on map below) is Beeks ‘wide area network’ where they can transmit the traffic from the data centres in a secure low latency manner.

Beeks allow clients to deploy IT infrastructure at speed with flexible rather than fixed costs.

“You can come and peel off infrastructure from us in real time rather than doing it yourself” said founder and CEO, Gordon McArthur in his broad Scottish accent.

“Rather than spending millions of dollars on cap exp, you can do it on a month-to-month cost with us” he added.

Mr McArthur spent years working at cloud computing giant IBM. When he noticed the lack of low latency trading infrastructure available, he decided to setup Beeks in 2010 – growing the business rapidly to IPO in 2017.

Exciting new products

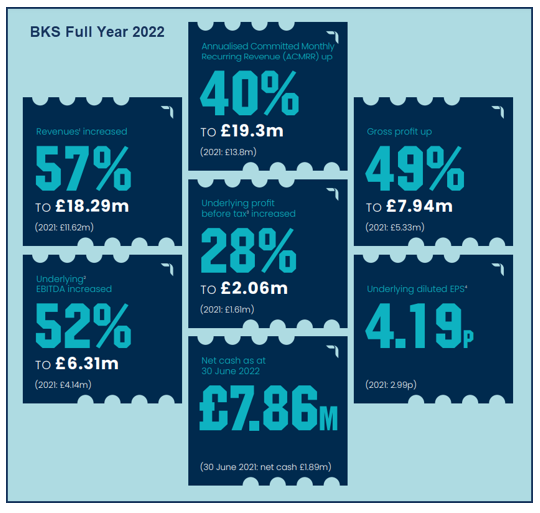

The majority of Beeks £18.8m (FY22) revenue comes from their Private Cloud offering with Public Cloud being less than 5% of turnover.

Beeks’ Private Cloud offering involves designing a cloud infrastructure for a client’s sole use. It allows clients to build bespoke security into their cloud set-up as well as offering guaranteed performance.

With security and speed being essential to Beeks’ client base, demand for Private Cloud services has grown rapidly, driving Beeks’ top line revenue compound annual growth rate (CAGR) to 36.5% over the last five years.

Beeks have also launched two exciting new Managed Cloud services which build on their Private Cloud business and separate them from the competition:

Proximity Cloud – aimed at larger customers who are more interested in complete dedicated infrastructure that can reside under their own security models and serviced by their own engineers, but they still get a cloud platform that comes with all of Beeks’ automation and analytics.

Proximity Cloud is the only fully configured, pre-installed physical capital markets environment that is fully optimised for low latency trading conditions.

The service was only launched 18-months ago but it is already contributing more than 12% of group revenue.

Exchange Cloud – a derived version of Proximity Cloud which has the same underlying technology but is aimed at financial exchanges.

Exchange Cloud allows a financial exchange to host their own multi hold cloud environment which they can sell to their clients.

Exchange Cloud has been built in partnership with the world largest financial exchange group ICE Global Network, which own the New York Stock Exchange.

ICE have licenced Exchange Cloud as a cloud play for their global locations. This is a materially large endorsement in the technology which will have gone through a lot of security testing from ICE.

Rapid growth in recurring revenue

Being a micro-cap with tight margins and modest levels of cash free cashflow, Beeks is at the higher end of our risk spectrum, but we believe the potential rewards far outstrips the risk.

Beeks are starting to see larger deal sizes from existing and new customers with revenue and profitability doubling in the last year.

Annualised committed monthly recurring revenue (ACMRR), Beeks key performance indictor, surged 40% to £19.3m (FY22).

These high levels of recurring revenue, coupled with Beeks’ unique position in the capital markets cloud computing space, go some way to justify the stock’s forward PE of 24.9.

This PE also look reasonable given Beeks’ forecast growth in earnings per share (EPS) of 59.2%, giving the stock a Price to Earnings Growth (PEG) ratio of 0.7 (where anything less than 1 indicates growth at a reasonable price).

Technical Timing

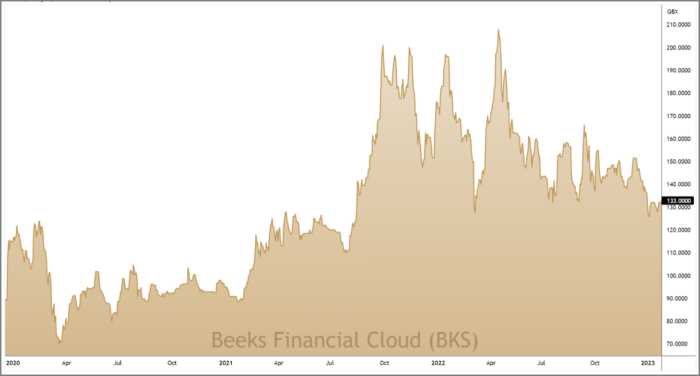

Beeks’ share price has been locked in a choppy sideways consolidation phase for the last two years.

Period of long-term consolidation are normal for small-cap growth stocks and the long-term direction of Beeks’ share price has been upwards since their 2017 IPO at 44p.

The consolidation range runs from support at 120p-130p to resistance at 200p-209p.

Beeks’ recent price action has seen the shares drift back toward the bottom of the consolidation range, tipping the short-term risk to reward in favour of buyers.

With this in mind, we believe the technical timing is compelling, given the 50%+ upside to the top of the range.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.