16th Nov 2023. 9.01am

Regency View:

BUY Solid State (SOLI) – Second Tranche

Regency View:

BUY Solid State (SOLI) – Second Tranche

Solid State: Where momentum meets quality

The end of earnings season and run up to Christmas is a great period to add to stocks that are showing potential within your portfolio.

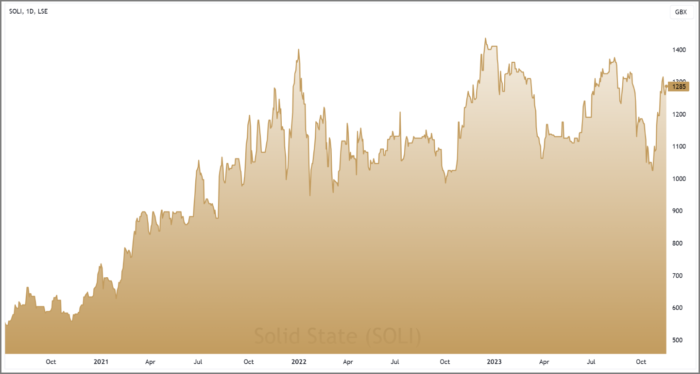

Across our list of AIM Investor open positions, electrical components company, Solid State (SOLI) has stood out as a star performer after they released a market-beating trading update at the end of October.

We first recommend Solid State back in February of last year. Since then, the company has won plenty of contracts, and a number of key macro factors have aligned to create a strong tailwind for the company.

Business model overview

Solid State operates through two primary divisions: Systems and Components. These divisions contribute distinctively to the company’s overall business model.

Systems division

Contribution: The Systems division accounted for approximately 45% of Solid State’s total revenue in 2023.

Focus: This division focuses on delivering high-performance systems across industrial computing, vision systems, custom battery packs, advanced communication systems, and wideband antennas.

Financial impact: With revenue reaching £57.5 million in 2023 (a 77% increase from the previous year), it’s a significant driver of the company’s growth and expansion efforts.

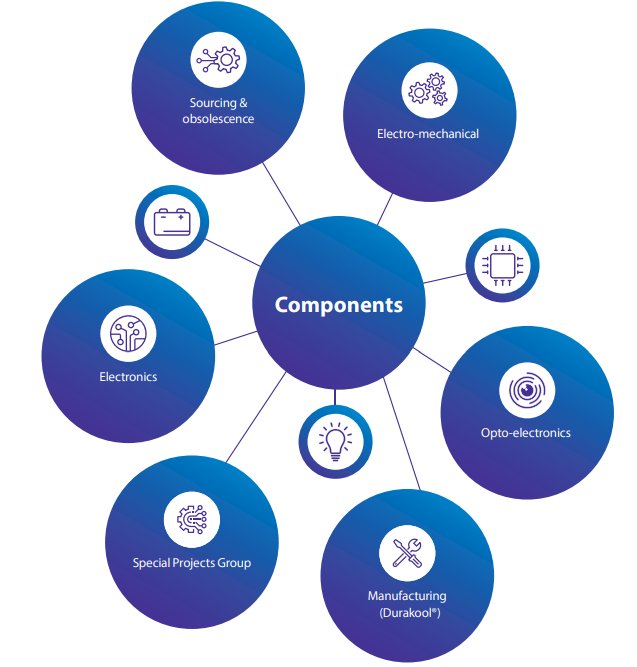

Components division

Contribution: The Components division contributes around 55% to Solid State’s total revenue.

Specialisation: This division specialises in providing a range of products and services, including own-brand manufactured components, franchised components, and value-added services like sourcing and obsolescence management.

Financial impact: In 2023, this division reported revenue of £70 million, showcasing a 33% increase compared to the previous year, highlighting its substantial contribution to the company’s revenue streams.

Solid State’s business model is built on the strength of these two divisions, each playing a pivotal role in the company’s revenue generation, with their specialised offerings catering to diverse market segments and driving consistent growth in their respective areas of expertise.

Areas for growth

1. Strategic acquisitions and expansion:

The acquisition of Custom Power, a prominent US battery pack manufacturer, for $45 million has been a pivotal move for Solid State. Custom Power’s integration has fortified their foothold in the US market, enabling local production capabilities and an enhanced product portfolio. As the demand for efficient battery solutions continues to surge across industries such as renewable energy, automotive, and consumer electronics, Solid State is well-positioned to capitalise on this high growth market.

2. Defence and security sector advantage:

The ongoing geopolitical tensions, notably in regions like Ukraine and Gaza, have triggered a surge in orders within Solid State’s defence and security division.

Solid State’s robust relationships with Tier 1 suppliers in the defence sector, including prominent names like BAE Systems, NATO, and others, fortify their position as a preferred supplier. These alliances not only ensure a steady flow of contracts but also open avenues for more extensive collaboration and expansion into additional defence markets.

3. Medical division momentum:

The post-pandemic resurgence in the medical division, particularly in the design segment, presents promising growth prospects. Solid State’s ability to provide tailored, high-performance electronic solutions aligns perfectly with the evolving needs of the healthcare industry. From advanced medical devices to imaging technologies and diagnostic equipment, the company is poised to make significant strides in this critical sector.

Trading update creates bullish catalyst

In the latest update, Solid State demonstrated substantial growth in revenue and profit for the six months ending September – causing the shares to gap higher.

Their revenue surged by 48.1%, reaching £88 million, while profit before tax soared by 67% to £7 million compared to the same period in 2022. This impressive performance was primarily attributed to the success of the company’s security and defence division, fulfilling £23 million of orders, and benefiting from full-period revenues from Custom Power.

Despite a slightly reduced open order book at £99.7 million, 60% of these orders are expected to translate into revenue within the current financial year, indicating strong forward visibility. Solid State’s efficient cash generation during this period is anticipated to contribute to reducing the company’s net debt.

The shares trade on a forward price to earnings ratio of 15, which cannot be considered cheap, but we believe it is worth paying up for Solid State’s substantial quality. And with fresh momentum behind the shares, we’re more than happy to snap up a second tranche.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.