Regency View:

BUY Solid State (SOLI)

Market-beating Solid State has all the hallmarks of a high-quality stock

When it comes to selecting quality stocks, cash is king…

High levels of free cash flow tend to bring high levels of organic growth and high levels of financial stability – all essential characteristics of high-quality stocks that can compound investment returns over many years.

And we believe today’s addition to our AIM Investor portfolio, Solid Sate (SOLI) have many high-quality characteristics…

Solid State is an electronics group supplying commercial, industrial and military markets with durable components, assemblies and manufactured units for use in specialist and harsh environments.

They are highly cash generative, winning big contracts and performing well ahead of market expectations…

Much more than an electronics manufacturer

Solid State have built specialist expertise in ‘ruggedised’ electronics, this means hard-wearing, shock-proof electronics that can withstand extreme conditions.

The products are used in industries where product and component failure simply aren’t an option. Industries like defence, aerospace, medical, life sciences and transportation.

With over fifty years industry knowledge and longstanding key supplier relationships, Solid State is positioned as the ‘subject matter expert’ for its customers…

Solid State selects the most appropriate component, module, computing technology, cell chemistry, or communications solution for its clients.

This tailored approach brings with it ‘sticky’, long-term contracts with high margins that can withstand inflationary pressures.

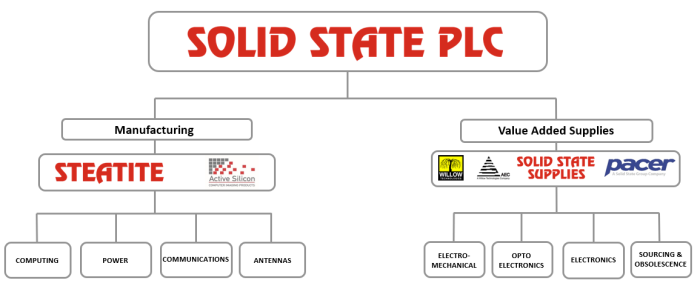

In terms of Group structure, Solid State operates through two clear divisions:

- Components

Components generates roughly 60% of Group’s £66.3m (FY21) revenue and covers own brand manufactured components, franchised components and the provision of value-added services such as Sourcing & Obsolescence management.

- Systems

Solid State’s Systems Division has market leading capabilities in the design, development and supply of high specification industrial computers and electronics. These include; circuit board level design and manufacturing capabilities primarily for image capture, processing, transmission, custom battery packs and advanced communication systems.

Contract wins

Solid State have a strong track record at delivering double-digit revenue growth (12.5% CAGR / Avg).

The company has started the New Year in style by announcing two key contract wins:

The first being a $2.1m order for radio frequency components from a new customer CyanConnode…

CyanConnode will use the component solutions for IoT connectivity to enable ‘smart metering’ in India – a fast-growing market which is “ramping up quickly with around 37 million units currently being tendered” according to CyanConnode CEO, Heather Peacock.

The second contract was “multi-million pound contract” with defence giant BAE Systems…

Steatite, the manufacturing arm of Solid State won the contract to design, develop and qualify computer consoles for maritime platforms.

The project will be led from the Redditch site utilising a new EMC facility installed in 2021.

Market-beating trading update

Those of you who follow our research closely will know that we like align our entry with a short-term catalyst, and Solid State’s came in the form of last week’s trading update…

The update previewed Solid State’s Full Year results for the year ending 31st March 2022, and the numbers made for pleasant reading…

Strong momentum witnessed in the first half to end December has continued and Solid State now expects to report Full Year revenues of “at least” £80m, up from £66.3m the year prior and ahead of expectations.

Solid State also said it expects adjusted profit before tax “well ahead of current consensus expectations”.

Order intake remains strong, with a record open order book at 31 January 2022 standing at £74.1m (30 November 2021: £70.3m).

Outstanding Free Cashflow

Rather surprisingly for a manufacturer, Solid State is lean and mean with a high percentage of cashflow flowing through into free cashflow…

Solid States Free Cashflow currently stands at £94.9 on a trailing twelve-month (TTM) basis – not bad for a stock with a market cap of just £101.28m!

And Solid State’s Free Cashflow has increased at a compound an annual rate of 45.2% (CAGR / Avg) over the last five years.

Whilst the stocks forward PE ratio of 18, is middling for the Machinery Equipment & Components sector, the shares currently trade on a Price to Free Cashflow ratio of 12.3, which is one of the best in the sector.

The company has a stable balance sheet with debt more than 4x covered by cash. And Solid State’s five-year Return on Capital Employed (ROCE) of 12.2% indicates the company knows how to grow profitably.

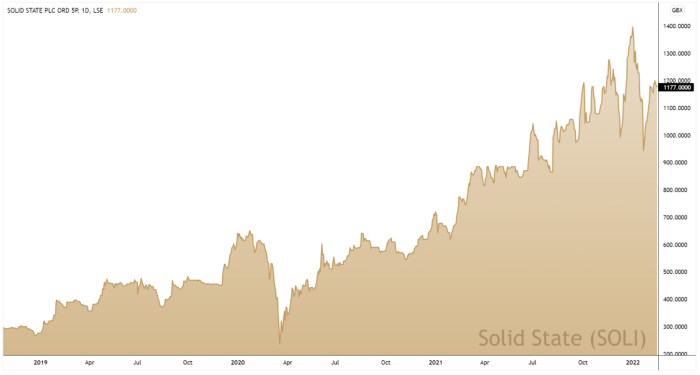

The shares have carved out a powerful long-term uptrend. And after a pullback to support, the shares have started to regain momentum – helped by February’s BAE contract win and bullish trading update.

We believe Solid State represents another high-quality addition to our AIM Investor portfolio.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.