2nd Aug 2023. 8.57am

Regency View:

BUY Prudential (PRU)

- Growth

- Value

Regency View:

BUY Prudential (PRU)

Growth potential with a solid financial foundation

At FTSE Investor, Prudential (PRU) is a stock we closely monitor, particularly for its strong position in high-growth markets, especially in Asia.

Prudential’s strategic focus on rapidly expanding regions has allowed it to capitalise on the increasing demand for insurance and financial products, benefiting from the region’s economic growth and the rising middle-class population.

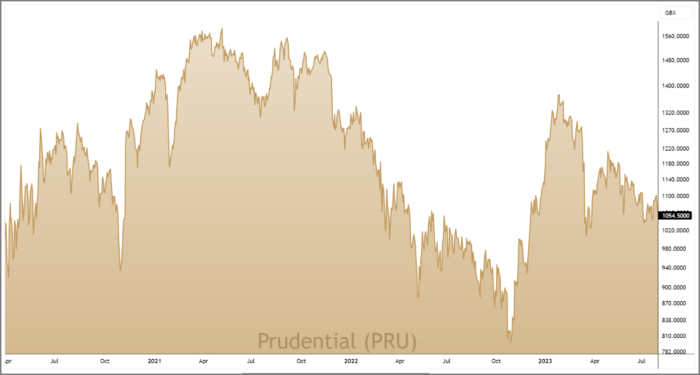

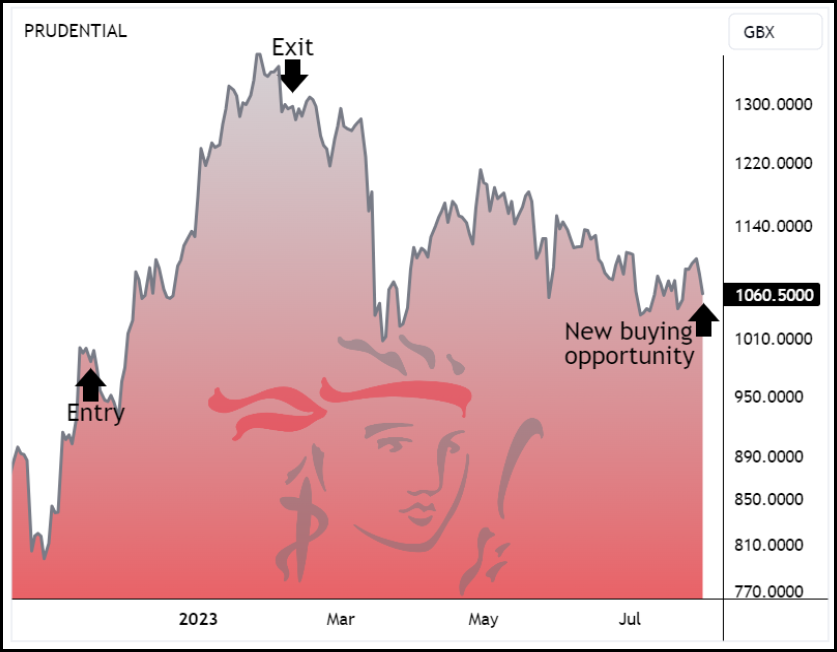

We originally recommended buying Prudential in the final quarter of last year as the stock looked “significantly undervalued”. This left us perfectly positioned to ride the China ‘reopening rally’, and we used advance price action analysis to enable us to exit our position for a swift 31.7% profit in February.

Since then, Prudential’s share price has undergone a 20% pullback from its New Year highs. A key reason for the pullback was Prudential’s new business profit falling by 11%, partly due to higher interest rates offsetting higher volumes.

However, as we approach then end of the rate hike cycle, we would expect Prudential’s short-term headwinds to dissipate. And over the long-term, we believe Prudential is well placed and well priced to deliver substantial growth for shareholders.

Seven reasons why Prudential lead the Asian insurance market

1. Strong presence in China and Hong Kong: Prudential has established itself as a leading life insurer in China and Hong Kong, two of the most significant high-growth markets in Asia. With an extensive distribution network and a range of tailored products, the company has captured a substantial share of the life insurance market in these regions.

2. Rising middle-class population: The rapid growth of the middle-class population in Asian markets has translated into higher disposable incomes and increased demand for insurance and wealth management solutions. Prudential’s ability to cater to the financial needs of this expanding demographic has been a crucial factor in its success.

3. Increasing insurance penetration: Despite the economic growth, insurance penetration in many Asian countries remains relatively low compared to developed markets. Prudential’s focused efforts on increasing awareness and promoting insurance products have contributed to expanding the market and increasing insurance penetration rates.

4. Favourable demographic trends: Asia’s aging population and growing awareness of the need for retirement planning and health coverage present significant opportunities for Prudential’s insurance and asset management businesses. The company’s offerings cater to the diverse financial needs of different age groups, making it well-positioned to capture a broad customer base.

5. Tailored products for local markets: Prudential’s success in high-growth markets can be attributed to its understanding of local customer preferences and needs. The company has developed a portfolio of products and services tailored to the specific requirements of each market, creating a competitive advantage over global competitors with a one-size-fits-all approach.

6. Strategic partnerships: Prudential has leveraged strategic partnerships with local banks and financial institutions to expand its distribution channels and reach a wider customer base. These partnerships allow the company to tap into existing customer networks and provide more seamless access to its insurance and investment products.

7. Capitalising on digitalisation: In line with digital trends, Prudential has used tech to enhance customer experiences and expand market penetration. Investments in digital platforms and mobile applications have allowed the company to effectively engage with a tech-savvy customer base.

By capitalising on the region’s favourable demographic trends and embracing digital transformation, Prudential continues to drive grow its market share and position itself for long-term success in these dynamic markets.

Growth at a reasonable price

Prudential’s cash-generating prowess and robust balance sheet make it an attractive investment.

The company generates substantial cash, which not only reinforces its financial stability but also provides ample resources for funding growth initiatives without diluting shareholders.

Though the current dividend yield is modest at less than 2%, Prudential’s focus on developing markets and growth prospects outweigh the immediate income appeal.

With a forward price-to-earnings (PE) ratio of 11.6, Prudential’s valuation appears higher than some peers in the insurance market.

However, what sets it apart is the remarkable earnings growth forecast of 48.3%. This translates to an attractive forward Price-to-Earnings-Growth (PEG) ratio of just 0.4, indicating that the stock offers growth opportunities at a reasonable price.

Furthermore, discounted cashflow analysis suggests that Prudential’s share price is trading at a substantial 32.3% discount to its estimated ‘Fair Value’.

The company’s long-term growth story, driven by key markets in Asia and Africa, bodes well for meeting and potentially surpassing earnings growth forecasts over the next five years. As a result, Prudential presents an enticing proposition for investors seeking growth potential with a solid financial foundation.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.