Regency View:

BUY Prudential (PRU)

Prudential holds dominant position in high growth markets

Prudential (PRU) is a very different beast to the proud British life insurer which forged its brand decades ago.

Having spun off its UK and US businesses, Prudential is now a ‘pure play’ on high growth Asian & African insurance markets.

Insurance penetration across these emerging markets remains very low despite rising levels of prosperity, creating a vast long-term growth opportunity for Prudential.

The last eighteen months have been far from smooth sailing with the shares feeling the brunt of China’s strict ‘zero-Covid’ policy.

However, with restrictions starting to lift we don’t expect Prudential’s share price to remain this cheap for long.

Asian growth story

It’s not hard to see why Prudential decided to focus purely on Asia & Africa…

Asia alone contributes more than 40% to global GDP growth, but insurance penetration is less than 3%.

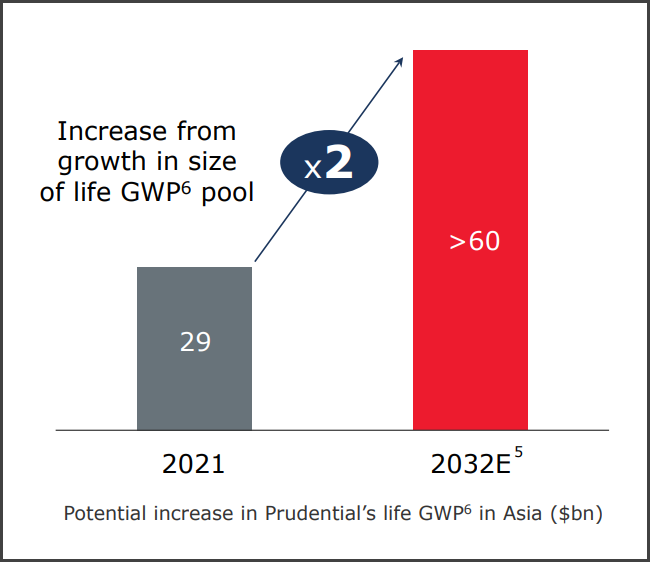

Prudential estimate the ‘health protection gap’ market in Asia to be $1.8tn, and Prudential expects to more than double its life insurance coverage in the region over the next decade.

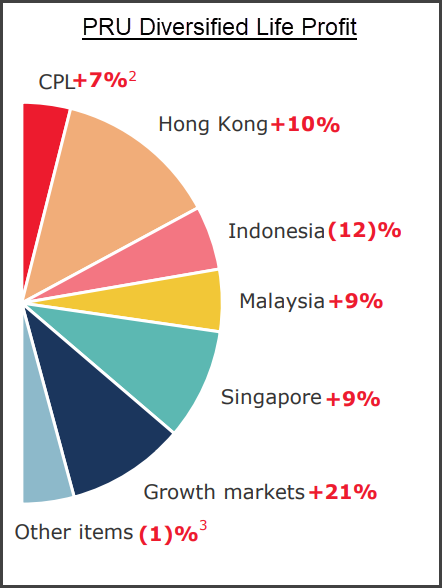

In China, Prudential has access to more than 80% of the Chinese mainland market and in India Prudential has a 15% market share in life insurance and 12% market share in asset management.

And perhaps Prudential’s most exciting growth opportunity comes in South-East Asia (ASEAN), where it is top three in eight out of nine ASEAN markets.

The ASEAN region alone gives Prudential access to a rapidly growing middle class emerging from a population of 670m.

Prudential has a distribution network of over 500,000 licensed agents as well as partnerships with more than 25,000 banks.

There is also an increasing shift towards digital customers which are cheaper to recruit and cheaper to serve, helping to enhance Prudential’s already substantial margins.

The long-term trends of increased insurance penetration in developing markets and the shift to digital create a highly compelling tailwind which should drive Prudential’s growth for years to come.

China showing signs of easing Covid restrictions

The timing of Prudential’s pivot to Asia couldn’t really have been much worse given the impact of the pandemic and China’s ‘zero-Covid’ policy.

China’s closure of its border between Mainland China and Hong Kong has been nothing short of a nightmare for Prudential and it missed out on hundreds of millions of dollars’ worth of business.

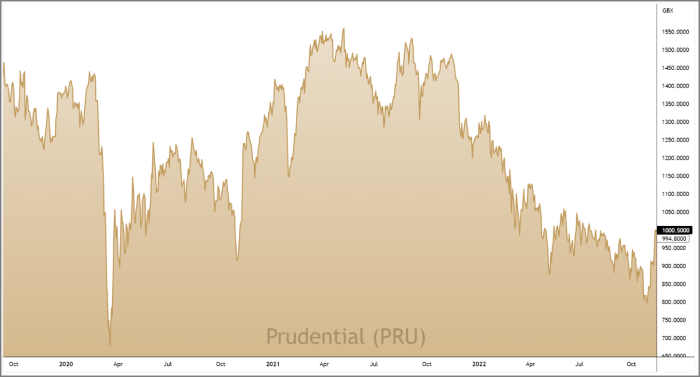

This has largely driven the sell-off in Prudential’s share price which nearly halved from its May 2021 highs.

However, after almost three years of border closures, mandatory quarantines and restrictions on businesses and social gatherings, Hong Kong is finally reopening.

This month, Hong Kong hosted its finance summit and an international Rugby Seven’s tournament. These two high-profile events sent a clear message that Hong Kong is back open for business.

And, while the boarder to mainland China remains closed, Beijing has recently pledged support for Hong Kong’s ‘scientific-based Covid adjustments’ – leading several analysts to predict a lifting of restrictions in the New Year.

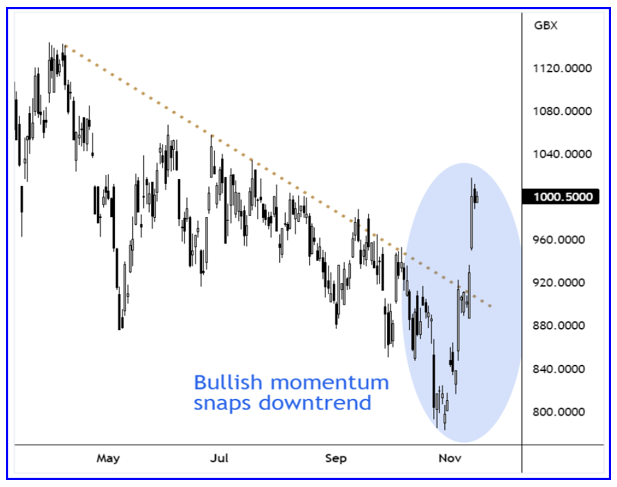

And a glance at Prudential’s price chart gives a taste of what a lifting of restrictions could do for its share price.

Having been stuck in a strong downtrend since the turn of the year, recent price action has seen a sharp rally punctuated by multiple bullish price gaps.

This burst of upwards momentum has snapped Prudential’s downtrend and indicates that the shares may have hammered out a bottom.

Shares are significantly undervalued

Despite the recent rally in Prudential’s share price the stock remains attractively priced.

Investors are being asked to pay less than 10 times forward earnings and this single digit PE ratio (9.9) contrasts nicely to Prudential’s double digit forecast EPS growth of 20.2%.

Prudential have a rock-solid balance sheet with $5.6bn cash, which gives them the “firepower to take advantage” of new opportunities according to interim boss Mark FitzPatrick.

And, based on discounted cashflow analysis, Prudential’s share price is currently trading at a 48.8% discount to ‘Fair Value’.

Whilst discounted cashflow analysis has its limitations, the long-term growth story which underpins Prudential’s key markets should see them comfortably meet earnings growth forecasts over the next five years.

We believe investors who snap up Prudential at current prices will be well rewarded when the long-term Asian growth story kicks back into gear.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.