Regency View:

BUY Yü Group (YU.)

The fast-growing ütility company with a £50bn addressable market

When researching stocks, every now and again you come across a company operating in a sweet spot.

Revenues are rising rapidly, costs are falling with increased scale, and the company wants to shout about it from the rooftops – that’s Yü Group (YU) right now.

“We performed well in the pandemic; even better in 2021, despite challenges in the market; and we expect even better performance in the remainder of 2022 and beyond”.

“As we continue to enjoy the fruits of our hard work, I look forward to delivering significant shareholder value in the near future”.

The confident comments of Bobby Kalar, Yü’s Founder, CEO and majority shareholder.

Yü is a multi-utility supplier focused on small and medium-sized businesses across the UK.

Trading under the brand Yü Energy, Yü provides a simple approach to energy management, offering competitive fixed price, bundled utility plans.

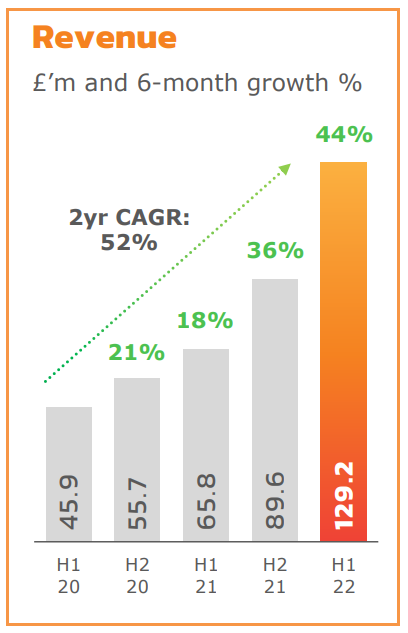

This simple approach is paying off and Yü have grown rapidly in recent years, more than tripling revenue since 2018.

And with the size of the UK B2B utility market standing at £50bn, Yü has significant scope for growth.

Yü Smart a ‘game changer’

Yü have done a great job of offering clean tech-savvy energy solutions to UK businesses, prime examples being their ‘100% renewable’ offering and their ‘Business Energy Analytics’ tool.

Alongside supplying energy, Yü has recently gained certification from the Retail Energy Code (REC) and approval from Elexon and Xoserve to operate as a Meter Equipment Manager (MEM) and Meter Installer (MI) for both gas and electricity customers.

This has created the opportunity for Yü to install and maintain SMETS2 meters under the product Yü Smart.

The successful launch of Yü Smart is a “game changer in terms of value chain ownership” according to Bobby Kalar.

“Owning the asset, creating an annuity income, provides an exciting new value pool for the Group to benefit from. I look forward to updating the market as we rapidly scale this capability” he added.

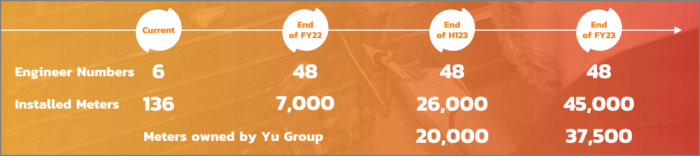

Yü is planning an aggressive rollout for Yü Smart over the next year, ramping up its number of installed meters from approx. 7,000 this year to more than 45,000 by the end of 2023.

Series of strong trading updates create momentum

Yü has plenty of bullish momentum…

September’s strong half year numbers were followed by an unexpected update in November’s in which Yü said revenue, adjusted EBITDA and operational cashflow was anticipated to “significantly exceed current market expectations” for the year to 31 December.

Record average monthly bookings from new and renewed customer contracts over the last three months has resulted in Yü expecting revenue of approx. £260m for the full year – a jump of 67% on the year prior.

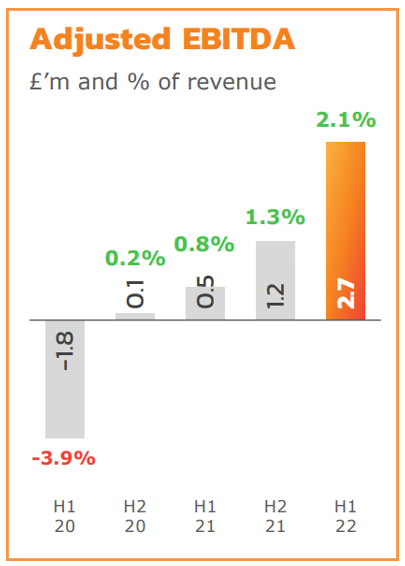

And Bobby Kalar recently reiterated his ambition “to achieve £500m revenue at over 4% EBITDA as soon as possible”.

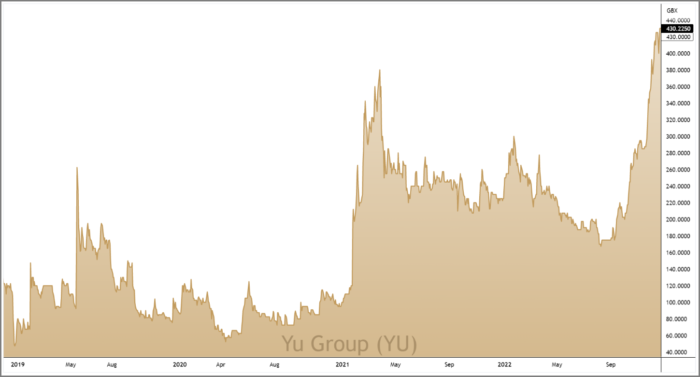

The series of impressive trading updates has been reflected on Yü’s price chart with the shares surging higher since September.

The shares have high levels of short-term momentum and the stock has shown strength relative to its peer group and the wider market.

Quality to match the momentum

Importantly, Yü has the quality to match this price momentum and the shares remain attractively priced.

Yü has a 2yr revenue CAGR north of 50% and gross margins have followed suit creating a proven profit trajectory which has seen Yü swing from a half year loss (adjusted EBITDA) of £1.8m in H1 2020 to delivering four consecutive half year profits.

And on a trailing twelve-month (TTM) basis, Yü boasts a Return on Equity of more than 80%, the highest of any multi-line utility company.

Yü also run a rock-solid balance sheet, which current has net cash of £15.7m (TTM) and operating cashflow has been very strong this year at £41.6m, with 90% flowing through into free cashflow.

On a forward valuation basis, Yü remains attractively priced despite its recent rally.

The shares are trading on a forward PE ratio of 10.4, which looks reasonable relative to the market and relative to forecast EPS growth of 16.3% – putting Yü on a price to earnings growth (PEG) ratio of 0.7.

And on a discounted cashflow basis, Yü has an estimated Fair Value of 610p-635p, indicating that the stock is around 40%-50% undervalued.

As our last AIM Investor pick of 2022, we believe the addition of Yü to our list of open positions will add some fresh momentum as we enter the New Year.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.