9th Feb 2024. 10.57am

Weekly Briefing – Friday 9th February

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.14% |

| FTSE 250 | -0.31% |

| FTSE All-Share | -0.18% |

| AIM 100 | -0.54% |

| AIM All-Share | -0.44% |

* Price movement from Monday's open at 8am

Weekly Briefing – Friday 9th February

Market Overview

Dear Investor,

As China ushers in the Year of the Wood Dragon this weekend, government-backed initiatives are breathing life into the country’s struggling stock market.

Chinese stocks faced significant headwinds in recent months, prompting a decline that wiped out nearly $2 trillion in market value. Several factors contributed to this downturn, including a lack of confidence among global investors, concerns over economic growth, an unresolved property sector crisis, and diplomatic tensions between Beijing and Washington.

Investors, once enticed by China’s rapid economic growth, found themselves grappling with three years of grinding losses. The benchmark MSCI China stock index has plummeted more than 60% from its early 2021 peak, reflecting the challenging environment faced by the Chinese stock market.

However, as the Year of the Wood Dragon dawns, there are signs of a potential turnaround. Recent market dynamics indicate a rebound, with small-cap and tech companies leading the charge. The China Securities Regulatory Commission’s commitment to guide institutional investors and encourage share buybacks has injected a sense of optimism into the market.

Amidst the long-term downtrend reflected in the MSCI China stock index, recent price action suggests the possibility of a more sustained bounce. The market has broken its pattern of lower swing highs and lower swing lows, establishing new higher swing high. Notably, the price has surged above the 50-day moving average for the first time since August, signalling a potential shift in momentum.

While investors should be mindful that established trends take considerable time and effort to change, the recent positive developments bring a glimmer of hope as the Chinese New Year festivities begin.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Premier African Minerals (AIM:PREM) +32% on the week

Shares in lithium miner, Premier African Minerals have surged higher this week, driven by optimism surrounding the imminent commencement of production at the Zulu lithium and tantalum project in Zimbabwe later this month.

A recent update in late January outlined significant operational enhancements at Zulu, encompassing plant equipment upgrades such as the incorporation of colour-based UV sorter detection and the introduction of a new thickener to optimise waste material removal and flotation processes.

CEO George Roach expressed unwavering confidence in meeting the production deadline, affirming, “unless there are unforeseen circumstances… we remain on target to produce late in February 2024.”

In today’s announcement, the company disclosed a mineral resource estimate (MRE) for Zulu, revealing approximately 107,000 tonnes of lithium across inferred and indicated categories, alongside over a thousand tonnes of tantalum (pentoxide). The MRE draws on assay results from 163 drill holes, totalling 33,258 meters, drilled between September 2016 and the end of August 2023.

REGENCY VIEW:

PREM is banking on achieving a higher grade spodumene product with lower iron levels, which would allow it to command a substantial price premium.

The Zulu project’s advanced stage and established market presence are significant strengths. However, PREM has acknowledged the likelihood of additional funding needs in the near term and should they fail to find an alternative to equity-based funding, shareholders are likely to be diluted.

Consumer goods company, PZ Cussons cut its dividend and trimmed its profit forecast this week due to a 40% devaluation of the Nigerian Naira.

The Naira’s depreciation, primarily due to a float by the Nigerian central bank, impacted PZ Cussons significantly as Nigeria stands as its largest market. The devaluation resulted in an £88.2 million foreign exchange loss and contributed to an 88% contraction in overall sales in Africa.

The company, looking to de-list its Nigerian subsidiary by buying out minority shareholders, is expected to complete the transaction by year-end. Facing challenging trading conditions, the board deemed it “prudent” to nearly halve the dividend. The adjusted operating profit for the year is now anticipated to be £55 million-£60 million, down from the previous guidance range of £61.5 million-£68.2 million.

While PZ Cussons achieved market share gains in the UK personal care business, overall revenue on a statutory basis declined across all geographies. The challenging outlook has led brokers to cut operating profit and earnings per share forecasts for the next year.

REGENCY VIEW:

The recent profit warning highlights the issues associated with investing in company’s that have high levels of exposure to emerging markets. Currency risk is often underestimated and in light of the recent profit warning, the short-term prospect of a share price revival appears challenging.

Sector Snapshot

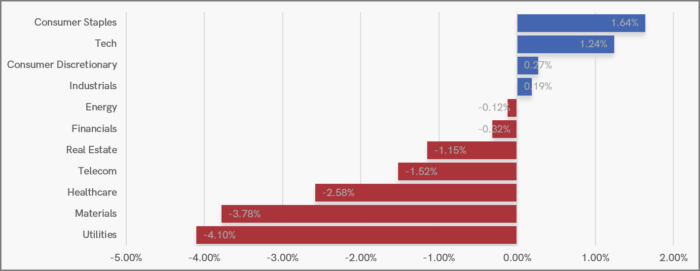

This week’s Sector Snapshot is negatively asymmetric in terms of % gainers and losers, with a clear skew to the downside. But in terms of ‘risk on’ / ‘risk off’ sectors, its relatively balanced…

We have risk on Materials sector being hit hard this week, but we also have ultra-defensive risk off Utilities showing heavy losses. The same applies to the sectors showing relative strength, Tech and Consumer Discretionary are traditionally risk on, but the biggest riser on the week is risk off Consumer Staples.

UK Price Action

We mentioned in last week’s UK Price Action that the FTSE looked set to retest the resistance zone and we saw this on Wednesday.

Having rejected resistance, should the market break below Monday’s low this would likely trigger a deeper sell-off towards the bottom of the long-term range.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.