8th Nov 2024. 10.48am

Weekly Briefing – Friday 8th November

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.25% |

| FTSE 250 | +0.08% |

| FTSE All-Share | -1.05% |

| AIM 100 | -0.35% |

| AIM All-Share | -0.37% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 8th November

Market Overview

Dear Investor,

The strength and magnitude of Donald Trump’s election victory this week took the market by surprise, unleashing a wave of reactions across asset classes…

Equities surged as investors saw potential benefits from Trump’s economic agenda, driving the S&P 500 and Nasdaq to fresh highs. This rally reflects renewed optimism around policies like corporate tax cuts and deregulation, which many believe could stimulate growth in key sectors, especially those domestically focused. The Russell 2000 index of small-cap stocks, for example, outpaced larger indices, soaring 5.8% as investors anticipated stronger benefits from tax cuts for smaller, U.S.-centred companies.

However, the bond market has been far less enthusiastic, taking a more cautious stance on what Trump’s policies could mean in the longer term. Bond yields jumped sharply, with the 10-year Treasury yield climbing to its highest level since July.

This upward pressure on yields suggests a growing concern about inflation risks tied to Trump’s proposals, including aggressive tariffs and large-scale deportations. Such measures could strain supply chains and labour markets, potentially leading to higher prices just as the Federal Reserve has been signalling confidence in controlling inflation.

Looking ahead, the potential for ‘bond vigilantism’—a situation where bond investors push back on government spending by driving up yields—adds a layer of complexity. If Trump’s policies lead to increased borrowing, we may see bond investors start to raise yields to make borrowing more expensive, effectively pressuring the government to rein in its spending plans. This dynamic is especially important given that the Fed has been more cautious with rate cuts recently, and inflation could dampen their willingness to ease policy further.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Wise (LSE:WISE) +15.8% on the week

Fast-growing fintech Wise has had a strong week following a surge in trading activity, with its share price climbing by over 7% as investor confidence grew. The company’s impressive performance has sparked interest from both retail and institutional investors, especially as it continues to show strong growth potential.

Wise’s strategy of reducing the cost and complexity of international money transfers has been highly effective. For the first half of 2024, the company reported a 30% increase in revenue, reaching £450 million, driven by an expansion in active customers and transaction volumes. The fintech’s customer base grew by 15% year-on-year, with over 15 million active users, reinforcing its position as a leader in the market.

Investor sentiment was particularly high this week, fuelled by Wise’s latest quarterly report. The company reported a 25% year-on-year increase in transaction volumes, reaching £45 billion, while net profit rose by 20%, totalling £40 million. These figures demonstrate the company’s scalability and operational efficiency, which continue to drive its growth.

Wise’s shares have responded positively, showing resilience amid broader market volatility. This strong performance underscores its ability to adapt to market conditions and maintain its growth trajectory, making it a standout player in the fintech sector. With continued expansion in new markets and product offerings, Wise is well-positioned to deliver further value to its shareholders.

REGENCY VIEW:

Wise stands out for its strong quality metrics, with high profitability and impressive returns on capital, but its valuation presents a challenge. Despite its solid financial performance, the stock trades at a high PE ratio of 23.8, reflecting a premium price that may limit its appeal for value-focused investors.

Schroders became the latest asset manager to experience a sharp drop in share price following a combination of disappointing net outflows and market volatility. Despite reporting record assets under management (AUM) of £777.4 billion and positive net flows of £1.6 billion for the first nine months of 2024, the company faced challenges in the third quarter.

A significant outflow of approximately £8 billion from the legacy Scottish Widows mandate in its Solutions division, along with losses from three Institutional clients totalling £2 billion, weighed on investor sentiment. Additionally, continued market volatility, especially in China, negatively impacted net flows from joint ventures and associates, further adding to concerns.

Schroders’ difficulties come on the heels of a similar drop for fellow asset manager abrdn, which saw its share price plummet sharply last month. Abrdn’s decline was due to a combination of sluggish performance in its core businesses and weaker-than-expected earnings.

Like Schroders, abrdn has been grappling with the pressures of shifting market conditions and investor sentiment. This has led to concerns about the impact on future growth and profitability.

REGENCY VIEW:

Schroders have an attractive valuation with a low P/E ratio of 9.9 and a healthy dividend yield of 6.97%, which may appeal to value-focused investors. However, given the recent sharp declines in share price and ongoing challenges with net outflows and market volatility, potential buyers should remain cautious and consider the risks of further downside.

Sector Snapshot

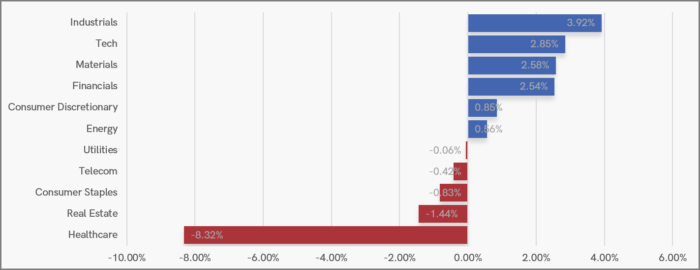

This week’s Sector Snapshot highlights the impact of the recent US election on the UK market, with US-focused Industrials like Ashtead seeing strong gains. The Tech sector is also performing well, along with Materials and Financials.

On the weaker side, Real Estate is trailing despite a recent rate cut from the Bank of England, while Healthcare is under pressure, led lower by AstraZeneca amid Chinese insurance fraud allegations.

UK Price Action

The FTSE’s reaction to Trump’s election win felt more like a damp firework than a lasting celebration. When markets opened Wednesday, the FTSE initially shot up like a rocket, coming close to retesting the upper end of its range. Yet, this enthusiasm was short-lived as caution quickly settled in, leading the index to erase its gains.

From a broader perspective, the outlook remains largely unchanged. The FTSE is still in a consolidation phase within its long-term uptrend. However, a decisive break and close below the 200-day moving average could suggest a shift in this trend, indicating that the market may be poised for a more sustained downturn.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.