8th Mar 2024. 11.07am

Weekly Briefing – Friday 8th March

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.24% |

| FTSE 250 | +0.77% |

| FTSE All-Share | -0.09% |

| AIM 100 | -0.48% |

| AIM All-Share | -0.24% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 8th March

Market Overview

Dear Investor,

This week’s budget took centre stage as Chancellor Jeremy Hunt unveiled a series of measures that reflected the government’s short-term political objectives, sparking speculation about a potential general election in May. The budget, seemingly tailored for immediate voter appeal, raises concerns about its long-term economic viability.

The introduced promises of tax cuts were strategically designed to win back voter support for the Conservative party. Key measures included a 2p reduction in National Insurance rates, with employees seeing their rate drop from 10% to 8%, and self-employed individuals experiencing a decrease from 8% to 6%. While some households may benefit from the tax cuts, critics argue that the short-term focus neglects the underlying issues in public services and may jeopardise the country’s fiscal health in the long run.

For investors and financial markets, the budget unveiled a new British ISA aimed at boosting investments in UK-listed companies and supporting domestic businesses. This additional £5,000 allowance, coupled with the existing £20,000, is anticipated to encourage investors to allocate funds toward UK shares. The FTSE 250 index experienced a positive surge, rising over 1% after the ISA confirmation.

Despite the short-term boost in the stock market, uncertainties loom over the long-term implications of the budget on financial markets. Creating a low tax, high investment environment is only attractive if it can be sustained for longer than an election cycle, if it will be enough to boost Rishi’s ratings remains to be seen.

Wishing you a fantastic weekend,

Tom

Market Movers

ITV’s share price jumped this week following the release of its full-year results, indicating a potential positive shift for the company. Despite a 2% decline in total revenue to £4.3bn and a 41% drop in pre-tax annual profits, the market is optimistic about the record revenues in its production arm, ITV Studios, showing a 4% growth to £2.2bn and a 10% increase in adjusted earnings (EBITDA) to £286m.

The digital sector, especially ITVX, played a significant role in the positive results, contributing to a 19% rise in digital revenues to £490m. The company’s efforts to cut costs have also shown progress, surpassing the initial target of £150m in savings by delivering £130m by the end of 2023.

Additionally, ITV has initiated a new strategic restructuring and efficiency program that aims to deliver incremental gross savings of at least £50m per year by the end of 2024. This program is expected to reshape the cost base, enhance profitability, and support the growth drivers of Studios and Streaming.

REGENCY VIEW:

ITV heavily relies on advertising revenue from its traditional television channels, but this revenue source is shrinking as companies tighten their marketing budgets due to uncertain economic conditions. While digital advertising is growing, it doesn’t yet compensate for the decline in traditional advertising.

Ashtead’s share price dropped sharply this week after expressing caution about its outlook.

The US-focused industrial equipment rental company cited slow third-quarter trading, influenced by extended strikes and reduced emergency response activity to natural disasters. Consequently, the full-year rental revenue growth is expected to fall at the lower end of the guided range of 11% to 13%.

Despite the challenges, Ashtead’s CEO, Brendan Horgan, expresses positivity about the long-term outlook for North America, highlighting robust end markets and opportunities from market conditions and structural changes.

In the third quarter ending on December 31, revenues increased by 9% to $2.66 billion following 16% growth in the first half. However, the adjusted pre-tax profit experienced an 11% decline to $473 million, attributed to a higher depreciation charge due to lower fleet utilisation and increased financing costs.

REGENCY VIEW:

Ashtead is a high-quality market leader and the stock tends to outperform when the US economcy is doing well. However, the market’s bearish reaction to this week’s trading update indicates that there is potential further downside to come in the short-term.

Sector Snapshot

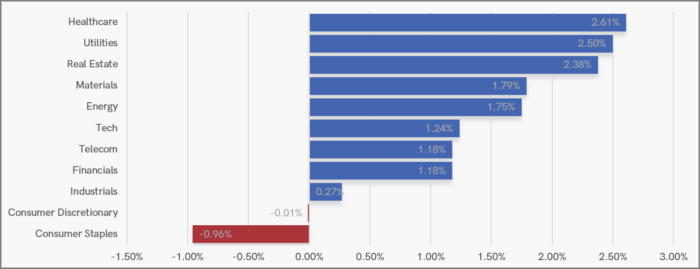

At the sector level, the UK market has developed a distinctly bullish glow during the last seven sessions. Whilst the index itself has been treading water and consolidating, we have seen broad-based buying with the majority of the FTSE’s major sectors making gains of more than +1%.

UK Price Action

We are seeing signs in the FTSE’s recent price action which may indicate that this index is getting ready to breakout.

1. The New Year sell-off didn’t make it back to the bottom of the range. Instead, the market formed a higher swing low.

2. We have seen a series of higher swing lows form in recent weeks.

3. Price action during the last two weeks has seen the market consolidate just beneath resistance.

These subtle technical signs may not be enough to mark the FTSE out as a screaming buy, but they are enough to give FTSE bears pause for thought before simply selling at resistance.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.