7th Mar 2025. 10.49am

Weekly Briefing – Friday 7th March

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -1.99% |

| FTSE 250 | -1.72% |

| FTSE All-Share | -1.93% |

| AIM 100 | -1.83% |

| AIM All-Share | -1.90% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 7th March

Market Overview

Dear Investor,

It’s been a rocky week for the markets, with the FTSE 100 sliding over 2% while still holding onto a solid 6% gain year-to-date. The S&P 500, however, is feeling the heat a bit more, down over 3% this week and now in the red for the year at -2%.

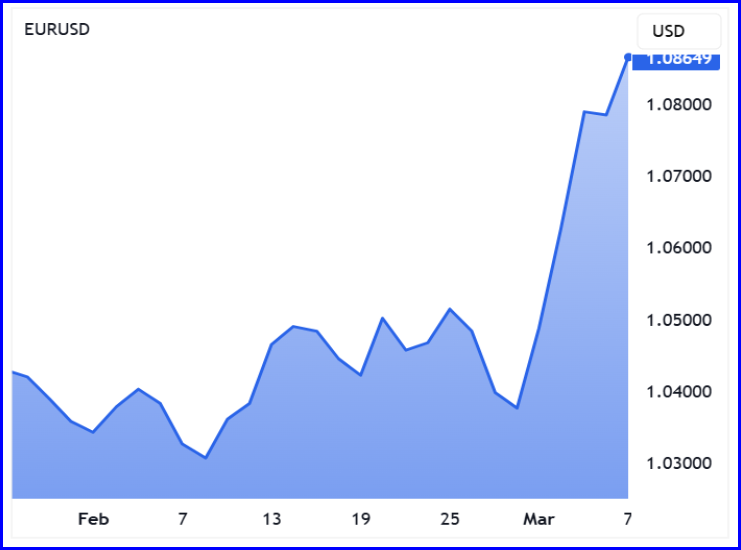

The European Central Bank made headlines this week by cutting interest rates by a quarter-point to 2.5%, but the real shift came in the tone of their statement. ECB President Christine Lagarde hinted that future rate cuts may not be as imminent as once thought. Traders quickly recalibrated their expectations, trimming the chance of more cuts this year, and the euro rallied as a result. However, the ECB also downgraded its 2025 growth forecast for the sixth consecutive time, highlighting ongoing risks to the region’s economy.

Meanwhile, the bond market had its own drama. Germany’s 10-year Bund yield surged to 2.85%, triggering a global sell-off. Yields spiked across the Eurozone and Japan, with Japan’s 10-year bond hitting its highest level since 2009. The move is sparking concerns about the sustainability of fiscal policy in an environment where borrowing costs are rising, especially as global debt issuance is on track to hit a record high this year.

It’s not just central banks and bond yields that are causing concern. Former President Trump’s renewed tariff threats have added fresh uncertainty to the equation. The prospect of new trade tensions, particularly with China and the EU, is giving investors another headache. With the ECB taking a more cautious stance on rate cuts and global fiscal policy shifting, the markets are left with more questions than answers.

While these challenges are weighing on investor sentiment, it’s worth noting that we are still in a positive territory year-to-date. That being said, the coming months will likely be shaped by how central banks respond to evolving inflation data and economic growth, as well as how the geopolitical landscape continues to unfold. As always, staying adaptable and keeping an eye on the broader trends will be key to navigating the months ahead.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: BAE Systems (LSE:BA.) +15.4% on the week

Another week, another defence stock surging to the top of our highest risers list! This time, it’s BAE Systems, riding the wave of heightened geopolitical tensions and ramped-up defence spending across Europe.

With NATO and European leaders doubling down on military commitments—most recently at the Ukraine Defence Summit hosted by Keir Starmer—demand for defence equipment is soaring. That’s put BAE firmly in the spotlight, with investors piling in as the company looks set to benefit from increased orders.

But it’s not just sentiment driving the stock higher. BAE has delivered strong financials, reporting a record order backlog of £77.8 billion and guiding for 7-9% sales growth alongside an 8-10% rise in earnings per share for 2025. That bullish outlook has fuelled further momentum, reinforcing confidence in the company’s long-term prospects.

It’s also part of a broader trend. The European defence sector has been powering ahead, with Rolls-Royce and other key players seeing strong gains. With governments prioritising military investment and geopolitical risks remaining elevated, BAE finds itself in a prime position to capitalise.

With its diverse portfolio and proven ability to secure major contracts, BAE has emerged as one of the FTSE 100’s standout performers this year. As long as defence spending remains high on the agenda, the stock’s upward trajectory may have further to run.

REGENCY VIEW:

BAE Systems continues to ride a strong momentum wave, with the stock up 34.7% in the past month and comfortably outperforming key moving averages. While its 21.3x forward P/E isn’t cheap, the company’s 16.4% forecast EPS growth and record order backlog suggest the rally is well-supported by fundamentals, keeping it firmly on our FTSE Investor radar.

Greggs’ share price tumbled to a two-year low this week despite delivering record-breaking results for 2024…

The sausage roll maker reported total sales of over £2 billion for the first time and a double-digit increase in profits, yet investors appeared unsettled by signs of slowing momentum in early 2025. Like-for-like sales growth in company-managed shops came in at just 1.7% in the first nine weeks of the year, a notable slowdown from the 5.5% growth seen in 2024. Challenging weather conditions in January were cited as a factor, though the company noted an improvement in February.

Beyond the softer start to the year, concerns may also stem from a more cautious consumer backdrop. While Greggs remains the UK’s leading food-to-go brand, industry data suggests the overall market struggled to expand in 2024. Consumer confidence remained weak, and with food price inflation still weighing on household budgets, discretionary spending patterns may be shifting.

Another possible factor weighing on sentiment is the company’s ambitious expansion strategy. Greggs added a record 145 net new shops in 2024 and plans another 140 to 150 in 2025, with a long-term goal of exceeding 3,000 locations. While this reflects confidence in future growth, scaling up at this pace requires significant investment, particularly in supply chain infrastructure. The company has made progress in expanding capacity, but with new distribution centres and manufacturing sites still in development, investors may be wary of execution risks.

Despite these concerns, Greggs’ management remains confident in delivering another year of progress in 2025. The company continues to invest in digital channels, menu innovation, and growing its evening trade, all of which are key drivers of its multi-channel strategy. The dividend was lifted by 11.3% in line with earnings growth, underscoring management’s belief in the company’s financial strength. However, in the short term, the market appears to be focusing on near-term headwinds rather than the longer-term growth story.

REGENCY VIEW:

Greggs’ stock has been under pressure, with momentum taking a significant hit over the past year, down nearly 44%. Despite this, the company still offers an attractive dividend yield of 3.92% and maintains solid fundamentals, with strong returns on capital and equity, though its near-term growth prospects face headwinds.

Sector Snapshot

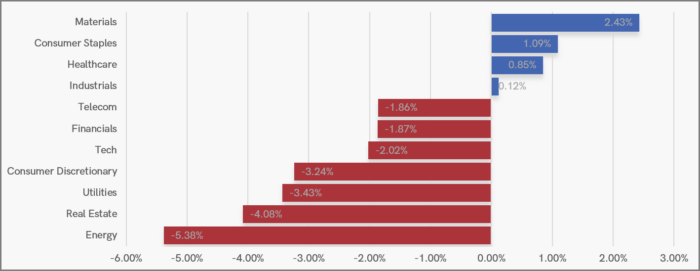

This week, the Materials sector has taken the lead, driven by a decline in the US dollar. Consumer Staples are also showing strong relative performance, supported by steady gains from defensive heavyweights like Unilever and Diageo.

On the flip side, Energy is lagging behind, with Trump pushing for increased oil production, while Real Estate continues to struggle as investors brace for the potential impact of persistent inflation.

UK Price Action

This week the FTSE faked out at swing resistance and then fell back to the ascending trendline. Whilst the UK index is fairing better than its US counterpart, this is the first time the FTSE has failed at swing highs in several weeks – indicating that we could be entering a new consolidation phase.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.