7th Jun 2024. 10.41am

Weekly Briefing – Friday 7th June

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.50% |

| FTSE 250 | -0.56% |

| FTSE All-Share | -0.49% |

| AIM 100 | -2.02% |

| AIM All-Share | -1.49% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 7th June

Market Overview

Dear Investor,

With Farage getting a banana milkshake facial in Clacton and Sunak and Starmer trading verbal jabs in the first live TV debate, election campaigning was in full swing this week.

As we’ve seen with the Brexit referendum and Liz Truss’s mini-Budget, political events can dramatically sway financial markets. However, the looming election looks unlikely to see a repeat of this volatility, with investors seeing it as something of a foregone conclusion. Current projections indicate a comfortable Labour win with a majority of over 300 seats, suggesting a significant shift in the political landscape.

A Labour victory would bring significant policy changes, particularly in taxation, regulation, and public spending. Shadow Chancellor Rachel Reeves has been working hard to recast Labour as a business-friendly party, aiming to dispel the old anti-business image. Her rhetoric focuses on sustainable growth, economic stability, and a commitment to maintaining a healthy environment for businesses to thrive. For investors, this could mean a more predictable and stable regulatory environment, which is generally positive for market sentiment.

However, there are concerns about Labour’s potential tax policies. Historically, Labour governments have been associated with higher taxes, which might impact corporate profits and investor returns. Increased taxation on higher earners and businesses could lead to a temporary dip in market confidence. Additionally, Labour’s plans for increased public spending could raise questions about fiscal discipline and the potential for increased national debt, which might cause some initial market jitters.

On the other hand, Labour’s focus on infrastructure and green energy investment could be a boon for sectors tied to construction, renewable energy, and technology. Companies operating in these industries might see increased demand and growth opportunities, which could bolster their share prices.

Interestingly, historical trends suggest that UK markets tend to be resilient to changes in government. Research from the FT indicates that the FTSE All-Share has often recorded gains following elections that result in a government change. This resilience is likely due to the fact that market performance is influenced by a multitude of factors beyond political leadership, including global economic conditions, monetary policy, and investor sentiment.

While the election’s outcome will undoubtedly create some ripples, it’s essential to stay focused on fundamental economic indicators and maintain a diversified portfolio to navigate these potential shifts smoothly. Labour’s anticipated policies could present both challenges and opportunities, and staying informed and agile will be key for investors in the coming months.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Carnival (LSE:CCL) +8.4% on the week

Carnival’s share price jumped this week due to a number of developments…

Firstly, on Tuesday, Carnival announced plans to discontinue its P&O Cruises Australia brand and merge its Australian operations into Carnival Cruise Line. This strategic move likely boosted investor confidence by simplifying operations and enhancing efficiency.

Secondly, on Wednesday, Carnival emerged as the top gainer on the mid-cap index with an impressive 7.3% jump. This surge followed Peel Hunt’s upgrade of the stock from “add” to “buy,” indicating increased optimism about Carnival’s future prospects.

Additionally, the drop in crude oil prices, attributed to OPEC+ increasing supply despite uncertain demand, may have contributed to Carnival’s positive momentum by easing cost pressures for the company.

REGENCY VIEW:

While recent financial results indicate positive momentum, Carnival still grapples with high debt levels, rising costs, and uncertain earnings outlook.

Shares in GSK plummeted over 9% following a Delaware judge’s decision to allow more than 70,000 lawsuits alleging that the discontinued heartburn drug Zantac caused cancer to proceed.

The ruling dealt a significant blow to the pharma giant, leading to a market reaction that wiped out nearly £7 billion ($8.90 billion) from GSK’s market value. GSK swiftly announced its disagreement with the ruling and its intention to appeal.

Investors have raised concerns that the potential liability for GSK could surpass the previously estimated $2 billion to $3 billion figure. The judge’s decision allows expert witnesses to testify in court regarding the potential link between Zantac and cancer, a point contested by GSK, Pfizer, Sanofi, and Boehringer Ingelheim, who argued that such opinions lacked scientific support.

The lawsuits surrounding Zantac have been an ongoing concern for GSK and other former Zantac makers, with worries about prolonged legal battles and compensation issues. These concerns previously impacted the market value of these companies, leading to a collective loss of nearly $40 billion in August 2022.

REGENCY VIEW:

Market’s hate uncertainty, and despite GSK’s recent share price recovery, the Delaware ruling is expected to weigh heavily on the stock.

While legal battles and regulatory challenges are part and parcel of the pharmaceutical industry, the ruling’s implications, including potential lengthy legal proceedings and hefty settlement costs, cast doubts on GSK’s future performance.

Sector Snapshot

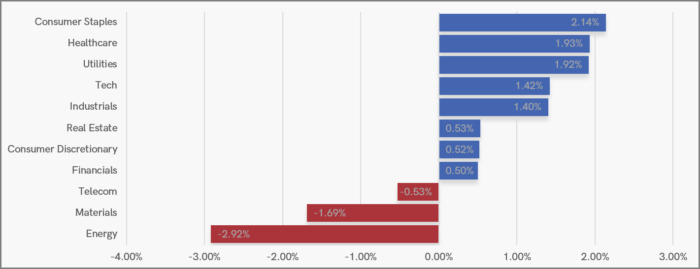

This week’s Sector Snapshot reveals a defensive tilt to the UK market. Top of the pops are Consumer Staples, Healthcare, and Utilities – three highly defensive sectors. And at the bottom of the table are the aggressive ‘risk on’ sectors Materials and Energy.

UK Price Action

Consolidation phases tend to be complex and full of random price action as the market enters short-term equilibrium. We’re currently seeing this on the FTSE which rallied last week only to form a lower swing high on Monday – funnelling price action into a wedge consolidation pattern.

A break below the wedge could trigger a retest of last week’s lows, while a break above the wedge would indicate a resumption of the dominant uptrend.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.