6th Sep 2024. 10.39am

Weekly Briefing – Friday 6th September

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -2.12% |

| FTSE 250 | -2.03% |

| FTSE All-Share | -2.10% |

| AIM 100 | -3.78% |

| AIM All-Share | -3.19% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 6th September

Market Overview

Dear Investor,

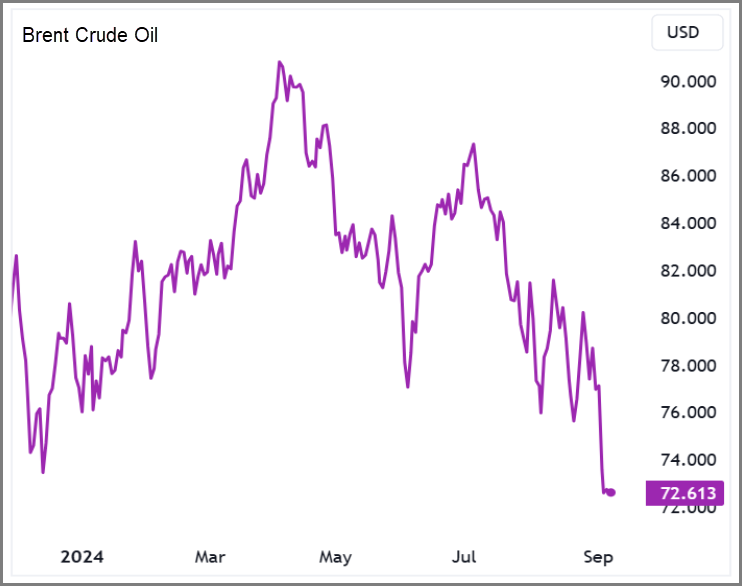

Oil prices dropped to their lowest levels since December this week, as concerns intensified over a potential oversupply combined with weaker global demand.

The decline was triggered by reports that Libya, after cutting about 60% of its oil production due to internal political conflict, may soon restore full output. This potential increase in supply comes at a time when demand—especially from China, the world’s largest oil importer—has been softer than anticipated.

Brent crude, the global oil benchmark, fell 5% to $73.67, its lowest point in six months, while West Texas Intermediate (WTI), the U.S. equivalent, dropped 4.5% to $70.25. The significant decline reflects growing market unease about the strength of oil prices.

Global demand has been under pressure, with China’s economic recovery proving weaker than expected. The International Energy Agency (IEA) recently forecasted that oil demand growth could slow towards the end of the year, particularly after the U.S. summer driving season, a key period of high oil consumption. This has added to concerns that a surge in supply, such as from Libya, could exacerbate the supply-demand imbalance.

Attention is also focused on the response from OPEC+. The cartel, which had planned to increase oil production in the fourth quarter, may now reconsider those plans in light of falling prices. Saudi Arabia, a key player in OPEC relies on stable oil revenues. This has sparked speculation that OPEC+ might delay any planned production hikes to prevent further price declines and support the market.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: ASOS (LSE:ASC) +20.1% on the week

Online fashion house ASOS saw a significant rally this week following a series of strategic moves designed to strengthen its financial position and refocus its business.

One of the key announcements was a £250 million Convertible Bond offering, set to mature in 2028, which is part of a broader refinancing effort. Alongside this, ASOS unveiled a major joint venture with HEARTLAND, the investment arm of Bestseller, in which HEARTLAND will acquire a 75% stake in ASOS’ iconic Topshop and Topman brands for £135 million. ASOS will retain a 25% stake in the brands, allowing it to continue benefiting from their future growth potential while significantly improving its balance sheet.

The joint venture marks a strategic shift, enabling ASOS to focus more on its core business while leveraging HEARTLAND’s extensive wholesale and retail expertise to expand Topshop and Topman’s global reach. The partnership comes as part of ASOS’ “Back to Fashion” strategy, aimed at streamlining operations, enhancing product offerings, and driving sustainable, profitable growth. Additionally, ASOS reported that it expects its FY24 adjusted EBITDA to reach the top end of consensus estimates, further buoying investor confidence.

The market response has been positive, as these moves signal a renewed focus on financial discipline, better capital allocation, and stronger partnerships. The company’s emphasis on reducing returns and introducing innovative AI-driven customer experience improvements also reflect a clear commitment to enhancing operational efficiency, making ASOS a more agile and competitive player in the online fashion space.

REGENCY VIEW:

Despite a recent uptick in momentum, the company is grappling with negative profitability metrics, such as a -6.97% operating margin and a -35.1% return on equity. The substantial net debt and declining free cash flow further compound the risk, suggesting that while there is potential for recovery, investors should be cautious given the ongoing financial struggles and the current market environment.

Shares in Woodside Energy, Australia’s largest gas producer, dropped sharply this week after the company raised $2 billion in the U.S. bond market, amplifying investor concerns about its capital expenditure plans amid weakening oil prices.

The capital raise came through a two-part bond issuance, consisting of $1.25 billion in 10-year bonds with a 5.1% coupon and $750 million in 30-year bonds with a 5.7% coupon. While Woodside stated the funds would be used for general corporate purposes, it provided few details, leaving investors uncertain about the company’s strategic direction.

This uncertainty has fuelled speculation about where the capital will be allocated, with some analysts suggesting the funds may be directed toward recent acquisitions. Ratings agency Standard & Poor’s noted that the company might use part of the money to finance two deals worth more than $3 billion: the $2.35 billion purchase of a clean ammonia project in Texas and a $900 million acquisition of an LNG terminal in Louisiana. Both deals are seen as steps in Woodside’s efforts to diversify its energy portfolio and invest in cleaner energy sources, but investors are wary of the potential return on these investments in the near to medium term.

At the same time, the decline in global oil prices—driven by concerns over demand and oversupply—has added pressure on Woodside’s stock. Crude oil prices recently hit their lowest levels in 14 months, further dragging down shares in energy companies like Woodside. The stock has fallen to its lowest level since January 2022.

REGENCY VIEW:

While the company’s valuation metrics such as a price-to-book ratio of 0.90 and a dividend yield of 6.26% suggest it’s trading at a relatively attractive value, investor confidence is being shaken by declining revenue (-19%) and EPS growth projections (-19%). The stock may appeal to value-oriented investors given its long-term prospects and clean energy investments, but the near-term outlook is clouded by market volatility and questions over strategic execution.

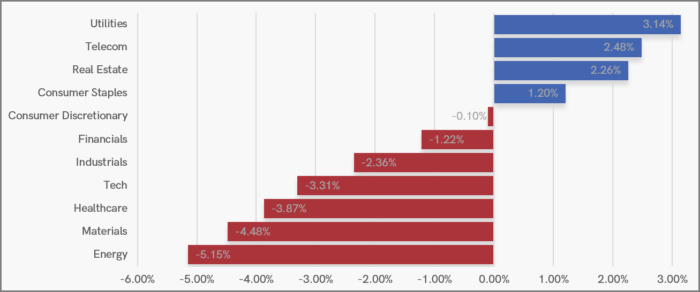

Sector Snapshot

We’re seeing some broad-based gains this week with Industrials, Healthcare and Consumer Staples all up more than 1.5% during the last seven sessions.

Real Estate is lagging as investors start to bet that the Bank of England won’t be as quick to cut rates as previously expected. BoE Governor Andrew Bailey has indicated that it’s still too early to declare victory over inflation – causing the British pound to hit 2-year highs against the US dollar this week.

UK Price Action

The FTSE failed at the August swing highs and has spent this week in retreat, posting four day’s of consecutive losses on the daily rolling futures.

Short-term momentum is bearish, but the long-term trend remains bullish and there are several areas of key support on the chart.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.