6th Dec 2024. 11.06am

Weekly Briefing – Friday 6th December

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.80% |

| FTSE 250 | +1.46% |

| FTSE All-Share | +0.91% |

| AIM 100 | +1.53% |

| AIM All-Share | +1.12% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 6th December

Market Overview

Dear Investor,

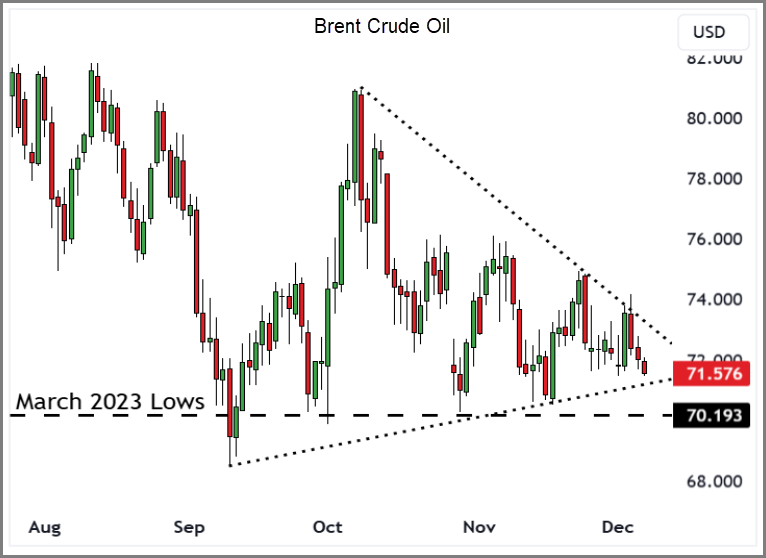

While this week’s extension of production cuts from OPEC+ was largely anticipated, it does mark a significant moment in the oil market. By extending output cuts through the end of 2025, the group has reaffirmed its commitment to stabilising prices amidst a backdrop of economic uncertainty, geopolitical shifts, and uneven demand recovery.

The decision to maintain daily production at 39.7 million barrels, with voluntary contributions from key producers, underscores the cautious strategy OPEC+ has adopted. This approach reflects the challenging factors that are currently shaping the market. On the one hand, China’s efforts to stimulate its economy have offered a glimmer of hope for demand recovery, while on the other, slowing growth in Western economies and the prospect of tighter US sanctions on Iran and Venezuela create headwinds.

Price action in the oil market has mirrored this indecision, Brent Crude has been locked in a triangular consolidation pattern for months. Prices are caught between strong support near the March 2023 lows and resistance formed by a series of lower highs. This narrowing range reflects the market’s cautious sentiment, as traders weigh OPEC+’s actions against potential increases in supply from non-OPEC producers, particularly US shale, which could respond aggressively to any price strength.

While the extension of cuts provides some clarity for the market, it also sets the stage for heightened scrutiny. Oil traders will be watching closely for signs of demand recovery from China, shifts in US monetary policy, and whether OPEC+ members adhere to their commitments. As prices continue to consolidate, a breakout from the current pattern feels increasingly imminent, though the direction remains unclear.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: International Consolidated Airlines (LSE:IAG) +9.2% on the week

IAG’s share price has continued to ascend this week, topping the UK’s large-cap list as investors responded enthusiastically to the airline group’s strategic initiatives.

The British Airways owner has been on a strong uptrend since announcing robust Q3 profits in November, underpinned by a €350 million share buyback programme that signals confidence in the company’s financial health and long-term strategy.

Key to the buyback’s design is its inclusivity, with Qatar Airways maintaining its 25.143% stake in the company through a structured arrangement. Under this plan, Qatar Airways will sell shares proportionate to those acquired by Goldman Sachs and Morgan Stanley in the open market, ensuring its proportional ownership remains intact.

The programme will run between 11 November 2024 and 28 February 2025. The €350 million allocation, split between €262 million for open-market purchases and €88 million for shares acquired from Qatar Airways, underscores IAG’s confidence in its medium-term strategy. This includes investment in fleet renewal, enhanced customer experience, digital transformation, and sustainability.

Investors have interpreted these developments as a vote of confidence in IAG’s operational resilience and financial prospects, pushing its share price to new heights.

REGENCY VIEW:

IAG’s buyback programme reflects its disciplined capital allocation framework, which has delivered notable margin growth and strong free cash flow. With its balance sheet already robust—net debt to EBITDA standing at a low 1.0x, well below the target of 1.8x—the group is now in a position to prioritise returning excess cash to shareholders.

Shares in Frasers Group, the owner of Sports Direct, dropped sharply this week after the company issued a profit warning in its half-year results. The retailer downgraded its full-year Adjusted Profit Before Tax (APBT) forecast to £550m-£600m, citing weaker consumer confidence and tougher trading conditions following the UK Budget. This news raised concerns among investors already cautious about the retail sector.

Despite this, Frasers Group made significant progress in other areas. The company reported £74.7m in cost savings and synergies from automation and recent acquisitions, and successfully reduced inventory by 16.5%. Sports Direct saw sales growth and a 3.4% increase in trading profit, while Premium Lifestyle posted a 41.1% rise in profits, supported by cost efficiencies.

Frasers Group is also expanding internationally, with new acquisitions in Australia, the Netherlands, and South Africa, positioning the company for global growth. It’s strengthening relationships with big-name brands like Fendi and Prada Beauty while continuing to invest in premium UK retail with new flagship stores.

However, the company’s challenges were clear. CEO Michael Murray noted that recent economic pressures and policy changes could lead to an additional £50m in costs for FY26. Despite long-term ambitions for profitable growth, the revised forecast and broader retail concerns left investors uneasy, resulting in the drop in share price.

REGENCY VIEW:

Frasers Group are currently trading at a discount, with a P/E ratio of just 6.9, which is well below the market average, and a price-to-sales ratio of 0.60, pointing to its undervaluation relative to revenue. While recent profit warnings and the challenging retail environment have raised concerns, the group’s focus on international expansion and strategic brand partnerships still offers solid growth potential, making it a stock worth keeping an eye on for those prepared to weather some short-term volatility.

Sector Snapshot

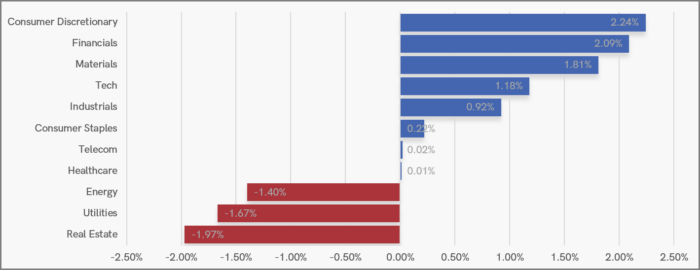

There’s a Black Friday / Cyber Monday feel to our seven-day sector snapshot this week with Consumer Discretionary topping the charts. Tech and Financials are also showing strength.

While it’s a second week of losses for Materials and Energy as the sectors find themselves weighed down by the strong dollar—a headwind amplified by Donald Trump’s election win.

UK Price Action

Last week, we highlighted how ‘high and tight’ consolidation often signals bullish intent, with price compression typically breaking in line with the prevailing trend and momentum. This setup played out perfectly over the past week, as the FTSE pushed higher into a critical resistance zone. Now, the big question is whether this Santa rally has enough momentum to close the year at fresh highs—or if we’ll see sellers step in to defend these levels.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.