5th Jul 2024. 10.59am

Weekly Briefing – Friday 5th July

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +1.20% |

| FTSE 250 | +2.69% |

| FTSE All-Share | +1.41% |

| AIM 100 | +1.81% |

| AIM All-Share | +1.48% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 5th July

Market Overview

Dear Investor,

Putting politics to one side this week we’re going to focus on something far more rewarding: tennis!

With the Wimbledon tennis championships starting, it seems only appropriate that we take inspiration from tennis GOAT Roger Federer. In a recent speech at Dartmouth College in the US, the 20-time major winner shared insights from his tennis career that resonate deeply with those pursuing success in investing:

“In the 1,526 singles matches I played in my career, I won almost 80% of those matches. Now, I have a question for you, what percentage of points do you think I won in those matches? Only 54%. In other words, only top-ranked tennis players win barely half of the points they play.”

Federer’s revelation underscores a critical lesson: success is not about perfection in every moment but about resilience and consistency over time. His 80% match-winning record, despite winning just over half the points, illustrates that dealing with setbacks is integral to achieving long-term success.

This lesson speaks to the challenges faced by investors. Consider the FTSE 100: out of the 127 trading days so far this year, the FTSE 100 has only closed in positive territory on just 52 of them, a hit rate of 40.94%. Despite this, the market is up by nearly 7% year-to-date.

This discrepancy highlights a critical point: the journey to financial growth is often marked by fluctuations and periods of decline. However, the overall trend can still be positive despite these setbacks. Just as Roger Federer won only 54% of the points he played but still managed to win nearly 80% of his matches, the FTSE 100’s performance shows that success in investing doesn’t require winning every day.

Investors often face the temptation to react impulsively to daily market movements, selling in response to downturns and buying during upswings. Federer’s career teaches us the importance of patience and the ability to stay focused on long-term goals despite short-term volatility. His resilience and consistency, despite winning just over half of his points, underline the value of persistence and strategic planning.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: IAG (LSE:IAG) +7.8% on the week

Shares in British Airways owner IAG took off this week following positive developments in the aviation sector, particularly the approval granted to Lufthansa to acquire a 41% stake in Italy’s ITA Airways. This approval, granted by EU antitrust regulators, came after Lufthansa agreed to concessions including the ceding of routes and slots.

The acquisition is expected to bolster Lufthansa’s foothold in the southern European market and provide strategic advantages through ITA’s hub at Fiumicino airport, enhancing connectivity to key destinations in Africa and Latin America.

Investors responded positively to these developments, with IAG’s shares surging by as much as 4.7% to 172.05p. The market’s optimism was fuelled by expectations that the regulatory approval for Lufthansa’s acquisition would pave the way for similar favourable outcomes for IAG’s bid to acquire Air Europa.

REGENCY VIEW:

The aviation sector’s ongoing efforts to consolidate and scale operations in response to rising operating costs and competitive pressures underscored the significance of this week’s developments. For IAG, the positive market sentiment reflects the broader industry dynamics favouring consolidation to optimise operational efficiencies and strengthen market positions.

Shares in nonlife insurer Beazley dropped this week after Hurricane Beryl intensified and concerns about its financial impact mounted.

The storm, which had already caused widespread devastation in Grenada and St. Vincent and the Grenadines, further intensified to a Category 5 hurricane as it approached Jamaica and the Cayman Islands. This escalation raised fears of substantial insurance claims and potential financial losses for the company.

The news caused Beazley’s shares to drop by more than 8% across Monday and Tuesday, making it the largest mover on the hurricane update and one of the top losers on the FTSE blue-chip index this week.

Beryl’s rapid intensification was fuelled by unseasonably warm sea temperatures, which scientists attribute to global warming. This has increased the frequency, intensity, and destructive power of tropical storms.

REGENCY VIEW:

The storm has underscored the growing risks faced by insurers like Beazley in an era of increasingly severe weather events linked to climate change. That said, Beazley have an impressive track record of delivering profitable growth, and with the shares trading on a forward earnings multiple of 6.2, the shares look reasonably priced.

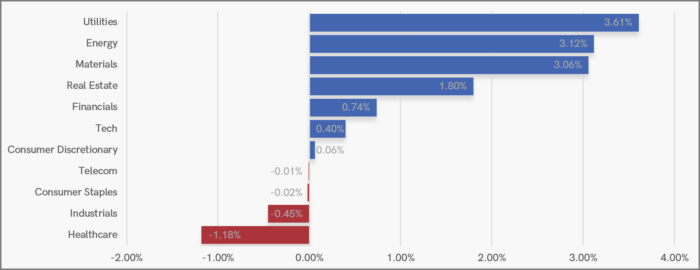

Sector Snapshot

The Energy sector is among the highest risers this week after crude oil prices hit a two-month high. Optimistic forecasts of increased demand during the Northern Hemisphere’s summer driving season and escalating geopolitical tensions in the Middle East have fuelled the rise. Additionally, OPEC+ extending production cuts into 2025 to manage supply levels has further supported higher oil prices, translating into positive gains for energy companies.

UK Price Action

This week the FTSE found support at the June swing lows – a level we have highlighted for several weeks. The bounce from support has generated enough fresh momentum to retest the top of the wedge – a weekly close above this consolidation pattern would be a bullish sign.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.