5th Jan 2024. 10.37am

Weekly Briefing – Friday 5th January

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.82% |

| FTSE 250 | -2.82% |

| FTSE All-Share | -1.08% |

| AIM 100 | -2.65% |

| AIM All-Share | -1.45% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 5th January

Market Overview

Dear Investor,

Happy New Year! 2024 promises to be a year of dynamic change and global significance. Elections will dominate headlines across major democracies such as the US, India, the EU, the UK, and Taiwan, reshaping political landscapes worldwide.

Economically, all eyes are on interest rates. The US might witness a potential decrease, while caution persists in the Eurozone. Discussions on AI’s influence on markets, led by tech giants like Microsoft, Alphabet, and Apple, continue to shape investment decisions.

There are uncertainties, particularly regarding the ongoing conflicts in Ukraine and the Middle East which could have far-reaching implications for global stability. The prospect of overlapping campaigns, such as a hypothetical UK election alongside the US presidential campaign, raises concerns about cyber manipulation and heightened international polarisation.

Beyond politics and economics, 2024 offers an array of key events including the Euro 2024 football tournament and the Paris Olympics. Alongside these sporting events, key political summits, such as the G20 summit in Brazil and the Commonwealth Heads of Government Meeting in Samoa, alongside crucial economic gatherings like the IMF and World Bank spring meetings in the US, mark the calendar.

Wishing you a prosperous and fulfilling year ahead!

Tom

Market Movers

On the rise: Next (LSE:NXT) +4.9% on the week

Next’s share price surged higher on Thursday after it unveiled exceptional sales performance during the pivotal holiday season. The buoyant numbers revealed a substantial uptick in full-price sales, outstripping earlier projections by a significant margin.

Investors were greeted with impressive figures showcasing a robust +5.7% increase in full-price sales for the months of November and December, a stark contrast to the modest +2.0% growth initially anticipated. This strong performance triggered an upward revision in Next’s full-year profit before tax guidance, now expected to hit £905 million, marking a substantial +4.0% surge from the previous year. A substantial portion of this uptick, £17 million, directly resulted from the impressive sales beat witnessed during this period.

The market response to this upbeat performance has been swift and positive, driving a surge in Next’s share price. Investors and analysts alike have been buoyed by the company’s resilient sales figures, indicating a robust consumer appetite even amidst economic uncertainties. Furthermore, Next’s proactive approach to financial management, including strategic plans to mitigate costs and a clear focus on debt reduction, has bolstered investor confidence in the brand’s future prospects.

The trading update’s announcement regarding a shift in accounting practices to exclude brand amortization from headline profits starting in the next financial year has also resonated positively with market participants. This adjustment aims to offer a clearer view of the company’s underlying profitability, a move applauded for enhancing transparency and accurate financial representation.

REGENCY VIEW:

Next remains a stalwart in the retail industry, demonstrating resilience amid economic fluctuations. However, even with multiple guidance upgrades, Next anticipates only a marginal increase in full-year pre-tax profits, underscoring the retail sector’s difficulty amid economic uncertainty.

Topps Tiles’ share price declined this week due to challenges impacting the company’s sales performance in its Q1 trading update.

The report highlighted a 4.0% decrease in overall sales compared to the previous year, reflective of persistent hurdles in discretionary consumer spending. Specifically, like-for-like sales dropped by 7.1% during the period, indicating a consistent downward trend from the first eight weeks. This downturn, particularly in homeowner sales, raised concerns about the company’s ability to navigate challenging market conditions affecting the Repair, Maintenance, and Improvement (RMI) sector.

Despite certain segments performing well—such as the resilient trade customer sales and growth in the Online Pure Play division driven by Pro Tiler Tools—the overall figures underscored the difficulty in stimulating homeowner purchases.

Additionally, the disclosure that profits for 2024 are expected to be skewed towards the second half of the year due to various factors, including higher energy usage in the first half, may have contributed to the decrease in share price.

REGENCY VIEW:

Topps Tiles are lacking top-line revenue growth and profitability has fallen in recent years. That said, the business generates healthy levels of free cashflow and a dividend yield of 7.75% along with a forward PE of 10 may catch the eye of income-seeking value investors.

Sector Snapshot

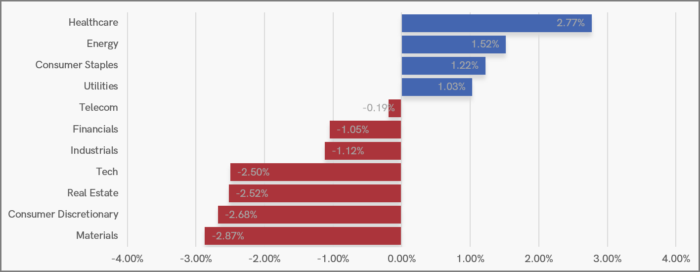

The first Sector Snapshot of the New Year represents something of a damp firework…

We’ve seen the fed-fuelled ‘risk on’ pre-Christmas rally start to reverse with defensive sectors such as Consumer Staples, Healthcare and Utilities leading the market. While the aggressive sectors linked to the anticipation of lower interest rates, such as Materials, Consumer Discretionary and Real Estate, have erased some of their December gains.

UK Price Action

The FTSE spent the festive period coiled beneath a key zone of resistance at 7,750 – an area that we’ve been highlighting for several weeks.

Whilst we’ve seen five clear rejections of the resistance zone since mid-December, the market has refused to retreat, and this signals underlying strength.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.