5th Apr 2024. 10.29am

Weekly Briefing – Friday 5th April

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | -0.45% |

| FTSE 250 | -0.76% |

| FTSE All-Share | -0.47% |

| AIM 100 | -0.98% |

| AIM All-Share | -0.72% |

* Price movement from Monday's open at 8am

Weekly Briefing – Friday 5th April

Market Overview

Dear Investor,

This week’s colour pallet is black and gold with precious metals and oil prices surging to multi-month highs, reflecting investor concerns and shifting market dynamics.

Gold has soared to record highs as investors seek refuge from persistent inflationary pressures. The precious metal climbed to an all-time high of $2,295 per troy ounce. With inflation stubbornly above the US Federal Reserve’s target, investors are turning to gold as a hedge against eroding purchasing power.

The rally in gold prices has also been fuelled by geopolitical tensions, including concerns over escalating conflicts in the Middle East. Additionally, increased options trading in gold futures backed by rising Chinese demand suggests growing investor optimism regarding further price appreciation.

Meanwhile, oil prices have reached a four-month high, surpassing $85 per barrel, as reduced forecasts for supply growth and voluntary production cuts by OPEC+ members have contributed to the market’s bullish sentiment.

Recent gains in oil prices have been supported by geopolitical events, including drone strikes on Russian oil refineries by Ukraine and a decline in US stockpiles. Hedge funds have increased their net bets on rising prices, providing further momentum to the market. Despite concerns over potential strains on government budgets in oil-producing countries like Saudi Arabia and Russia, higher oil prices could pose challenges for US President Joe Biden ahead of a tough re-election fight.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Fresnillo (LSE:FRES) +14.3% on the week

Silver miner, Fresnillo is one of the strongest stocks this week due to a surge in the price of silver.

The rise in silver prices has provided a much-needed boost to Fresnillo after the company reported disappointing full-year results for 2023, including a 50% drop in operating profit and increased operating costs.

These increased costs were attributed to factors such as currency fluctuations and a notable setback from the theft of 20,000 ounces of gold from one of its mines.

Despite the challenges Fresnillo said it would proceed with planned growth capital spending for the current year. Mining analysts anticipate a rebound in operating profit for 2024, which could further support the stock.

CEO Octavio Alvídrez commented that Fresnillo achieved its production targets despite challenges. Cost reduction efforts were made, yet currency revaluation and inflation impacted expenses. The company announced a final dividend payment in line with its policy.

REGENCY VIEW:

Whilst Fresnillo’s share price has picked up momentum in recent weeks – taking prices back to their 200 day moving average, the company’s valuation remains unattractive. The shares trade on a forward price-to-earnings (PE) ratio of 25.9 – this looks expensive relative to its peer group and forecasted contraction in earnings per share (EPS).

Topps Tiles shares fell this week after it reported a decline in revenues for the first half of the year, citing several factors including a weaker market.

Total sales dropped by 5.9% year-on-year to £122.6m, attributed to subdued demand in the domestic repair, maintenance, and improvement (RMI) sector. While trade customers showed more resilience, overall trade sales were also lower compared to the previous year.

Despite improvements in conversion rates and the brand, like-for-like sales fell by 11.3% year-on-year in the second quarter, mainly due to reduced footfall and volume. Although gross margin percentage increased year-on-year due to easing cost of goods pressures, net profits were impacted by lower volumes, operating cost inflation, and operational gearing.

Topps Tiles anticipates that first-half profitability will be affected by market conditions, timing of holiday pay accrual, and seasonally higher energy usage. However, it remains optimistic about benefiting from a cyclical recovery in the RMI market, leveraging its strong brands, expertise, and service.

REGENCY VIEW:

Topps Tiles is a cyclical stock, top line revenue growth has been stagnant and its share price has broadly mirrored this over the past five years. The stock trades on a forward PE of 12.6 which looks quite pricey, but a forward dividend yield north of 7% is likely to catch the attention of income investors.

Sector Snapshot

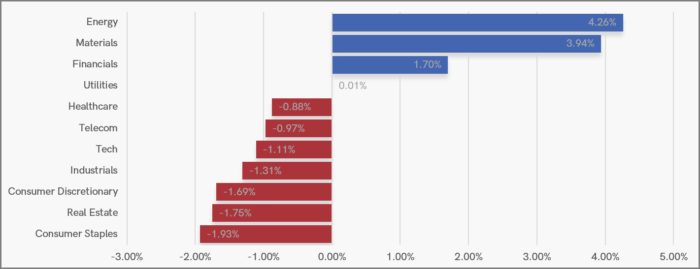

This week’s sector snapshot reflects investors concerns that inflation will remain stubbornly high.

Inflation hedges are making gains with Energy, Materials and Financials topping the charts. While sectors that perform poorly in high inflation / high interest rate environments, such as Real Estate and Consumer Staples are performing poorly.

UK Price Action

The FTSE fell just short of retesting the February 2023 all-time highs on Tuesday.

From Tuesday’s highs the index has retraced back to the first ascending trendline – an area that coincides with the volume weighted average price (VWAP) anchored to the breakout.

Pullbacks like this are part and parcel of uptrend’s and we would still expect the FTSE to retest the all-time highs in the coming weeks.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.