3rd May 2024. 10.41am

Weekly Briefing – Friday 3rd May

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.81% |

| FTSE 250 | +1.24% |

| FTSE All-Share | +0.87% |

| AIM 100 | +2.09% |

| AIM All-Share | +1.85% |

* Price movement from Monday's open at 8am

Weekly Briefing – Friday 3rd May

Market Overview

Dear Investor,

This week, e-commerce behemoth Amazon released its Q1 earnings, delivering a strong performance across various sectors. However, one of the most captivating aspects of the earnings report was Amazon’s substantial investment in AI.

The standout aspect of Amazon’s earnings was the remarkable growth trajectory of its cloud computing division, Amazon Web Services (AWS). AWS experienced accelerated sales growth, particularly fuelled by the soaring demand for AI tools. This demand for AI services contributed significantly to AWS’s sales, surpassing expectations and reaching the milestone of a $100 billion annual revenue run rate.

Amazon’s CFO, Brian Olsavsky, highlighted the pivotal role of generative AI in this growth, stating that it has evolved into a multibillion-dollar revenue stream for the company. And CEO, Andy Jassy, emphasised Amazon’s commitment to furthering its AI capabilities, signalling plans to allocate substantial investments to support the expansion of cloud and AI infrastructure.

This commitment to AI investment aligns with broader industry trends, as AI continues to transform various sectors, including e-commerce, logistics, and advertising. By investing heavily in AI, Amazon aims to not only enhance its cloud computing offerings but also to bolster its competitive edge in key areas such as security and data processing.

Beyond its cloud business, Amazon is strategically leveraging AI across its entire ecosystem to drive efficiencies and innovation. From optimising its logistics operations to enhancing its advertising platform, AI is playing an increasingly integral role in Amazon’s overarching strategy to streamline processes, personalise customer experiences, and drive growth.

As AI continues to shape the future of business, Amazon’s proactive approach positions it well to capitalise on emerging opportunities and stay ahead of the curve in an ever-evolving digital landscape.

Wishing you a fantastic weekend,

Tom

Market Movers

On the rise: HSBC (LSE:HSBA) +7.1% on the week

HSBC have enjoyed a strong week after exceeded expectations in its first-quarter results…

The Asian banking giant reported a revenue increase of $0.5 billion to $17.0 billion, excluding one-off items. Despite a slight decline in reported profit before tax, the figures were in line with market forecasts. Notable one-off items included a $4.8 billion gain from the sale of its Canadian business and a $1.1 billion charge related to putting its Argentina business up for sale.

The bank’s net interest margin (NIM), a key profitability metric in borrowing and lending, improved to 1.63% from the previous quarter’s 1.52%. Additionally, charges for expected loan losses were better than expected, totalling $720 million.

HSBC maintained a strong financial position, with a tier 1 capital ratio of 15.2%, surpassing its target range of 14.0-14.5%. Shareholders were rewarded with a dividend of $0.10 per share, along with a special dividend of $0.21 per share from the Canadian sale and a new buyback program of up to $3 billion.

Guidance remained steady, with costs anticipated to increase by 5% in 2024 and banking net interest income expected to reach at least $41 billion.

In a surprising announcement, CEO Noel Quinn revealed his intention to retire, adding a layer of uncertainty to the company’s future leadership. Despite this, HSBC’s shares saw a positive response and have trading higher throughout the week.

REGENCY VIEW:

HSBC’s focus on Asia remains, with progress in portfolio reshuffling and reinvestment in growth areas. Challenges include managing costs in a higher inflation environment and risks in the Chinese commercial real estate market. Overall, while uncertainties loom with Quinn’s departure, HSBC’s strong balance sheet supports further shareholder returns and growth opportunities, particularly in Asia.

Aston Martin’s trading update revealed it faced a significant setback in the first quarter of the year, with losses soaring by nearly 90%.

The British carmaker attributed this downturn primarily to a substantial decline in SUV sales, which plummeted by two-thirds. Additionally, increased expenses stemming from debt refinancing further exacerbated the financial strain.

Despite shipping fewer cars, Aston Martin’s strategic decision to wind down production on certain models ahead of new launches contributed to the decline in sales, a move the company’s finance chief, Doug Lafferty, emphasised as part of their planned lineup renewal.

The company’s persistent struggle with high debt remains a pressing concern. While a recent refinancing effort aimed to reduce borrowing costs, overall net debt surpassed £1 billion by the end of the quarter. This financial strain led to a decline in available cash, prompting a drop in the shares this week.

Despite the challenges, Aston Martin said it anticipates improved financial performance and positive cash flow generation in the latter half of the year and beyond.

REGENCY VIEW:

While Aston Martin’s cars are the epitome of high-end luxury, their shares look more like an old banger. The company is loss-making and cash-burning with a debt-heavy balance sheet – making them a high-risk long-term investment.

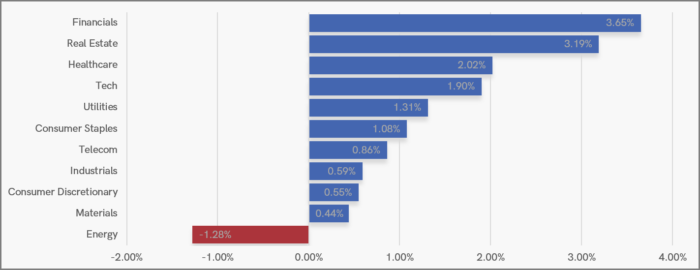

Sector Snapshot

With 10 of our 11 sectors in positive territory, the UK market has had another strong week.

Leading the pack is Financials – buoyed by market beating trading updates from HSBC and Standard Chartered. We’ve also seen some mean reversion this week with previously weak Real Estate making gains, and previously strong Energy lagging.

UK Price Action

In last week’s UK Price Action we mentioned that “all eyes will now be on Friday’s closing price to see if the breakout can be maintained”. Well, the market rallied into the closing bell last Friday and that set the tone for a week of ‘high and tight’ consolidation. This sideways price action is a bullish sign as it indicates that the market is finding a foothold at new highs.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.