31st Oct 2025. 9.42am

Weekly Briefing – Friday 31st October

| Market | Movement this week (%)* |

|---|---|

| FTSE 100 | +0.76% |

| FTSE 250 | -1.25% |

| FTSE All-Share | +0.52% |

| AIM 100 | -0.78% |

| AIM All-Share | -0.48% |

* Price movement from Monday's open at 8am

Regency View:

Weekly Briefing – Friday 31st October

Market Overview

Dear Investor,

This week, the shine has come off gold. After an extraordinary run that saw the precious metal surge more than 25% in just seven weeks, prices have finally cooled. Gold slipped below the $4,000 mark earlier in the week before stabilising, as the market took a collective breath and reassessed what had been one of the most rapid climbs in recent memory.

Much of the move lower has been driven by a shift in sentiment rather than a sudden change in fundamentals. Global risk appetite has improved, with optimism growing around US and China trade relations and a noticeable calming of tensions in the Middle East. Equity markets across Asia have surged to record highs, while commodity prices such as copper have climbed on hopes of stronger global growth. In short, the fear that fuelled gold’s explosive rally has started to ease.

That is not necessarily a bad thing. When prices rise too far too fast, they tend to detach from reality, and the market eventually pulls them back to earth. Even gold industry veterans have described the recent rally as frothy, driven as much by speculative enthusiasm as by genuine demand. This week’s consolidation is part of a natural cooling process, a healthy correction that allows the market to reset before finding its next equilibrium.

For long term investors, the bigger story has not changed. Central banks remain steady buyers, retail demand has broadened, and the reasons investors hold gold for diversification, inflation protection and stability during uncertain times remain as relevant as ever. If anything, the pullback may create a more sustainable foundation for the next phase of the trend.

Happy Halloween, and wishing you a fantastic weekend,

Tom

Market Movers

On the rise: Next (LSE:NXT) +7.7% on the week

Shares in fashion and homeware retailer Next rose this week after the group upgraded its full-year guidance on the back of a strong third quarter. Full-price sales climbed 10.5% year-on-year in the 13 weeks to 25 October, £76m ahead of expectations. UK sales rose 5.4%, slightly slower than the first half but still ahead of forecasts, while overseas sales surged 38.8%, helped by stronger digital marketing returns and improved stock availability through Zalando’s logistics network. Management lifted fourth-quarter sales guidance from 4.5% to 7.0%, adding another £36m to its forecast.

Next also raised its profit outlook, with full-year pre-tax profit now expected to reach £1.14bn, up £30m on previous guidance and 12.2% higher than last year. Earnings per share are forecast to rise nearly 15% to 729.4p, reflecting steady demand and tight cost control. The company credited better stock management and higher marketing spend for sustaining momentum in both its online and retail operations. Strong international performance continued to offset the moderation in UK growth as overseas expansion gathered pace.

Next expects to generate around £425m of surplus cash this year and plans to distribute roughly £500m to shareholders through dividends and buybacks. Management also signalled the likelihood of a £3.10 per share special dividend at the end of January, assuming no further acquisitions or buybacks before year-end. The group continues to target full-price sales growth of nearly 10% for the full year, underlining its position as one of the UK’s most consistent retail success stories.

REGENCY VIEW:

Next continues to deliver in style, combining tight execution with enviable profitability and global reach. It is hard not to admire how the business keeps outperforming expectations in what should be a tricky retail climate.

Shares in advertising giant WPP dropped sharply this week following a weak third quarter update and a downgrade to full-year guidance. Revenue fell 8.4% year-on-year to £3.26bn, while revenue less pass-through costs declined 11.1% to £2.46bn. On a like-for-like basis, revenue was down 3.5% and revenue less pass-through costs dropped 5.9%. The company said its media division saw a “step down” in performance versus the second quarter, dragging overall results to the low end of expectations. WPP now expects like-for-like revenue less pass-through costs to fall between 5.5% and 6.0% for the year, with operating margins around 13%.

Weakness was broad-based across both regions and business segments. Global Integrated Agencies saw a 6.2% decline in like-for-like revenue less pass-through costs, led by a 5.7% drop at WPP Media, while Public Relations fell 5.9% and Specialist Agencies slipped 2.2%. In North America, revenue declined 6%, while the UK and Western Europe were down 8.9% and 4.4% respectively. India stood out with 6.7% growth, offset by a 10.6% fall in China. The company cited client losses and spending cuts across consumer goods, automotive and government sectors, while tech and digital services cooled after a strong first half.

New CEO Cindy Rose said the company’s performance was “unacceptable” and outlined plans to simplify operations and refocus on growth. A strategic review is underway, targeting improved execution, tighter cost control, and expansion into enterprise and technology solutions. Alongside the review, WPP has strengthened its leadership team and extended its AI partnership with Google, moves aimed at restoring momentum in 2026 and beyond.

REGENCY VIEW:

WPP is starting to look like a bargain hunter’s dream, trading on a forward PE of just 5.3 and offering a dividend yield north of 6%. The big task now is rebuilding growth, and that means getting the basics right with simpler operations, better execution, and leaning into its AI and tech partnerships to steady the ship.

Sector Snapshot

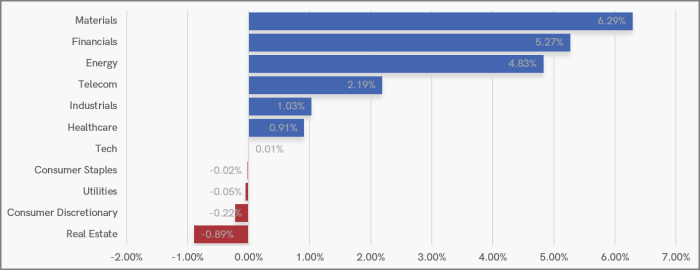

Materials led the market this week, building on renewed optimism around global demand and commodity pricing. Financials and Energy were close behind, giving the market a strong cyclical tone as investors rotated back into sectors most sensitive to economic momentum. Telecom and Industrials also added to the upside, rounding out a week dominated by pro-growth themes.

On the softer side, defensives such as Consumer Staples, Utilities and Healthcare lagged slightly, while Real Estate and Consumer Discretionary drifted lower. Tech was broadly flat, suggesting that leadership remains firmly with traditional sectors rather than high-growth names for now.

UK Price Action

The FTSE has continued to make steady progress, extending the powerful uptrend that has defined much of the second half of the year. Price action remains orderly, and momentum continues to favour the bulls as the index holds near record territory.

Should we see a pullback this week, the broken swing high around 9,600 is the key area to watch. That level now marks a zone of potential support where dip buyers could look to step back in, keeping the broader bullish structure intact.

Disclaimer:

All content is provided for general information only and should not be construed as any form of advice or personal recommendation. The provision of this content is not regulated by the Financial Conduct Authority.